Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

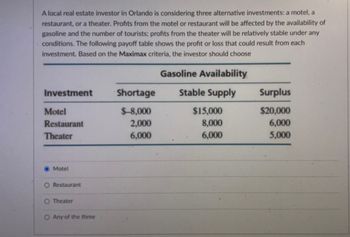

Transcribed Image Text:A local real estate investor in Orlando is considering three alternative investments: a motel, a

restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of

gasoline and the number of tourists; profits from the theater will be relatively stable under any

conditions. The following payoff table shows the profit or loss that could result from each

investment. Based on the Maximax criteria, the investor should choose

Investment

Motel

Restaurant

Theater

Motel

Restaurant

O Theater

O Any of the three

Shortage

$-8,000

2,000

6,000

Gasoline Availability

Stable Supply

$15,000

8,000

6,000

Surplus

$20,000

6,000

5,000

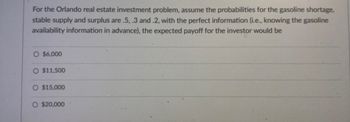

Transcribed Image Text:For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,

stable supply and surplus are .5, .3 and .2, with the perfect information (i.e., knowing the gasoline

availability information in advance), the expected payoff for the investor would be

O $6,000

O $11,500

O $15,000

O $20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Net Present Value and Internal Rate of Return. Below are the projected revenues and expenses for a new clinical nurse specialist program being established by your healthcare organization. The nurses would provide education while patients are in the hospital and home visits are on a fee-for-service basis after patients have been discharged Should the hospital undertake the program if its required rate of return is 12%? Note: it must be assumed that the revenues and costs in this problem represent cash flows. Present value analysis is based on cash, not revenue or expenses. Provide a response to support the findings in the table listed below. Your response should be at least a half page long in addition to the table. Please include citations. Year One Year Two Year Three Year Four Total Revenue $100,000 $150,000 $200,000 $250,000 $700,000 Costs $150,000 $150,000 $150,000 $150,000 $600,000 $ <50,000> $0 $50,000 $100,000…arrow_forwardThe terminal cap rate used for valuation purposes in a DCF is fundamentally different than the discount rate used in that same DCF. The assumed sale of the property takes place at the end of your hold period, generally 10 years later in most models. The property is older and the market and the economy have changed. With that said, what do you believe to be the right approach for terminal cap rate selection in a DCF on a development project and why?arrow_forwardIn this part of the project, you will be purchasing the home you chose in the Budget Project. You will need to obtain a loan from a financial institution since you cannot pay cash for your home. You will be researching three different loan scenarios and determining which loan option best fits your situation and needs. Purchase price of the home you chose from the Budget Project: ________$431,873______ Part 1: Financing your home Loan Scenario 1: In this scenario, your financial institution is offering you a 30-year fixed mortgage with a 20% down payment at a 3.43% fixed rate. Determine the following: Calculate the down payment for this loan. How much will you need to finance from the bank for this loan? What is your monthly payment? Use technology or the monthly payment formula in your text to get the monthly payment for this loan. What is the total cost of the loan over 30 years? How much of this cost is interest? What is the total you will expect to pay at closing for this loan…arrow_forward

- Use the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. QUESTION) Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest inone of them. You are given the following projected data:Project A Project BInitial cost R300 000 R300 000Scrap value R40 000 0Depreciation per year R52 000 R60 000Net profitYear 1 R20 000Year 2 R30 000Year 3 R50 000Year 4 R60 000Year 5 R10 000Net cash flowsYear 1 R90 000Year 2 R90 000Year 3 R90 000Year 4 R90 000Year 5 R90 000 Additional informationThe discount rate used by the company is 12%. Transcribed Image Text:Number of Periods 1 2 3 4 5 6 7 8 m 10 11 12 13 14 15 1% 2% 0.9901 0.9804 0.9709 3% 3.9020 3.8077…arrow_forwardPlease Calculate the Following using the Table Given. Beta Internal Rate of Return (IRR). Gamma’s Internal Rate of Return (IRR). The incremental Internal Rate of Return (ΔIRR) between the Alpha and Gamma harvesters (using Excel’s IRR function).arrow_forwardWhat is the net present value of the investment in the car wash?arrow_forward

- An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin operations and are accepting capital commitments. When the funds begin acquiring properties, capital calls will be made for capital contributions during the investment period. Fund A will charge a fee of 45 BP on capital committed and 60 BP on capital invested after the investment period ends. Fund B will charge a fee of 50 BP on capital committed and 55 BP on capital invested after the investment period ends. Both funds expect to have $506,000,000 in capital commitments when the fund commences operations and both project a five-year cycle for startup and acquisitions. Capital flows are expected as follows: Fund A Year 1 Year 2 Year 3 Year 4 Year 5 Fund B Year 1 Year 2 Year 3 Year 4 Year 5 Contributed Capital $ 202,400,000 303,600,000 Contributed Capital $ 303,600,000 202,400,000 Required A Fund A Fund B Capital Returned $0 0 0 Required B 101,200,000…arrow_forwardTwo potential real estate investments are under review by an investment firm. One is a 75,000 square foot office building in Portland, Oregon with a projected pre-tax leveraged IRR of 18.8% and the other is a 54-unit garden apartment building in Scranton, Pennsylvania with a projected pre-tax leveraged IRR of 14.5%. The investment firm should: a. Carefully weigh the projected returns relative to the potential risks of each investment during the due diligence process to determine whether either investment should be chosen b. Choose the Scranton apartment building with the lower expected IRR because it must be a safer investment c. Choose neither investment because both IRRs seem too good to be true in today’s market d.Choose the Portland industrial building with the higher expected IRR because it will definitely appreciate in value more over timearrow_forwardAcme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme must decide how to have the property rezoned for commercial use and then how to develop the site. Based on its market study, Acme has made estimates for the two uses that it deems possible, that is, office or retail. Based on its estimates, the land could be developed as follows: Rentable square feet Rents per square foot Operating expense ratio Average growth in NOI per annum Required return (r) Total construction cost per square foot Office 100,000 $ 42.00 Required: Which would be the highest and best use of this site? Which would be the highest and best use of this site? 40% 3% 13% $118 Retail 80,000 $ 52.50 50% 3% 14% $118arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education