Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

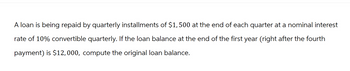

Transcribed Image Text:A loan is being repaid by quarterly installments of $1,500 at the end of each quarter at a nominal interest

rate of 10% convertible quarterly. If the loan balance at the end of the first year (right after the fourth

payment) is $12,000, compute the original loan balance.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- If Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forwardA customer takes out a loan of $130,000 on January 1, with a maturity date of 36 months, and an annual interest rate of 11%. If 6 months have passed since note establishment, what would be the recorded interest figure at that time? A. $7,150 B. $65,000 C. $14,300 D. $2,383arrow_forwardA loan of $92,800.00 is repaid by equal payments made at the end of every three months for 3 years. If interest is 8% compounded quarterly, find the size of the quarterly payments and construct an amortization schedule showing the payment number, amount paid, interest paid, principal repaid and outstanding principal balance of each payment. Additionally, include the totals for amount paid, interest paid and principal repaid of the loan.arrow_forward

- A loan company advertises that $100 borrowed for one year may be repaid by 12 monthly installments of $9.46. Assuming the difference between the amount repaid and the amount borrowed is interest only, what is the effective annual interest rate being charged?arrow_forwardA loan of $36,999.85 is to be repaid by payments at the end of each quarter for eight years. Each payment is 5% higher than its predecessor. The loan is made at a nominal rate of discount of 4% payable quarterly. Find the balance just after the 20th payment, the amount of interest in the twentieth payment, and the amount of principal in the twentieth payment. (Round your answers to the nearest cent.) balance after 20th payment amount of interest in 20th payment amount of principal in 20th paymentarrow_forwardA borrower takes out a 15-year loan for $65000 with equal end-of-month payments. The annual nominal interest rate of the loan is 12% convertible monthly. Immediately after the 60th payment is made, the remaining loan balance is reamortized. The maturity date of the loan remains unchanged, but the annual nominal interest rate of the loan is changed to 6% convertible monthly. Calculate the new endof-month payment.arrow_forward

- Olfert Inc. is repaying a loan of $52500.00 by making payments of $4700.00 at the end of every six months. If interest is 7.5% compounded semi-annually, the outstanding balance after the first, second, third payment will be respectively: O 49268.75, 47565.08 and 43995.14 O 49768.75, 45015.08 and 42105.48 49768.75, 46935.08 and 43995.14 O48425.12, 45238.21 and 42355.23 Mrs. Robinson madearrow_forwardA loan is amortized over five years with monthly payments at a nominal interest rate of 12% compounded monthly. The first payment is 1,000 and is to be paid one month from the date of the loan. Each succeeding monthly payment will be 1% lower than the prior payment. Calculate the outstanding loan balance immediately after the 20th payment is made.arrow_forwarda loan is amortized by level payments made at the end of each quarter for 25 years.Tge monthly rate is 1%.The principal in the 29th payment is 5580.Find the amount of interest in the 60th paymentarrow_forward

- A loan is being repaid with 20 payments of 1500 at the end of each year. Interest is calculated at an annual effective rate of 5% for the first 10 years and 4% thereafter. Find the OLB immediately after five payments have been made by both the prospective and the retrospective method.arrow_forwardSportZ has negotiated a loan of $25 000 with interest at 7.6% per annum, to be paid as month-end payments of $2200.00 over the next year. Construct a loan amortization schedule to answer the following questions. i. How much interest is paid over the first two months? ii. How much of the principal is paid by the end of the first two months? iti. How much interest is paid over the term of the loan? iv. What is the amount of the final payment?]arrow_forwardPrepare an amortization schedule for a three-year loan of $96,000. The interest rate is 9 percent per year, and the loan calls for equal annual payments. How much total interest is paid over the life of the loan? Year 1: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Year 2: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Year 3: Beginning Balance, Total Payment, Interest Payment, Principal Payment, Ending balance Total Interest for all 3 Years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning