Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

1 - Create amortization table and solve using formulas, do not use amortization function on calculator.

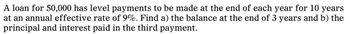

Transcribed Image Text:A loan for 50,000 has level payments to be made at the end of each year for 10 years

at an annual effective rate of 9%. Find a) the balance at the end of 3 years and b) the

principal and interest paid in the third payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardHow is the goodwill impairment calculated? I thought it was by adding assets and subtracting the accounts payable for net assets. Then adding goodwill and subtracting the fair valuearrow_forwardPlease answer the following question Must choose from the following LIST OF ACCOUNTS: Accounts Payable Accounts Receivable Accumulated Amortization - Copvrights Accumulated Amortization - Customer Database Accumulated Amortization - Customer lists Accumulated Amortization - Development Costs Accumulated Amortization - Franchises Accumulated Amortization - Licences Accumulated Amortization - Patents Accumulated Amortization - Software Accumulated Amortization - Trademarks Accumulated Depreciation Accumulated Impairment Losses - Copyrights Accumulated Impairment Losses - Goodwill Accumulated Impairment Losses - Licences Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Trade Names Accumulated Impairment Losses - Trademark Administrative Expenses Advances to Employees Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Bank Loans Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Equipment Gain on Disposal…arrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease explain calculation of transaction b) Where the value 612 is comingarrow_forwardUsing formulas, no tables, correct answer= 6,962.6, can you try again?arrow_forward

- Need a worksheet in excel form add interest expense - of 167.00 please.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardIncludes claims to specific assets in the event of default Group of answer choices Secured Unsecured Increases Asset Increases Liabilityarrow_forward

- This is not clear please make it clear in coherent writing with calculations providedarrow_forwardAnswered: The fo x b Details | bartleby x b My Questions |b x Post Altendee -2 x FA Midterm Exan X -> File | C:/Users/Wendy/Downloads/FA%20Midterm%20Exam.pdf ME6 Which of the following entries records the payment of an account payable? a) Debit Accounts Payable, credit Cash b) Debit Cash, credit Accounts Payable c) Debit Expense, credit Cash d) Debit Cash, credit Expense ME7 The process of initially recording a business transaction is called: a) Sliding b) Posting c) Journalizing d) Transposing ME8 Which of the following entries for goods sold by cash is correct? a) Cash Dr, AR Cr b) AR Dr, Revenue Cr c) Fees Earned, debit; Cash credit d) Cash, debit; Bank Cr ME9 The verification that the sum of the debits and the sum of the credits in the ledger are equal is called: a) A journal b) A ledger c) Posting Type here to searcharrow_forwardI completed the general journal i cannot cumpute the balance sheet and income statementarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education