FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:+A

LA

$

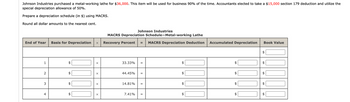

Johnson Industries purchased a metal-working lathe for $36,000. This item will be used for business 90% of the time. Accountants elected to take a $15,000 section 179 deduction and utilize the

special depreciation allowance of 50%.

Prepare a depreciation schedule (in $) using MACRS.

Round all dollar amounts to the nearest cent.

MACRS Depreciation Deduction

Accumulated Depreciation

Book Value

$

+A

Johnson Industries

MACRS Depreciation Schedule-Metal-working Lathe

End of Year Basis for Depreciation

Recovery Percent

1

2

3

$

4

$

$

A

✓

33.33%

=

44.45%

=

14.81%

7.41% =

A

$

$

+A

A

+A

+A

+A

+A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- A small truck is purchased for $22,000. It is expected to be of use to the company for 9 years, after which it will be sold for $4,000. Determine the depreciation deduction and the resulting unrecovered investment during each year of the asset’s life. Part a Use straight-line depreciation: EOY Depreciation Deduction Unrecovered Investment 0 $enter a dollar amount 1 $enter a dollar amount $enter a dollar amount 2 $enter a dollar amount $enter a dollar amount 3 $enter a dollar amount $enter a dollar amount 4 $enter a dollar amount $enter a dollar amount 5 $enter a dollar amount $enter a dollar amount 6 $enter a dollar amount $enter a dollar amount 7 $enter a dollar amount $enter a dollar amount 8 $enter a dollar amount $enter a dollar amount 9 $enter a dollar amount $enter a dollar amount Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10.…arrow_forwardHaresharrow_forwardOn 1/1/23, Dugout Co buys a piece of equipment for $512,000. It is estimated that the equipment will have a salvage value of $80,000 at the end of its expected useful life of 8 years. REQUIREMENTS: 1. Prepare a depreciation schedule using the following methods: a. Straight-line (SL) b. Sum-of-the-years'-digits (SYD) c. Declining balance - 200% (DDB) 2. Assume that the original purchase was made on 5/1/23. Using the "exact" method, determine the yearly depreciation expense for the following depreciation methods: a. SL b. SYD c. DDB What would the "Half-Year" convention look like for SL? 3. Assume that in 2026, it is discovered that the original purchase (on 1/1/23) was expensed rather than capitalized. Give JE's, ignoring the tax effects, required during 2026 if the DDB method is used. 4. Assume that in 2027, the estimated salvage value is decreased by $45,000 and the expected useful life is changed to a total of 9 years from date of purchase (1/1/23). Prepare depreciation schedules for…arrow_forward

- On July 10, 20X8, your firm purchases for $126,000 a machine with an estimated useful life of 8 years and a salvage value of $6,000. Your firm uses SYD depreciation and depreciates assets purchased between the 1st and 15th of the month for the entire month and assets purchased after the 15th as though they were acquired the following month. What is 20X1 depreciation expense $13,333 $11,111 $26,667 $13,889arrow_forwardBhupatbhaiarrow_forwardManjiarrow_forward

- am Warren Company plans to depreciate a new building using the double declining balance depreciation method. The building cost is $780,000. The estimated residual value of the building is $48,000 and it has an expected useful life of 25 years. What is the building's book value at the end of the first year? Grew H Multiple Choice O $717,600 $62,400 $31,200 $33.850 < Prevarrow_forwardNonearrow_forwardQuantum Electronic Services paid P = $40,000 for its networked computer system. Both tax and book depreciation accounts are maintained. The annual tax depreciation rate is based on the previous year’s book value (BV), while the book depreciation rate is based on the original first cost (P). Use the rates listed to plot annual depreciation and book values for each method. Develop the graphs using hand calculations or a spreadsheet, as directed by your instructor.arrow_forward

- Depreciation Problems: 1. Strand Corp purchases a machine on 4/1/20. Cost $110,000, costs to ship $5,000, costs to install $5,000. They borrowed the money from a bank. Estimated Salvage Value 20%. Estimated Useful Life = 6 years. Strand is a calendar year-end. REQUIRED: A. For the year 2020 and 2021 only a. Calculate Straight Line Depreciation expense b. Using the Accounting Equation, account for Depreciation Expense for the year c. Show the Tangible Asset section of Strand's Balance Sheet at 12/31/20 and 12/31/21arrow_forwardPlease prepare the following joiurnal entries: Show all calcualtions Bought a van, paying $10500 cash as a down payment and signed a 10 month $32000, 9% note payable for the balanceThe company paid 750 to have its company logo printed on the side of the van. The residual value is $7500. The old van was sold for $7500; it cost $32000 and acculumated depreciation up to the date of disposal was $30000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education