Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

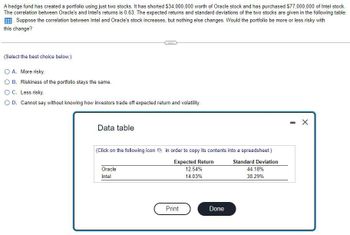

A hedge fund has created a portfolio using just two stocks. It has shorted $34,000,000 worth of Oracle stock and has purchased $77,000,000 of Intel stock. The correlation between Oracle's and Intel's returns is 0.63. The expected returns and standard deviations of the two stocks are given in the following table below. Suppose the correlation between Intel and Oracle's stock increases, but nothing else changes. Would the portfolio be more or less risky with this change?

Transcribed Image Text:A hedge fund has created a portfolio using just two stocks. It has shorted $34,000,000 worth of Oracle stock and has purchased $77,000,000 of Intel stock.

The correlation between Oracle's and Intel's returns is 0.63. The expected returns and standard deviations of the two stocks are given in the following table:

Suppose the correlation between Intel and Oracle's stock increases, but nothing else changes. Would the portfolio be more or less risky with

this change?

(Select the best choice below.)

O A. More risky.

O B. Riskiness of the portfolio stays the same.

OC.

Less risky.

O D. Cannot say without knowing how investors trade off expected return and volatility.

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Expected Return

Standard Deviation

12.54%

14.03%

Oracle

Intel

Print

Done

44.18%

38.29%

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The two stocks in your portfolio, X and Y, have independent returns, so the correlation between them, rXY is zero. Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y. Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%. Describe your two stocks portfolio by calculating its return and beta. Show your calculationsarrow_forwardConsider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta A 11.45% 14% 0.9 B 12.55 14 1.1 C 15.30 14 1.6 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 6.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) What is the market risk premium (rM - rRF)? Round your answer to one decimal place. % What is the beta of Fund P? Do not round intermediatearrow_forwardAn individual common stock has a beta of 0.9 and a correlation coefficient of 0.9. The expected return of the stock is 20%, and the standard deviation of its returns is 12%. If a risk-free asset has an expected return of 4%, then: a) the expected return on the market portfolio is 22%. b) the market returns standard deviation is 12%. c) the beta of the market returns is 0.9. d) both a) and b) are true. e) both a) and c) are true. Pls show procedure, thanksarrow_forward

- RiverRocks, Inc., is considering a project with the following projected free cash flows: Year 1 2 3 Cash Flow - $49.7 $10.2 $19.6 $19.6 $15.1 (in millions) The firm believes that, given the risk of this project, the WACC method is the appropriate approach to valuing the project. RiverRocks' WACC is 12.4%. Should it take on this project? Why or why not? The timeline for the project's cash flows is: (Select the best choice below.) O A. Cash Flows (millions) - $49.7 - $10.2 - $19.6 - $19.6 - $15.1 Year 1 2 3 4 O B. Cash Flows (millions) $49.7 $10.2 $19.6 $19.6 $15.1 Year 1 4 O C. Cash Flows (millions) - $49.7 $10.2 $19.6 $19.6 $15.1 Year 1 2 3 4 O D. Cash Flows (millions) $49.7 - $10.2 - $19.6 $19.6 - $15.1 Year 1 2 4 The net present value of the project is S million. (Round to three decimal places.) RiverRocks V take on this project because the NPV is (Select from the drop-down menus.)arrow_forwardYour portfolio allocates equal funds to DW Co. and Woodpecker, Inc. DW Co. stock has an annual return mean and standard deviation of 15 percent and 38 percent, respectively. Woodpecker, Inc., stock has an annual return mean and standard deviation of 10.2 percent and 52 percent, respectively. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 16 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. Smallest expected loss 8.19 %arrow_forwardConsider the following information for stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.) Stock Expected Return Standard Deviation Beta A 6.95% 15% 0.7 B 8.35 15 1.1 C 10.45 15 1.7 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 4.5%, and the market is in equilibrium. (That is, required returns equal expected returns.) What is the market risk premium (rM - rRF)? Round your answer to one decimal place. % What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. % What would you expect the standard deviation of Fund P to be? Less than 15% Greater than 15% Equal to 15%arrow_forward

- Did I calculate this correctly? If not, what am I doing incorrectly? Suppose Intel stock has a beta of 1.72, whereas Boeing stock has a beta of 0.99. If the risk-free interest rate is 3.5% and the expected return of the market portfolio is 12.5%, according to the CAPM, What is the expected return of Intel stock? Expected return of stock = .1898 = 19%; Expected return of Intel stock is > the market return of 12.5% since Intel Beta is greater than 1 What is the expected return of Boeing stock? Expected return of stock = .1241 = 12%; Expected return of Boeing stock is < market return of 12.5% since Boeing Beta is less than 1 What is the beta of a portfolio that consists of 65% Intel stock and 35% Boeing stock? Find the Beta of the portfolio: Beta Portfolio Formula = Weight*Beta + Weight*Beta Beta Portfolio Formula = (.65)(1.72) + (.35)(0.99) 118 + .3465 Portfolio Beta @ 65% Intel and 35% Boeing = 1.4645 = 1.465 4. What is the expected return of a portfolio that consists of…arrow_forwardI am having trouble solving this problem. Can you please provide me with some help? Thank you. I appreciate it. You estimate that the expected return of MSFT stock is 4%, and standard deviation of MSFT stock is 9%. The expected return of AAPL stock is 3%, and standard deviation of MSFT stock is 8%. If the correlation between AAPL returns and MSFT returns is 80%, what is the expected return and standard deviation of a portfolio with $4,000 invested in MSFT and $6,000 invested in AAPL?arrow_forwardThe following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 500 index. A hedge fund manager believes that Waterworks is underpriced, with an alpha of 2,1% over the coming month. Beta 1.4 Standard Deviation R- of Residuals square 0.65 0.1 (i.e., 10% monthly) Now suppose that the manager misestimates the beta of Waterworks stock, believing it to be 0.5 instead of 1.4. The standard deviation of the monthly market rate of return is 9%. If he holds a $5,000,000 portfolio of Waterworks stock. The S&P 500 currently is at 2,000 and the contract multiplier is $50. a. What is the standard deviation of the (now improperly) hedged portfolio? (Round your answer to 3 decimal places.) Standard deviation % b. What is the probability of incurring a loss on improperly hedged portfolio over the next month if the monthly market return has an expected value of 1% and a standard deviation of 9%? The manager holds a $5 million portfolio of Waterworks…arrow_forward

- Using the CAPM theory, if the Volatility of a stock is twice as great as the market, the market return on stocks in general (using the S&P 500 as a proxy) is 12 %, and treasury bills are yielding 2%, what is the return that investors in that security can expect? C r = Rf + beta x (Km - Rf) where r is the expected (required) return rate on a security (based on how risky it is); Rf is the rate of a "risk-free" investment, i.e. cash; Km is the return rate of the appropriate asset class (Market Return) Beta measures the volatility of the security, relative to the asset class. 12% 16% 22% Capital Assets Pricing Model 20%arrow_forwardAssume the return on a market index represents the common factor and all stocks in the economy have a beta of 1. Firm-specific returns all have a standard deviation of 31%. Suppose an analyst studies 20 stocks and finds that one-half have an alpha of 2.0%, and one-half have an alpha of –2.0%. The analyst then buys $1.1 million of an equally weighted portfolio of the positive-alpha stocks and sells short $1.1 million of an equally weighted portfolio of the negative-alpha stocks. Required: a. What is the expected profit (in dollars), and what is the standard deviation of the analyst’s profit? (Enter your answers in dollars not in millions. Do not round intermediate calculations. Round your answers to the nearest dollar amount. b-1. How does your answer for standard deviation change if the analyst examines 50 stocks instead of 20?arrow_forwardYou own a portfolio equally invested in a risk-free asset and two stocks. If one of the stocks has a beta of 1.23 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock betaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education