Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

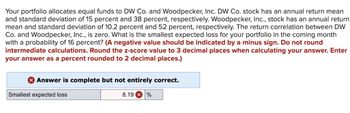

Transcribed Image Text:Your portfolio allocates equal funds to DW Co. and Woodpecker, Inc. DW Co. stock has an annual return mean

and standard deviation of 15 percent and 38 percent, respectively. Woodpecker, Inc., stock has an annual return

mean and standard deviation of 10.2 percent and 52 percent, respectively. The return correlation between DW

Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month

with a probability of 16 percent? (A negative value should be indicated by a minus sign. Do not round

intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter

your answer as a percent rounded to 2 decimal places.)

Answer is complete but not entirely correct.

Smallest expected loss

8.19 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B, you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: image a) Asset A is undervalued and therefore I will long the asset. b) Asset B is overvalued and therefore I will short the asset. c) Asset C is undervalued and therefore I will long the asset. d) a) and d) are true. e) None of the above. Pls show procedure, thanksarrow_forward(a) Calculate the expected rate of return, variance and standard deviation of Stock X & Stock Y. (b) Assume that the covariance between Stock X and Stock Y is -0.5%. Calculate the expected rate of return, variance and standard deviation of Jenny’s portfolio. (c) Explain why, in general, the portfolio risk is lower than the weighted average of individual stocks’ risk.arrow_forwardConsider a three-factor APT model. The factors and associated risk premiums are: Factor Risk Premium (%) Change in gross national product (GNP) + 6.5 Change in energy prices 0.5 Change in long-term interest rates +2.9 Calculate expected rates of return on the following stocks. The risk - free interest rate is 6.8%. A stock whose return is uncorrelated with all three factorsarrow_forward

- Your portfolio allocates equal funds to the DW Co. and Woodpecker, Inc. DW Co. stock has an annual return mean and standard deviation of 15 percent and 44 percent, respectively. Woodpecker, Inc., stock has an annual return mean and standard deviation of 11.4 percent and 58 percent, respectively. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 16 percent? (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Omit the "%" sign in your response.) Smallest expected loss %arrow_forwardTyler Trucks stock has an annual return mean and standard deviation of 12.5 percent and 46 percent, respectively. Michael Moped Manufacturing stock has an annual return mean and standard deviation of 12.0 percent and 46 percent, respectively. Your portfolio allocates equal funds to Tyler Trucks stock and Michael Moped Manufacturing stock. The return correlation between Tyler Trucks and Michael Moped Manufacturing is -.50. What is the smallest expected loss for your portfolio in the coming month with a probability of 1.0 percent? Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places. Smallest expected loss %arrow_forwardYour portfolio allocates equal funds to DW Co. and Woodpecker, Inc., DW Co. stock has an annual return mean and standard deviation of 9 percent and 30 percent, respectively. Woodpecker, Inc., stock has an annual return mean and standard deviation of 20 percent and 46 percent, respectively. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 16 percent? (Negative amounts should be indicated by a minus sign. Round your answer to 2 decimal places. Omit the "%" signs in your response.) Smallest expected loss. -12.81arrow_forward

- Your portfolio allocates equal funds to DW Co. and Woodpecker, Inc. DW Co. stock has an annual return mean and standard deviation of 10 percent and 33 percent, respectively. Woodpecker, Inc., stock has an annual return mean and standard deviation of 21 percent and 47 percent, respectively. The return correlation between DW Co. and Woodpecker, Inc., is zero. What is the smallest expected loss for your portfolio in the coming month with a probability of 2.5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round the z-score value to 3 decimal places when calculating your answer. Enter your answer as a percent rounded to 2 decimal places.) Smallest expected loss %arrow_forwardA portrollo consists of assets with the following expected returns: Technology stocks Pharmaceutical stocks Utility stocks Savings account a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? Round your answer to two decimal places. % 26% 16 9 4 b. What is the expected return on the portfolio if the investor puts 53 percent of available funds in technology stocks, 15 percent in pharmaceutical stocks, 14 percent in utility stocks, and 18 percent in the savings account? Round your answer to two decimal places. %arrow_forwardYou are examining a portfolio consisting of three stocks. Using the data in the table a. Compute the annual returns for a portfolio with 25% invested in North Air, 25% invested in West Air, and 50% invested in Tex Oil. b. What is the lowest annual return for your portfolio in part (a)? How does it compare with the lowest annual return of the individual stocks or portfolios in the table above. a. Compute the annual returns for a portfolio with 25% invested in North Air, 25% invested in West Air, and 50% invested in Tex Oil. The annual return for 2014 will be: (Round to two decimal places.) Year 2014 Year 2016 North Air 21% Year 2018 North Air The annual return for 2015 will be: (Round to two decimal places.) Year 2019 29% 6% Year 2015 The annual return for 2016 will be: (Round to two decimal places.) North Air North Air West Air West Air -6% 8% North Air -1% West Air North Air 21% 8% 6% The annual return for 2017 will be: (Round to two decimal places.) West Air Year 2017 The annual…arrow_forward

- Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill presented below. What is the Fama diversification measure for the Globex Fund? Assume the T-bill rate as the risk- free rate and the S&P return as the market average return. Use at least four decimal places in your calculations, but report your answer in percentage terms rounded to two decimal places. (Ex..12345 should be entered as "12.35") Investment Vehicle Globex Fund World Fund S&P500 90-day T-bill Answer: Average Rate of Return% 25.2 13.92 15.52 7.10 Standard Deviation 21.33 14 12.8 0.3 Beta 1.05 0.95 R² 0.756 0.741arrow_forwardYou hold 5% of your equity in stock A, 20% of your equity in stock B, and 75% of your equity in Stock C. You rebalance and tilt your portfolio towards stock A with a tilt size of 0.04. (A) What are the weights of the tilted portfolio? (B) Delever the tilted portfolio to create a position with zero risk-free weight that has the same Sharpe ratio as the tilted portfolio. Specify the portfolio weights of the delevered portfolio.arrow_forwardYou are allocating your wealth between two shares, Tinkle.com and Circumbendibus Wheels. Tinkle.com has volatility 35.10%, while Circumbendibus Wheels has volatility 58.30%. The correlation beteween the two shares' returns is 0.40. What percentage of your wealth should you allocate to Tinkle.com to minimise your portfolio's volatility?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education