Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

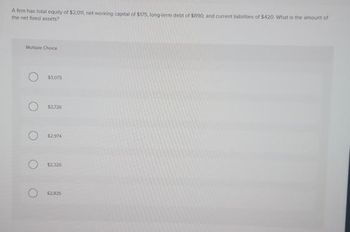

Transcribed Image Text:A firm has total equity of $2,0tt, net working capital of $175, long-term debt of $890, and current liabilities of $420 What is the amount of

the net fixed assets?

Multiple Choice

$3,075

$2,726

$2.974

$2.326

$2.825

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If assets are $348,000 and liabilities are $188,000, then equity equals: 3. Multiple Choice 1.66 polnts 02:58:50 $160,000. $188,000. $348,000. $536,000. $884,000. Mc Graw ...arrow_forwardPresent Value Index Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: Des Moines Cedar Rapids Total present value of net cash flow $252,720 $274,550 Amount to be invested (243,000) (289,000) Net present value $9,720 $(14,450) a. Determine the present value index for each proposal. Round your answers for the present value index to two decimal places. Des Moines Cedar Rapids Total present value of net cash flow Amount to be invested $ $ Present value index b. Which location does your analysis support? (If both present value indexes are the same, either location will grade as correct.) v, because the net present value index is 1.arrow_forwardConsider the following sets of investment projects n(years) A($) B($) C($) D($) 0 -3,500 -5,800 -5,200 -40,000 1 600 3,000 2,000 12,000 2 600 2,000 4,000 14,000 3 1,000 1,000 2,000 18,000 4 1,000 500 4,000 18,000 5 1,000 500 2,000 14,000 Compute the equivalent annual worth of each project at i=10% and determine the acceptability of each project.arrow_forward

- If assets are $375,000 and equity is $125,000, then llablikies are: O O Multiple Choice O $500,000. $125,000. $625,000. $250,000. $375,000 15arrow_forwardHh1.arrow_forwardAsset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 Cash Flow By using cell references to the given data and the function PV, Calculate the value of asset D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education