FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A guitar manufacturer is considering eliminating its electric guitar division because its $90,790 expenses are higher than its $84,030 sales. The company reports the following expenses for this division.

| Avoidable Expenses |

Unavoidable Expenses |

||||||

| Cost of goods sold | $ | 63,000 | |||||

| Direct expenses | 9,250 | $ | 2,950 | ||||

| Indirect expenses | 1,010 | 2,150 | |||||

| Service department costs | 10,400 | 2,030 | |||||

Should the division be eliminated? (Any loss amount should be indicated with minus sign.)

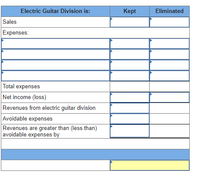

Transcribed Image Text:Electric Guitar Division is:

Кept

Eliminated

Sales

Expenses:

Total expenses

Net income (loss)

Revenues from electric guitar division

Avoidable expenses

Revenues are greater than (less than)

avoidable expenses by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer is considering eliminating a segment because it shows the following $6,300 loss. All $21,100 of its variable costs are avoidable, and $38,500 of its fixed costs are avoidable. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated? Complete this question by entering your answers in the tabs below. Required A $ 63,300 21,100 42,200 48,500 (6,300) Required B Compute the incomoarrow_forwardPlease solve this problemarrow_forwardNonearrow_forward

- please step by step solution.arrow_forwardChoose the product that will have the largest loss if sales greatly decrease. Letter Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Sales and costs for each product follow.arrow_forwardam .106.arrow_forward

- Marin Company makes several products, including canoes. The company reports a loss from its canoe segment (see below). All its variable costs are avoidable, and $330,000 of its fixed costs are avoidable. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) $ 1,097, 600 784,000 313,600 376,000 $ (62,400) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be continued or eliminated?arrow_forwardrrrrrrrrarrow_forwardnot use ai pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education