FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello teacher please help me this question general accounting

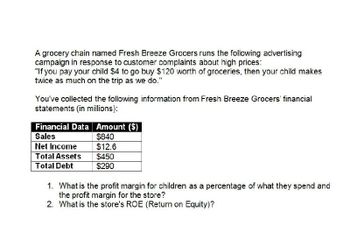

Transcribed Image Text:A grocery chain named Fresh Breeze Grocers runs the following advertising

campaign in response to customer complaints about high prices:

"If you pay your child $4 to go buy $120 worth of groceries, then your child makes

twice as much on the trip as we do."

You've collected the following information from Fresh Breeze Grocers' financial

statements (in millions):

Financial Data Amount ($)

Sales

$840

Net Income

$12.6

Total Assets

$450

Total Debt

$290

1. What is the profit margin for children as a percentage of what they spend and

the profit margin for the store?

2. What is the store's ROE (Return on Equity)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In response to complaints about high prices, a grocery chain runs the following advertising campaign: “If you pay your child $1 to go buy $32 worth of groceries, then your child makes about twice as much on the trip as we do.” You’ve collected the following information from the grocery chain’s financial statements: (millions) Sales $ 764.00 Net income 11.95 Total assets 345.00 Total debt 155.00 a. What is the child’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the store’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the store's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardM In response to complaints about high prices, a grocery chain runs the following advertising campaign:"If you pay your child $1 to go buy $31 worth of groceries, then your child makes about twice as much on the trip as we do." You've collected the following information from the grocery chain's financial statements: (in millions) Sales Net income Total assets Total debt $ 780.00 12.75 a. Child's profit margin b. Store's profit margin c. Store's ROE 385.00 159.00 a. What is the child's profit margin? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the store's profit margin? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. What is the store's ROE? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. %arrow_forwardMunabhaiarrow_forward

- You buy goods for $3,000 and receive a voucher for $500 off your next purchase within 30 days. Based on historical experience, the vendor estimates that 90% of its customers use these vouchers. How much revenue should the vendor recognize immediately at the time of your original purchase?arrow_forwardA clothing retailer is going to mail out 10,000 catalogues. It costs $2 to mail out each catalogue. When a customer places an order from a catalogue assume a profit of $50 per order is earned. It is assumed that 5% of those who receive a catalogue will place an order however, this number can vary. Use the file below to help you with your tables. Assume that: [total profit = total profit made from the orders – the amount spent on mailing out the catalogues]. a) Use a one-variable data table to determine how the total profit earned from the mailing will vary depending on a response rate between 4% and 10% (with increments of 2%). b) Create a two-variable data table to show how the total profit changes with a varying response rate and number of catalogues mailed. Vary the response rate between 4% and 10% with increments of 2% and vary the number of catalogues mailed from 10,000 to 30,000 at increments of 5000.arrow_forwardA school purchasing manager is seeking to buy tablets from either Entity A or Entity B and will pay shipping costs. The purchase price is $500 each. Entity A purchases the tablets from the manufacturer, Banana Industries (for $400). Entity A has the tablets shipped to its distribution center in Denver, and then ships them to schools when a sale is made. Entity A at times offers discounts to schools in accordance with its marketing strategy. On the other hand, Entity B sells tablets from a variety of manufacturers including Banana Industries. When a sale is made, Entity B remits the proceeds to the manufacturer, and retains a 10% commission (here $50). Entity B has no discretion as to the sales price. The manufacturer then ship the equipment to the customer. For each arrangement, indicate how much revenue and gross profit should be recognized. Provide support for your answer from the ASC and cite the applicable provisions. You should cite like this: ASC 606-10-35-3(e) so we can find…arrow_forward

- A woman’s store sells the following categories of clothing or the following prices : Blouse :GH 14 Skirt:GH 16 Dress:GH 25 Pantyhose:GH 2 pair for GH3 Socks :GH 7 A lady goes to the store on a day when the store has 20% off sale on all skirts.If Yaa buys 2 skirts,1 dress ,and 4 pairs of pantyhose,How much money does lady have to pay ?arrow_forwardMike purchases a bicycle costing $152.90. State taxes are 4% and local sales taxes are 2%. The store charges $20 for assembly. What is the total purchase price (in $)? (Round your answer to the nearest cent.) $ 182.08 Need Help? Read It Watch It Master Itarrow_forwardHello, please help. I dont know what I am getting wrongarrow_forward

- Part B. Beaver Limited is a retail company that sells sporting goods. The company has a customer loyalty program that allows customers to earn points based on sales made. These points can be accumulated and used for future purchases. One customer loyalty point is awarded for every $1 of purchases. During March 2023, the company recorded sales of $1,725,000 to customers who were accumulating points. The stand-alone value of these goods sold was $1,725,000. Beaver has also determined that each point has a fair value of $0.017. Required: a. What are the two performance obligations? b. Sale of Goods c. Customer Loyalty Program 1. Allocate the sales price of $1,725,000 to the two performance obligations Allocation to Performance obligation 1: $ Allocation to performance obligation 2: $ 2. Prepare the entry to record the sales (all cash) for the month of March 2023. Cash Revenue Loyalty Liability Debit 1,725,000 Creditarrow_forwardA wholesaler purchases widgets for $8 per unit from the manufacturer and sells it to retailers who then sell to consumers. The wholesaler marks up by 20% on the retailer purchase price, while the retailers mark up by 25% on the wholesaler selling price. Here, the retail selling price to the consumer is: O $12.00 O $12.80 All the other 4 answers are correct. $12.50 O $13.33arrow_forwardLook at the question belowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education