Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

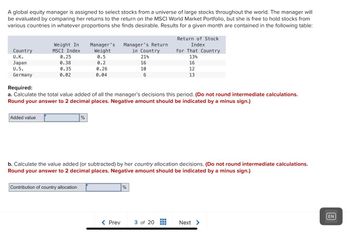

Transcribed Image Text:A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will

be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from

various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table:

Country

U.K.

Japan

U.S.

Germany

Weight In

MSCI Index

Added value

0.25

0.38

0.35

0.02

Manager's

Weight

0.5

0.2

0.26

0.04

%

Contribution of country allocation

Required:

a. Calculate the total value added of all the manager's decisions this period. (Do not round intermediate calculations.

Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.)

Manager's Return

in Country

< Prev

21%

16

10

6

b. Calculate the value added (or subtracted) by her country allocation decisions. (Do not round intermediate calculations.

Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.)

%

Return of Stock

Index

for That Country

13%

16

12

13

3 of 20

Next >

ΕΝ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardA global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table Country U.K. Japan U.S. Germany Weight In MSCI Index 0.15 0.30 0.45 0.10 Added value Manager's Weight 0.30 Answer is complete but not entirely correct. 0.51 0.10 0.40 0.20 Contribution of country allocation % Manager's Return in Country 20% Required: a. Calculate the total value added of all the manager's decisions this period. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) 15 10 5 0.11 Answer is complete but not entirely correct. Return of Stock Index for That Country 12% b. Calculate the value added (or subtracted) by her country…arrow_forwardBhupatbhaiarrow_forward

- Neha is an analyst at a wealth management firm. One of her clients holds a $7,500 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. 35% 0.750 0.53% Arthur Inc. 20% 1.400 0.57% Li Corp. 15% 1.300 0.60% Transfer Fuels Co. 30% 0.300 0.64% Neha calculated the portfolio’s beta as 0.828 and the portfolio’s expected return as 8.55%. Neha thinks it will be a good idea to reallocate the funds in her client’s portfolio. She recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4.00%, and the market risk premium is 5.50%. 1. According to Neha’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? 0.86% 0.67% 1.07% 0.99%…arrow_forwardMr. Ota is an analyst for a large pension fund and he has been assigned the task of evaluating two different external portfolio managers (K and C). He considers the following historical average return, standard deviation, and CAPM beta estimates for these two managers over the past five years: Actual Average Standard deviation Portfolio Beta Return Manager K Manager C 7.80% 10.05% 0.75 12.0% 15.50% 1.45 Additionally, Mr. Ota estimate for the risk premium for the market portfolio is 5.40% and the risk-free rate is currently 2.50%. a. For both Managers K and C, calculate the expected return using the CAPM. Express your answers to the nearest basis point (i.e., xX.XX%)arrow_forwardThe Standard and Poor's 500 is an index that include 500 of the best US companies and is based on the price of the stocks of said companies. Select one: True Falsearrow_forward

- A UK investor buys $1 million of UK stocks in a portfolio with beta 1.2 with respect to the UK market index, and $2 million of US stocks in a portfolio with beta 0.8 w.r.t. with respect to the US market index. Suppose the FTSE 100, S&P 500 and £/$ volatilities are 15%, 10% and 35% respectively, and their correlations are: %UK−US = 0.7, %UK−£/$= 0.4 and %US−£/$= 0.5. Calculate the VaR due to each market risk factor and then aggregate this into (a) the equity VaR and (b) the total systematic VaR. For each VaR figure apply the normal linear model and use 99% confidence (i.e. α = 1%) and h = 10 days for the risk horizon. Express all your answers in $.arrow_forwardquiz 8-20arrow_forwardThe stock market data given by the following table. Telmex Mexico World Correlation Coefficients Telmex 1.00 Equity cost Mexico 0.90 1.00 World 0.60 0.75 1.00 % SD (%) 18 15 10 R (%) ? The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations (SD) of returns and the expected returns (R). The risk-free rate is 6%. 14 12 Suppose now that Telmex has made its shares tradable internationally via crosslisting on the NYSE. Again using the CAPM paradigm, estimate Telmex's equity cost of capital. (Do not round intermediate calculations. Round your answer as a percent rounded to 2 decimal places.)arrow_forward

- Kelli Blakely is a portfolio manager for the Miranda Fund, a core large-cap equity fund. The benchmark for performance measurement purposes is the S&P 500. Although the Miranda portfolio generally mirrors the asset class and sector weightings of the S&P, Blakely is allowed a significant amount of leeway in managing the fund. Blakely was able to produce exceptional returns last year (as outlined in the table below) through her market timing and security selection skills. At the outset of the year, she became extremely concerned that the combination of a weak economy and geopolitical uncertainties would negatively impact the market. Taking a bold step, she changed her market allocation. For the entire year her asset class exposures averaged 50% in stocks and 50% in cash. The S&P's allocation between stocks and cash during the period was a constant 97% and 3%, respectively. The risk-free rate of return was 2%. One-Year Trailing Returns Miranda Fund 10.2% 37% Return Standard deviation Beta…arrow_forwardBelow are two alternative strategies under consideration by an investment fi rm:Strategy A : Invest in stocks that are components of a global equity index, have aROE above the median ROE of all stocks in the index, and have a P/E less thanthe median P/E.Strategy B : Invest in stocks that are components of a broad-based US equity index,have a ratio of price to operating cash fl ow in the lowest quartile of companies inthe index, and have shown increases in sales for at least the past three years.Both strategies were developed with the use of back-testing.1 . How would you characterize the two strategies?2 . What concerns might you have about using such strategies?arrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education