Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

answer in text form please (without image)

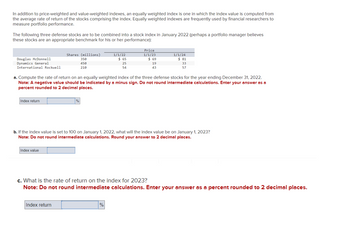

Transcribed Image Text:In addition to price-weighted and value-weighted indexes, an equally weighted index is one in which the index value is computed from

the average rate of return of the stocks comprising the index. Equally weighted indexes are frequently used by financial researchers to

measure portfolio performance.

The following three defense stocks are to be combined into a stock index in January 2022 (perhaps a portfolio manager believes

these stocks are an appropriate benchmark for his or her performance):

Douglas McDonnell

Dynamics General

International Rockwell

Index return

Shares (millions)

350

450

210

Index value

%

Index return

1/1/22

a. Compute the rate of return on an equally weighted index of the three defense stocks for the year ending December 31, 2022.

Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a

percent rounded to 2 decimal places.

$ 65

=

25

54

%

Price

1/1/23

$69

b. If the index value is set to 100 on January 1, 2022, what will the index value be on January 1, 2023?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

19

43

1/1/24

$ 81

33

57

c. What is the rate of return on the index for 2023?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardAll blanks need to be filled please and thank you, it's incomplete as of now.arrow_forwardHow do you make a two-dimensional columnar chart in excel?arrow_forward

- Please answer questions correctlyarrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forwardAny help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forward

- Write me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forwardHow do you get a report into PDF format? Select an answer: You need to email the report and then convert it to PDF. Click on the Export button and Click on Export as PDF. You cannot export reports into PDF. You have to print the report and then scan it as a PDF.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education