Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

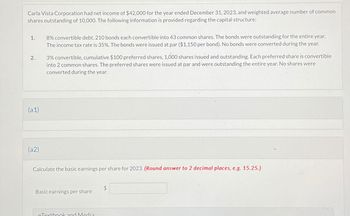

Transcribed Image Text:Carla Vista Corporation had net income of $42,000 for the year ended December 31, 2023, and weighted average number of common

shares outstanding of 10,000. The following information is provided regarding the capital structure:

1.

2.

(a1)

(a2)

8% convertible debt, 210 bonds each convertible into 43 common shares. The bonds were outstanding for the entire year.

The income tax rate is 35%. The bonds were issued at par ($1,150 per bond). No bonds were converted during the year.

3% convertible, cumulative $100 preferred shares, 1,000 shares issued and outstanding. Each preferred share is convertible

into 2 common shares. The preferred shares were issued at par and were outstanding the entire year. No shares were

converted during the year.

Calculate the basic earnings per share for 2023. (Round answer to 2 decimal places, e.g. 15.25.)

Basic earnings per share

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Whirlie Inc. issued $300,000 face value, 10% paid annually, 10-year bonds for $319,251 when the market of interest was 9%. The company uses the effective-interest method of amortization. At the end of the year, the company will record ________. A. a credit to cash for $28,733 B. a debit to interest expense for $31,267 C. a debit to Discount on Bonds Payable for $1,267 D. a debit to Premium on Bonds Payable for $1.267arrow_forwardBelow is select information from two, independent companies. Additional information includes: On January 1, Company A issued a 5-year $1,500,000 bond with at 6% stated rate. Interest is paid semiannually and the bond was sold at 105.5055 to yield a market rate of 4.75%. On January 1, Company B sold $1,500,000 of common stock and paid dividends of $75,000. A. Prepare an income statement for each company (ignore taxes) B. Explain why the net income amounts are different, paying particular attention to the operational performance and financing performance of each company. (Hint: it may be helpful for you to create an amortization table).arrow_forwardOn January 1, Jim Shorts Corporation issued bonds for $580 million. This bond issue was originally issued at premium. During the same year, $1,500,000 of the bond premium was amortized. On a statement of cash flows prepared using the indirect method, Jim Shorts Corporation should report: O that $1.5 million to be added to net income O An investing activity of $580 million. O A financing activity of $300 million. O that $1.5 million to be deducted from net incomearrow_forward

- The following information relates to the debt investments of Concord Inc. during a recent year: 1. On February 1, the company purchased Gibbons Corp. 10% bonds with a face value of $372,000 at 100 plus accrued interest. Interest is payable on April 1 and October 1. 2. On April 1, semi-annual interest was received on the Gibbons bonds. 3. On June 15, Sampson Inc. 9% bonds were purchased. The $248,000 par-value bonds were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On August 31, Gibbons bonds with a par value of $74,400 purchased on February 1 were sold at 99 plus accrued interest. 5. On October 1, semi-annual interest was received on the remaining Gibbons bonds. 6. On December 1, semi-annual interest was received on the Sampson bonds. 7. On December 31, the fair values of the bonds purchased on February 1 and June 15 were 98.5 and 101, respectively. Assume the investments are accounted for under the recognition and measurement requirements of…arrow_forwardOn January 2, $217981 in 10 year, 5% bonds with a market interest rate of 9%, and interest payable semiannually, were issued for $185895.On June 30, bond interest was paid. On December 31, the corporation showed an after tax Net Income of $53586. On December 31, bond interest was paid; and dividends were declared and paid. What is the Bond Interest Expense on the Income Statement on December 31? On January 2, $186442 in 11 year, 9% bonds with a market interest rate of 6%, and interest payable semiannually, were issued for $206254. On June 30, bond interest was paid. On December 31, the corporation showed an after tax Net Income of $59680. On December 31, bond interest was paid; and dividends were declared and paid. What is the Bond Interest Expense on the Income Statement on December 31?arrow_forwardKier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. The bonds have a 5.50% stated rate of interest interest is payable in cash on December 31 each year. Based on this information alone, what are the amounts of interest expense and cash flows from operating activities, respectively, that will be reported in the financial statements for the year ending December 31, Year 1? Multiple Choice O Zero and $40,700 $40,700 and $40,700 Zero and Zero $40,700 and Zeroarrow_forward

- On June 1 of the current year, Cross Corp. issued $300,000 of 8% bonds payable at par with interest payment dates of April 1 and October 1. In its income statement for the current year ended December 31, what amount of interest expense should Cross report? $ 8,000 $12,000 $14,000 $ 6,000arrow_forwardOn January 1, Year 1, Residence Company issued bonds with a $50,000 face value. The bonds were issued at face value. They had a 20 year term and a stated rate of interest of 7%. Which of the following shows how the payoff of the bond liability will affect Residence’s financial statements on December 31, Year 20 (the maturity date)? Balance Sheet Income Statement Statement of Cash Flows Assets = Liab. + Equity Rev. − Exp. = Net Inc. A. NA = NA + NA NA − NA = NA (50,000) IA B. NA = NA + NA NA − NA = NA (50,000) FA C. 50,000 = 50,000 + NA NA − NA = NA 50,000 IA D. (50,000) = (50,000) + NA NA − NA = NA (50,000) FAarrow_forwardsarasota corporation has 9% convertible bonds outstanding. it recorded interest expense (net of income taxes) Oven $6,300 on these bonds during the year. The bonds are convertible into 2500 shares of common stock. compute the impact of these convertible bonds on Sarasota diluted earnings per share.arrow_forward

- The following information relates to the debt securities investments of Sunland Company. 1. On February 1, the company purchased 10% bonds of Gibbons Co. having a par value of $324,000 at 100 plus accrued interest. Interest is payable April 1 and October 1. 2. On April 1, semiannual interest is received. 3. On July 1, 9% bonds of Sampson, Inc. were purchased. These bonds with a par value of $186,000 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On September 1, bonds with a par value of $60,000, purchased on February 1, are sold at 99 plus accrued interest. 5. On October 1, semiannual interest is received. 6. On December 1, semiannual interest is received. 7. On December 31, the fair value of the bonds purchased February 1 and July 1 are 95 and 93, respectively. (a)Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these are available-for-sale securities.…arrow_forwardGrocery Corporation received $300,652 for 12.50 percent bonds issued on January 1, 2018, at a market interest rate of 9.50 percent. The bonds had a total face value of $253,000, stated that interest would be paid each December 31, and stated that they mature in 10 years. Required: Prepare the following table for each account by indicating (a) whether it is reported on the Balance Sheet (B/S) or Income Statement (1/S). (b) the dollar amount by which the account increases, decreases, or does not change when Grocery Corporation issues the bonds; and (c) the direction of change in the account [increase, decrease, or no change) when Grocery Corporation records the interest payment on December 31. Account Bonds Payable Discount on Bonds Payable Interest Expense Premium on Bonds Payable (a) Financiat Statement the issuance (c) Interest Paid 4arrow_forwardOn the first day of its fiscal year, Ebert Company issued $12,500,000 of 10-year, 7% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 9%, resulting in Ebert receiving cash of $10,873,974. The company uses the interest method. Required: a. Journalize the entries to record the following transactions. Refer to the Chart of Accounts for exact wording of account titles. 1. Sale of the bonds. 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. b. Compute the amount of the bond interest expense for the first year. c. Explain why the company was able to issue the bonds for only $10,873,974 rather than for the face amount of $12,500,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning