Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:You Answered

orrect Answer

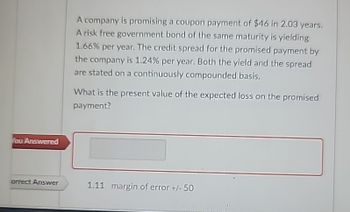

A company is promising a coupon payment of $46 in 2.03 years.

A risk free government bond of the same maturity is yielding

1.66% per year. The credit spread for the promised payment by

the company is 1.24% per year. Both the yield and the spread

are stated on a continuously compounded basis.

What is the present value of the expected loss on the promised

payment?

1.11 margin of error +/-50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the nominal yield on a 10-year government T-note if the real rate is 4%, the expected inflation is 5%, the liquidity premium is 1%, and the maturity risk premium is 1%? 1.5% • not enough information • 1.0% • 2.0% .arrow_forward4. Let R be the one-year LIBOR rate with annual compounding that will be determined in 6 years from now. Assume the forward interest rate volatility for the corresponding period is 20% per year. The risk-free rates with annual compounding are currently 5% for all maturities. a. Calculate the price of a financial derivative that pays 1000R € in 6 years from now. b. Calculate the price of a financial derivative that pays 1000R € in 7 years from now.arrow_forwardImagine that, during a job interview, you are handed the following quotes on U.S. Treasuries: Bond Maturity Coupon rate Yield to (years) maturity 1 1 5% 4.5% 2 2 5% 5.0% 3 3 0% 5.0% Assume that the par value is $100 and coupons are paid annually, with the first coupon payment coming in exactly one year from now. The yield to maturity is also quoted as an annual rate. What should be the 1-year forward rate between years 2 and 3? a. 6.482% ○ a. O b. 6.137% c. 6.507% O d. 6.736% NAVAarrow_forward

- Can you confirm if this answer is correct? Would it be upward sloping?arrow_forwardB. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 5.2 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? Probability Return a. 0.05 0.50 0.40 0.05 -5 3 7 8 % % % % The investment's expected return is ___%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education