FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

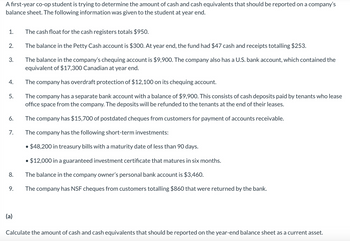

Transcribed Image Text:A first-year co-op student is trying to determine the amount of cash and cash equivalents that should be reported on a company's

balance sheet. The following information was given to the student at year end.

1.

The cash float for the cash registers totals $950.

2.

The balance in the Petty Cash account is $300. At year end, the fund had $47 cash and receipts totalling $253.

3.

The balance in the company's chequing account is $9,900. The company also has a U.S. bank account, which contained the

equivalent of $17,300 Canadian at year end.

4.

The company has overdraft protection of $12,100 on its chequing account.

5.

The company has a separate bank account with a balance of $9,900. This consists of cash deposits paid by tenants who lease

office space from the company. The deposits will be refunded to the tenants at the end of their leases.

The company has $15,700 of postdated cheques from customers for payment of accounts receivable.

6.

7.

The company has the following short-term investments:

• $48,200 in treasury bills with a maturity date of less than 90 days.

• $12,000 in a guaranteed investment certificate that matures in six months.

8.

The balance in the company owner's personal bank account is $3,460.

9.

The company has NSF cheques from customers totalling $860 that were returned by the bank.

(a)

Calculate the amount of cash and cash equivalents that should be reported on the year-end balance sheet as a current asset.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- On June 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,300. A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $138. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $420, Supplies $90, Postage Expense $260, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $170. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $252, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $192. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed…arrow_forwardOn June 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,300. A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $138. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $180. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $254, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $190. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed…arrow_forwardyoming Restoration Company completed the following selected transactions during July 20Y1: July 1. Established a petty cash fund of $1,200. 12. The cash sales for the day, according to the cash register records, totaled $8,356. The actual cash received from cash sales was $8,389. 31. Petty cash on hand was $217. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: July 3. Store supplies, $510. 7. Express charges on merchandise sold, $90 (Delivery Expense). 9. Office supplies, $30. 13. Office supplies, $35. 19. Postage stamps, $50 (Office Supplies). 21. Repair to office file cabinet lock, $60 (Miscellaneous Administrative Expense). 22. Postage due on special delivery letter, $28 (Miscellaneous Administrative Expense). 24. Express charges on merchandise sold, $135 (Delivery Expense). 30. Office supplies, $25. July 31. The cash sales for the day, according to the cash register records, totaled $10,289.…arrow_forward

- 1. Prepare a general journal entry to record establishing the petty cash fund. 2. Prepare a summary of petty cash payments. 3. Prepare the general journal entry to record the reimbursement and the decrease of the fund.arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $350 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $109.20 for janitorial expenses. May 15 b. Paid $89.15 for miscellaneous expenses. May 15 c. Paid postage expenses of $60.90. May 15 d. Paid $80.01 to Facebook for advertising expense. May 15 e. Counted $26.84 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $550. May 31 The petty cashier reports that $365.27 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $59.10. May 31 g. Reimbursed the office manager for mileage expense, $47.05. May 31 h. Paid $48.58 in…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $250 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures nade since May 1. May 15 a. Paid $78.00 for janitorial expenses. May 15 b. Paid $63.68 for miscellaneous expenses. May 15 c. Paid postage expenses of $43.50. May 15 d. Paid $57.15 to Facebook for advertising expense. May 15 e. Counted $19.17 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $450. May 31 The petty cashier reports that $303.39 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $48.36. May 31 g. Reimbursed the office manager for mileage expense, $38.50. May 31 h. Paid $39.75 in…arrow_forward

- On Jan. 1, Crisp Company had decided to establish a petty cash fund in the amount of $900.arrow_forwardKiona Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $350 to establish the petty cash fund. 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. a. Paid $109.20 for janitorial expenses. b. Paid $89.15 for miscellaneous expenses. c. Paid postage expenses of $60.90. d. Paid $80.01 to Facebook for advertising expense. e. Counted $26.84 remaining in the petty cashbox. 16 Prepared a company check for $200 to increase the fund to $550. 31 The petty cashier reports that $380.27 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. f. Paid postage expenses of $59.10. g. Reimbursed the office manager for mileage…arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $349.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78.…arrow_forward

- Journalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): a. On July 1, check No. 12-375 issued to establish a petty cash fund of $1,080. b. The amount of cash in the petty cash fund which is now $125. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $589; miscellaneous selling expense, $190; miscellaneous administrative expense, $150. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $1,080, record the discrepancy in the cash short and over account.)arrow_forwardKiona Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company's fiscal year). May 1 Prepared a company check for $300 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $93.60 for janitorial expenses. May 15 b. Paid $76.41 for miscellaneous expenses. May 15 c. Paid postage expenses of $52.20. May 15 d. Paid $68.58 to Facebook for advertising expense. May 15 e. Counted $23.01 remaining in the petty cashbox. May 16 Prepared a company check for $200 to increase the fund to $500. May 31 The petty cashier reports that $319.32 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31 f. Paid postage expenses of $53.73. May 31 g. Reimbursed the office manager for mileage expense, $42.78. May 31 h. Paid $44.17 in…arrow_forwardOn September 1, French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. On September 14, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $210. On September 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. On September 29, the company determined that the petty cash fund needed to be increased…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education