Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

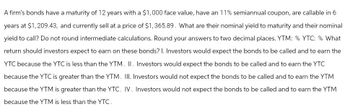

Transcribed Image Text:A firm's bonds have a maturity of 12 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 6

years at $1,209.43, and currently sell at a price of $1,365.89. What are their nominal yield to maturity and their nominal

yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What

return should investors expect to earn on these bonds? I. Investors would expect the bonds to be called and to earn the

YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC

because the YTC is greater than the YTM. III. Investors would not expect the bonds to be called and to earn the YTM

because the YTM is greater than the YTC. IV. Investors would not expect the bonds to be called and to earn the YTM

because the YTM is less than the YTC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A treasury bond with $100 maturity face value has a $9 annual coupon, and 15 years left to maturity. What price will the bond sell for assuming that the 15 year yield to maturity in the market is 4%, 9%, and 14% respectively. (Show working out, without the use of external software such as excel or stata) Explain whether the price movements would have been greater or smaller if a 10 year bond had been used rather than a 15 year one without any further calculations.arrow_forwardInterest rates on 4-year Treasury securities are currently 6.2%, while 6-year Treasury securities yield 8.05%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardGeneral Electric has just issued a callable (at par) 10- year, 5.7% coupon bond with annual coupon payments. The bond can be called at par in one year or anytime thereafter on a coupon payment date. It has a price of $ 102.15. a. What is the bond's yield to maturity? b. What is its yield to call? c. What is its yield to worst? Question content area bottom enter your response here %. (Round to two decimal places.)arrow_forward

- Interest rates on 4-year Treasury securities are currently 5.85%, while 6-year Treasury securities yield 7.85%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places.arrow_forwardA firm has liabilities of $98 in one year, $100 in two years, and $107 in three years. The firm exactly matches its liabilities by purchasing the following zero or annual coupon bonds redeemable at par: Bond Maturity Par Value Coupon Rate Effective Yield A 1 year 100 5% 3% B 2 years 100 0% 4% C 3 years 100 4% 5% Find the number of units of Bond A that must be purchased to match the liabilities exactly. (A) 0.894 (B) 0.897 (C) 0.913 (D) 0.933 (E) 0.959arrow_forwardRolling Company bonds have a coupon rate of 6.20 percent, 25 years to maturity, and a current price of $1,196. What is the YTM? The current yield? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) YTM % Current yield %arrow_forward

- A treasury bond with $100 maturity face value has a $9 annual coupon, and 15 years left to maturity. What price will the bond sell for assuming that the 15 year yield to maturity in the market is 4%, 9%, and 14% respectively. (Show working out) Explain whether the price movements would have been greater or smaller if a 10 year bond had been used rather than a 15 year one without any further calculations.arrow_forwardWhat are the excel formulas and answers to Part A and Part B. Part A: (Left Side) KIMCHI CORPORATION's capital investment bonds have a maturity of 10 years with a face value of $1,000 and a semi-annual 10% coupon. They are callable in 3 years at $1150 and currently sell for $1,290. What is the nominal yield to maturity and the nominal yield to call? What return should investors expect to earn on these bonds. Part B: (Right Side) KIMCHI CORPORATION also has bonds with 5 years left to maturity with an annual coupon of 10%. What would be the yield to maturity at a current market price of $850? What would be the yield to maturity if the current market price would be $1,125? What would be the price of the bond to you if your cost of capital was 12%? What would be the price of the bond to you if your cost of capital was 8%?arrow_forwardA firm's bonds have a maturity of 8 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 4 years at $1,047.04, and currently sell at a price of $1,091.13. What is their nominal yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. What is their nominal yield to call? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity 1 YTM(%) 5.6% 2 3 4 6.6 7.1 7.6 According to the expectations hypothesis, what is the market's expectation of the yield curve one year from now? Specifically, what are the expected values of next year's yields on bonds with maturities of (a) one year? (b) two years? (c) three years? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) APCO D Bond Years to Maturity YTM (%) B 1 % C 2 % D 3 %arrow_forwardA firm's bonds have a maturity of 12 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 6 years at $1,211.14, and currently sell at a price of $1,370.78. What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % What return should investors expect to earn on these bonds? Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM.arrow_forwardPlease answer fast I give you upvote.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education