Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

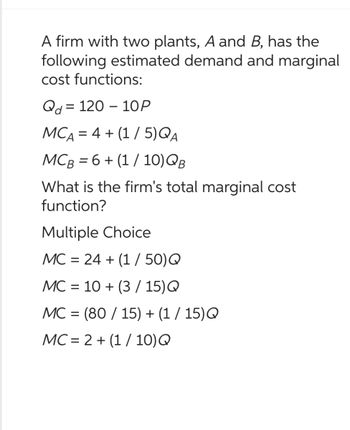

Transcribed Image Text:A firm with two plants, A and B, has the

following estimated demand and marginal

cost functions:

Qd 120 10P

MCA = 4+ (1/5)QA

MCB = 6 + (1 / 10) QB

What is the firm's total marginal cost

function?

Multiple Choice

MC = 24 +(1/50) Q

MC 10+ (3/15) Q

=

MC = (80/15)+(1/15)Q

MC2+(1/10)Q

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lion Completion Status: 30 50 7D 10 11D 12D 13D 140 15 16 17 18 19 20 21 22 23 24 25 26 27 Moving to another question will save this response. Question 10 If Q equals the level of output, P is the selling price per unit, V is the variable expense per unit, and F is the fixed expense, then the degree of operating leverage is equal to: O [P-V)QI/[(P-V)Q- F]. O F/(P-V). O Q(P-V). F/[(P-V)/P].arrow_forwardQ1:-A pooducen faces a f- Rs, So and avariable cosk Rs,Spes umit ob output when he produces less than 200 Units o output: Assuming that total cost funpetion is limeax, detemine the eajuation of the total cost of hunction. what is the break even level of fixed.cost of out pu-i the psice of output is Rscl0 pen umit, Also doaw the relevant gaphs Determime the producers net Jevenue u out pu is 12 units and the poice of outpuh Rs, S, RS,10and RSIS 8es pectively isarrow_forwardGlyde Air Fresheners is the price leader in the solid room aromatizer industry, which has a total market demand given by Q = 80 2P. Glyde has competition from a fringe of four small firms that produce where their individual marginal costs equal the market price. The fringe firms each have total costs given by TC;=10Q;+2Q2 and MC-10+4Qi Glyde's total costs are given by TCG = 100 + 6QG and MCG = 6 a. Complete the followers' supply equation QS= b. Complete Glyde's residual demand equation (Q-QS). QG= c. Compute Glyde's profit maximizing output level QG*= (Hint: 1. Set P=MC; 2. Solve P=10+4Q; for Qi. 3. QS-N*QS.) and Price PG=$ d. Compute the output level produced by four firms Qs= and the total market output level Q*=arrow_forward

- Please solve accurately. Thank youarrow_forwardThe following question is based on the demand and cost data for a pure monopolist given in the table below. Output Price Total Cost 0 $500 $250 12345 300 260 250 290 200 350 150 500 100 680 Refer to the above table. If the monopolist were forced to produce the socially optimal output through the imposition of a ceiling price, the ceiling price would have to be set at: O $100 $150 O $200 $250 www.yout House of High Ant SWEPT his OVER HIMarrow_forwardConsider the following duopoly model and determine profit - maximizing output and price for q_1+ q 2 TC_1 = 10 q_(1) TC_2 = 10 q_2 each firm. P = 200 - Q Industry Demand Q =arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education