Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

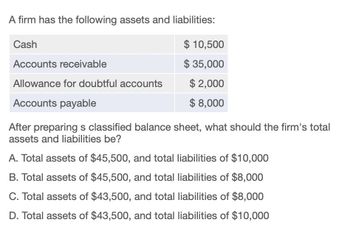

Transcribed Image Text:A firm has the following assets and liabilities:

Cash

$10,500

Accounts receivable

$35,000

Allowance for doubtful accounts

$ 2,000

Accounts payable

$8,000

After preparing s classified balance sheet, what should the firm's total

assets and liabilities be?

A. Total assets of $45,500, and total liabilities of $10,000

B. Total assets of $45,500, and total liabilities of $8,000

C. Total assets of $43,500, and total liabilities of $8,000

D. Total assets of $43,500, and total liabilities of $10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm's balance sheet has the following data:arrow_forward9. AllStarBank has the following balance sheet (in millions): Assets $ 30 90 50 Total assets $170 Cash Loans Securities Liabilities and Equity $110 40 Equity 20 Total liabilities and equity $170 Deposits Borrowed funds AllStarBank's largest customer decides to exercise a $15 million loan co ment. How will the new balance sheet appear if AllStar uses the fol liquidity risk strategies? a. Stored liquidity management. b. Purchased liquidity management. miarrow_forwardThe firm's current ratio and acid test ratio are closest to what valuesarrow_forward

- In forecasting a company's balance sheet, the CFO projected total assets of $8.47 million and total liabilities and equity of $7.63 million BEFORE balancing the balance sheet. To complete the pro forma balance sheet, the CFO must: a. Include $16.10 of external financing needed (EFN). b. Include $0.84 million of excess cash. c. Include $16.10 of excess cash. d. Include $0.84 million of external financing needed (EFN).arrow_forwarda. How much total operating capital does the firm have? Show all work. b. Briefly discuss the importance of operating income to a company.arrow_forwardA firm has the following current assets. Cash € 250,000 Marketable securities 100,000 Accounts receivable 800,000 Inventories 1,450,000 Total current assets € 2,600,000 If current liabilities are €1,300,000, the firm’s A.Current ratio will not change if a payment of €100,000 is used to pay €100,000 of accounts payable. B.Current ratio will decrease if a payment of €100,000 cash is used to pay €100,000 of accounts payable. C.Acid-test (quick) ratio will not change if a payment of €100,000 cash is used to purchase inventory. D.Acid-test (quick) ratio will decrease if a payment of €100,000 cash is used to purchase inventory.arrow_forward

- Your firm has the following balance sheet statement items: total current liabilities of $800,000; total assets of $2,650,000; fixed and other assets of $1,770,000; and long term debt of $200,000. What is the amount of the firm's net working capital? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a b с d $325,000 $770,000 $85,000 $80,000arrow_forwardSharpshooter Productions needs help checking the accuracy of their balance sheet. The firm reports the following: Entry Cash and marketable securities Accounts payable Common stock Retained Earnings Accounts Receivable Value Entry Value $201,250.00 Goodwill and other assets $89,330.00 $82,800.00 Net fixed assets $458,110.00 $100,000.00 Notes payable $66,075.00 $532,460.00 Long-term debt ????? $276,870.00 Inventory $123,225.00 What is the long-term debt for Sharpshooter for the financials to be correct? Submit Answer format: Currency: Round to: 2 decimal places. Show Hintarrow_forwardCotuit Company has a current ratio of 5.9 and an acid-test ratio of 5.4. The company's current assets consist of cash, marketable securities, accounts receivable, and inventories. Inventory equals $14,000. Cotuit Company's current liabilities must be _. a. $12,400 b. $60,000 c. $28,000 d. $216,000. Need help to get solution for this financial accounting problemarrow_forward

- The firm's current ration and acid- test ratio??arrow_forwardQ16. Use the following information to calculate the net liquid balance: Cash and equivalents $10 Accounts receivable = $30, Inventory = $25, Accounts payable $10, Notes payable = $25 a. $-25 b. $-15 c. $35 d.$70 Q17. Which of the following best characterizes a firm with current assets of $5,000 and current liabilities of $1,000? A.Liquid B.Solvent C.Insolvent D.Unprofitable Q18. which of the following best describes days sales outstanding? A. average time it takes to collect on a credit sale B. average length of time inventoried item is in stock before it is sold C. average length of time it takes to turn a cash outflow into a cash inflow D. average time between receipt of inventory and collection on a credit sale Q20. The ability of a firm to pay its bills on time while remaining a viable entity is referred to as: A.liquidity B. solvency C. cash conversion cycle D.the net liquidity balancearrow_forwardAnalysis of Financial StatementsThere was a bit of concern about one of Big Rock’s newer entities – Big Rock PavingCompany. Management wants you to review the two financial statements below and giveyour analysis of the company’s performance.Big Rock Paving CompanyAssetsLiabilitiesCurrent Assets: Current Liabilities:Cash 500,000 Accounts Payable 700,000Accounts Receivable 300,000 Notes Payable 500,000Inventory 800,000Total Current Assets 1,300,000 Total Current Liabilities 1,200,000Fixed Assets: Owners’ Equity:Property, Plant & Equipment 2,200,000 Common Stock ($1 Par) 600,000Less: Accumulated Depreciation 600,000 Capital Surplus 100,000Net Fixed Assets 1,600,000 Retained Earnings 100,000Total Assets 2,900,000 Total Owners’ Equity 800,000Total Liabilities and Owners’Equity2,900,000Big Rock Paving CompanyIncome Statement for Year Ending December 31, 2021Sales 3,400,000Less: Cost of Goods Sold 2,700,000Less: Administrative Expenses 700,000Less Depreciation 682,000Earnings Before…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning