Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

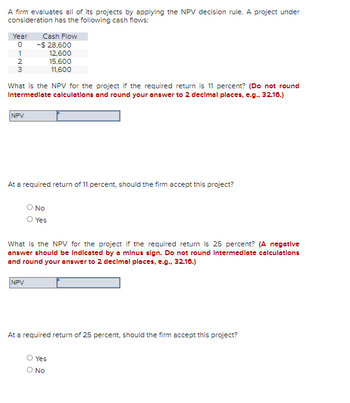

Transcribed Image Text:A firm evaluates all of its projects by applying the NPV decision rule. A project under

consideration has the following cash flows:

Year

0

1

2

3

NPV

Cash Flow

-$ 28,600

12,600

What is the NPV for the project if the required return is 11 percent? (Do not round

Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

NPV

At a required return of 11 percent, should the firm accept this project?

O No

15,600

11,600

Yes

What is the NPV for the project if the required return is 25 percent? (A negative

answer should be Indicated by a minus sign. Do not round Intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

At a required return of 25 percent, should the firm accept this project?

O Yes

O NO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering a project that has the following cash flow data. What is the project's payback? (Ch. 11) Year 0 1 2 3 Cash Flow -900 350 450 600 Group of answer choices 1.95 1.52 2.60 2.17 2.38arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: Cash flow: 0 -$15, 200 MIRR 1 $3,000 3 2 $4,200 $3,400 Use the MIRR decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) % 5 $3,400 $3,200 6 $3,000arrow_forwardA project has the following cash flows: Year Cash Flow 0 $ 37,000 1 -18,000 227,000 What is the IRR for this project? (Round the final answer to 2 decimal places.) IRR % What is the NPV of this project, if the required return is 11% ? ( Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ What is the NPV of the project if the required return is 0% ? ( Negative answer should be indicated by a minus sign. Omit $ sign in your response.) NPV $ What is the NPV of the project if the required return is 22 % ? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $arrow_forward

- Marielle Machinery Works forecasts the following cash flows for a project under consideration. It uses the Internal rate of return rule to accept or reject projects. C₁ Co -$ 10,000 C₂ +$ 7,500 IRR a. What is the project's IRR? Note: Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. C3 +$ 8,500 22.41 % b. Should this project be accepted if the required return is 12%? Yes Noarrow_forwardThe following are the cash flows of two projects: Year Project A Project B -$200 -$200 01234 Project A B If the opportunity cost of capital is 11%, what is the profitability index for each project? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Profitability index 80 80 80 80 00 100 100 100 Is the project with the highest profitability index also the one with the highest NPV? Yes Noarrow_forwardPlease do not provide solution in image format and give proper explanation.arrow_forward

- please answer both questions correctly: 10. A project has the following cash flows: Year Cash Flow 0 $ 43,500 1 −22,500 2 −33,500 a. What is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV of this project, if the required return is 12 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the NPV of the project if the required return is 0 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the NPV of the project if the required return is 24 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 11. Anderson International Limited is…arrow_forwardA firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 1 2 3 162,000 54,000 85,000 69,000 What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Internal rate of return %arrow_forwardConsider the following projects: Year 0 Year 1 Year 2 Year 3 Year 4 Discount Rate Cash Flow A -100 30 20 40 B -73 25 20 20 C -27 10 9 9 13= 60 14.50% 45 15.00% 11 14.00% a. Find the NPV of the projects, will you accept/reject them? b. What is the IRR of the projects, will you accept/reject? c. If the firm had $250 to invest today, what project(s) should it pursue? d. If the firm only had $100 to invest today, what project(s) should it pursue?arrow_forward

- You are considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 Cash Flow -900 350 450 550 Group of answer choices 2.40 1.53 1.96 2.18 2.62arrow_forwardA firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 -$ 152,000 1 64,000 2 75,000 3 59,000 a. What is the project's IRR? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. If the required return is 13 percent, should the firm accept the project? % a. Internal rate of return b. Project acceptancearrow_forwardA firm evaluates all of its projects by using the NPV decision rule. Year Cash Flow 0 -$ 27,000 1 23,000 14,000 8,000 a. At a required return of 25 percent, what is the NPV for this project? 2 WN 3 NPV b. At a required return of 34 percent, what is the NPV for this project? NPVarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education