MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

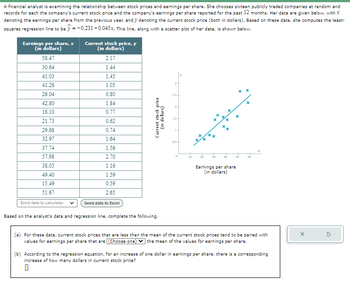

Transcribed Image Text:A financial analyst is examining the relationship between stock prices and earnings per share. She chooses sixteen publicly traded companies at random and

records for each the company's current stock price and the company's earnings per share reported for the past 12 months. Her data are given below, with X

denoting the earnings per share from the previous year, and y denoting the current stock price (both in dollars). Based on these data, she computes the least-

squares regression line to be ŷ=-0.231+0.045x. This line, along with a scatter plot of her data, is shown below.

Earnings per share, x

Current stock price, y

(in dollars)

(in dollars)

58.47

2.17

30.64

1.44

41.03

1.45

41.26

1.05

26.04

0.80

42.80

1.84

18.10

0.77

21.73

0.62

29.68

0.74

32.97

1.64

37.74

1.56

57.98

2.70

38.05

1.16

49.40

1.59

15.49

0.59

51.67

2.65

Send data to calculator ✓

Send data to Excel

Current stock price

(in dollars)

Based on the analyst's data and regression line, complete the following.

05

0

10

30

x

x

x

**

40

Earnings per share

(in dollars)

× ×

50

60

(a) For these data, current stock prices that are less than the mean of the current stock prices tend to be paired with

values for earnings per share that are (Choose one) the mean of the values for earnings per share.

(b) According to the regression equation, for an increase of one dollar in earnings per share, there is a corresponding

increase of how many dollars in current stock price?

☐

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Is It Getting Harder to Win a Hot Dog Eating Contest?Every Fourth of July, Nathan’s Famous in New York City holds a hot dog eating contest. The table below shows the winning number of hot dogs and buns eaten every year from 2002 to 2015, and the data are also available in HotDogs. The figure below shows the scatterplot with the regression line. Year Hot Dogs 2015 62 2014 61 2013 69 2012 68 2011 62 2010 54 2009 68 2008 59 2007 66 2006 54 2005 49 2004 54 2003 45 2002 50 Winning number of hot dogs in the hot dog eating contest Winning number of hot dogs and buns Click here for the dataset associated with this question. (a) Is the trend in the data mostly positive or negative? Positive Negative (b) Using the figure provided, is the residual larger in 2007 or 2008?Choose the answer from the menu in accordance to item (b) of the question statement 20072008 Is the residual positive or…arrow_forwardPa.n.narrow_forward19. You might think that increasing the resources available would elevate the number of plant spe- cies that an area could support, but the evidence suggests otherwise. The data in the accompany- ing table are from the Park Grass Experiment at Rothamsted Experimental Station in the U.K., where grassland field plots have been fertilized annually for the past 150 years (collated by Harpole and Tilman 2007). The number of plant species recorded in 10 plots is given in response to the number of different nutrient types added Plot 1 2 3 4 5 6 7 8 9 10 Number of nutrients added 0 0 0 3144 E2 3 Number of plant species 36 36 32 34 33 30 20 23 21 16arrow_forward

- For major league baseball teams, do higher player payrolls mean more gate money? Here are data for each of the American League teams in the year 2002. The variable x denotes the player payroll (in millions of dollars) for the year 2002, and the variable y denotes the mean attendance (in thousands of fans) for the 81 home games that year. The data are plotted in the scatter plot below, as is the least-squares regression line. The equation for this line is y = 11.43 + 0.23x. Player payroll, x (in Mean attendance, y (in $1,000,000s) thousands) Anaheim 62.8 28.52 Baltimore 56.5 33.09 40- Boston 110.2 32.72 35 Chicago White Sox 54.5 20.74 30- Cleveland 74.9 32.35 25- Detroit 54.4 18.52 Kansas City 49.4 16.30 15- Minnesota 41.3 23.70 10+ New York Yankees 133.4 42.84 Oakland 41.9 26.79 20 40 60 80 100 120 140 Seattle 86.1 43.70 Player payroll, Тarmpa Bay 34.7 13.21 X (in $1,000,000s) Техas 106.9 29.01 Toronto 66.8 20.25 Send data to calculator Send data to Excel Based on the sample data and…arrow_forwardManagement at Jagoda Wholesalers, in Calgary, Canada, has used time-series regression based on point-of-sale data to forecast sales for the next 4 quarters. Sales estimates are $100,000, $120,000, $140,000, and $160,000 for the respective quarters. Seasonal indices for the four quarters have been found to be1.30, .90, .70, and 1.10, respectively.arrow_forwardA financial analyst is examining the relationship between stock prices and earnings per share. She chooses fifteen publicly traded companies at random and records for each the company's current stock price and the company's earnings per share reported for the past 12 months. Her data are given below, with x denoting the earnings per share from the previous year, and y denoting the current stock price (both in dollars). Based on these data, she computes the least- squares regression line to be y = -0.137 +0.043x. This line, along with a scatter plot of her data, is shown below. Earnings per share, x (in dollars) Current stock price, y (in dollars) 59.10 2.35 30.89 1.34 40.95 1.76 29.50 1.02 48.19 1.63 37.29 1.68 21.65 0.63 15.95 0.63 1- 26.45 1.02 0.5 32.26 1.53 17.72 0.78 42.86 1.50 Earnings per share (in dollars) 36.45 1.17 57.56 2.84 40.32 1.06 Current stock price (in dollars)arrow_forward

- a. Develop the least squares estimated regression equation that relates labor hours to house square footage and type of flooring. b. Use the regression equation developed in part (a) to predict labor hours when the house size is 3350 square feet and the type of flooring is wood.arrow_forwardName Her Age His Age Barack and Michelle Obama 45 47 George W. and Laura Bush 54 54 Bill and Hillary Clinton 45 46 Ronald and Nancy Reagan 55 64 Gerald and Betty Ford 59 69 Lyndon and Lady Bird Johnson 56 61 John and Jacqueline Kennedy 31 43 Dwight and Mamie Eisenhower 50 55 (c) Remove the outlier and compute the least-squares regression line for predicting the president's age from first lady's age. Round the slope and y -intercept values to at least four decimal places. Regression line equation: =yarrow_forwardYou are studying how a penguin's bill length (in mm) explains its body mass (in grams) using linear regression. You choose a non-directional alternative to be safe. Given the information below, choose the formula for the least squares regression line. b₁ = 87.42 bo = 362.31 x = 43.92 y = 4202.0 O Bill Length = 87.42 Body mass + 362.31 O Bill Length = 87.42*4202.0 + 362.31 O 4202.0 = 362.31*43.92 +87.42 O Body mass = 87.42 * Bill Length + 362.31 O Body mass = 362.31 *Bill Length + 87.42 O Body mass = 362.31 43.92 + 87.42arrow_forward

- Suppose John is a high school statistics teacher who believes that watching many hours of TV leads to lower test scores. Immediately after giving the most recent test, he surveyed each of the 24 students in his class and asked them how many hours of TV they watched that week. He then matched each student's test grade with his or her survey response. After compiling the data, he used hours of TV watched to predict each student's test score. He found the least-squares regression line to be ?̂ =−1.5?+85y^=−1.5x+85. He also calculated that the value of ?r, the correlation coefficient, was −0.61. Which of the choices identifies the correct value of the coefficient of determination, ?2R2, and gives a correct interpretation of its meaning?arrow_forwardA financial analyst is examining the relationship between stock prices and earnings per share. She chooses sixteen publicly traded companies at random and records for each the company's current stock price and the company's earnings per share reported for the past 12 months. Her data are given below, with x denoting the earnings per share from the previous year, and y denoting the current stock price (both in dollars). Based on these data, she computes the least-squares regression line to be y = -0.224+0.044x. This line, along with a scatter plot of her data, is shown below. Earnings per share, x (in dollars) 30.13 42.76 58.46 37.50 57.30 27.60 30.17 41.82 50.09 38.18 22.41 33.44 39.66 14.13 17.85 53.57 Send data to calculator V Current stock price, y (in dollars) 1.41 1.37 2.25 1.54 2.64 0.90 0.79 1.04 1.56 1.15 0.65 1.72 1.80 0.51 0.71 2.74 Send data to Excel Current stock price (in dollars) Based on the analyst's data and regression line, complete the following. 2.5- 2+ 1.5. 0.5- 0…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman