Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Part (a)

A farmer plans to spend $110,000 to plant pomegranate bushes. It will take 4 years for the bushes to provide a usable crop. He estimates that every year for 20 years after that he will receive a crop worth of $10,500 per year.

Required:

(i) If the discount rate is 9%, calculate the NPV of this investment.

(ii) Should the farmer invest in planting the pomegranate bushes?

(iii) Discuss what incentives the government can provide to the farmer to make the investment more worthwhile.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

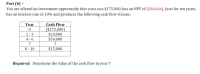

- Bill Williams has the opportunity to invest in project A that costs $6,900today and promises to pay $2,100, $2,400, $2,400, $2,000 and $1,800over the next 5 years. Or, Bill can invest $6,900 in project B that promises to pay $1,500, $1,500, $1,500, $3,600 and $4,000 over the next 5 years. (Hint: For mixed stream cash inflows, calculate cumulative cash inflows on a year-to-year basis until the initial investment is recovered.) a. How long will it take for Bill to recoup his initial investment in project A? b. How long will it take for Bill to recoup his initial investment in project B? c. Using the payback period, which project should Bill choose? d. Do you see any problems with his choice?arrow_forwardYou purchase a plot of land worth $54,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.22% APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $54,000. Round each answer to the nearest dollar.) (a) Assuming that you put some money down, what was your original loan amount (in dollars)? X $ (b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments? $ 170255.84 (c) How much equity (in dollars) do you have in the garden after 4 years? $ Xarrow_forwardYour younger sibling asks you to borrow $20. You, a smart financial professional, agree but also charge interest on the $20. You plan to collect $5 from your sibling each week for 8 weeks to repay the initial loan. What is the NPV of this project, assuming you invest the $5 at 12%? a. $4.84 b. $2.11 c. $0 d. $6.88arrow_forward

- Can some one please help me to solve the following question correctly per the directions. PLEASE AND THANK YOU!!!!!!arrow_forward.You want to start a scholarship fund at your alma mater with giving one $10,000 scholarship annually beginning one year from now. And you have at most $150,000 to start the fund. You also want the scholarship to be given out indefinitely. Assuming an annual interest rate of 8% (compounded continuously , do you have enough money for the scholarship fund? 15%4 (Hint: 1. Derive the formula of the present value of a perpetuity .2. Find the present value.)arrow_forwardHappy Trails Senior Living Community is considering investing in solar panels to save on utility costs. The initial cost of the panels, including installation, is $250,000. The expected reduction in utility costs are noted below. Utility costs savings for the next five years are: Year 1: $65,000 Year 2: $68,250 Year 3: $71,663 Year 4: $75,246 Year 5: $79,008 The current interest rate used to evaluate investment decisions is 6%. The inflation rate is expected to remain constant at 3% for the entire period. Instructions (a) Compute the present value of the expected cash flows (savings). (b) Should Happy Trails move forward with the investment?arrow_forward

- How would I solve this? Thanks!arrow_forwardYou purchase a plot of land worth $54,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.66% APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $54,000. Round each answer to the nearest dollar) (a) Assuming that you put some money down, what was your original loan amount (in dollars)? $ (b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments? (c) How much equity (in dollars) do you have in the garden after 4 years? $arrow_forwardYou purchase a plot of land worth $58,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.11% APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $58,000. Round each answer to the nearest dollar.) (a) Assuming that you put some money down, what was your original loan amount (in dollars)? $ (b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments? (c) How much equity (in dollars) do you have in the garden after 4 years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education