Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

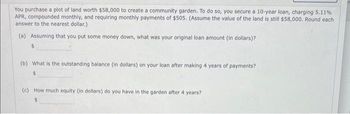

Transcribed Image Text:You purchase a plot of land worth $58,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.11%

APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $58,000. Round each

answer to the nearest dollar.)

(a) Assuming that you put some money down, what was your original loan amount (in dollars)?

$

(b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments?

(c) How much equity (in dollars) do you have in the garden after 4 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A real estate investor is considering the purchase of an apartment building that currently provides income of $30,000 and is expected to grow in income by 3% for the next 4 years. You would receive income from today, year 0, through year 4. At the end of year 4, they expect to sell the property for $800,000. The investor has a discount rate of 6%. How much should an investor be willing to pay for this property? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forwardThe Browning family of Colorado wants to buy a $102,000 house. (a) If they can get a loan of 80% of the value of the house, what is the amount of the loan?$ (b) What will be the down payment on this loan?$ (c) If they decide to obtain an FHA loan, what will be the minimum cash investment? (Do not forget that the maximum FHA loan for this location has to be determined using the FHA Maximum Loan Values by State table.)$arrow_forwardAssume you paid cash for a beach house in Florida a while back and that you are now wanting to sell it. You have two offers for the house as follows: 1. $500,000 paid immediately (spot market sale) 2. $520,000 paid 1 year from now (Forward sale) Here is a list of the annual cost/income considerations: ● Property tax: $5,000 Insurance: $3,000 HOA dues: $4,000 Maintenance: $3,000 Rental Income: $35,000 What is the fair value forward price from your perspective? Opportunity cost of not receiving the 500K today is the money-market rate of 5% = $25,000 for 1 year ● $535,000 $540,000 $505,000 $495,000 $520,000arrow_forward

- You want to investigate whether it will make financial sense for your business to purchase some real estate. Find a commercial property that is for sale in Charlotte, NC that your business could use (purchase price must be at least $20,000). Include the URL that will take the class to the webpage for the property. You will finance 80% of the purchase price; you will put 20% down on the purchase. Using 5% as the interest on your 30-year fixed rate mortgage, calculate the monthly payment. Next, calculate the payment using the same 5%, but for a 15-year mortgage. Show all steps in your calculations in your post. In a summary paragraph, discuss the results of your calculations and what you think is the best decision for your business to make regarding purchasing the property. Include these items in your post: URL link to property Calculation of 30-year monthly payment Calculation of 15-year monthly payment Steps in calculations (Excel is recommended) Summaryarrow_forwardHow would I input this information into excel?arrow_forwardYou’re considering purchasing an apartment for $200,000. You believe that you can earn an initial rental income of $12,000 per year on it and that the rental income will grow at 3% per year. You also believe that you can sell the apartment for $225,000 after 5 years. The IRR calculation is shown below:arrow_forward

- You purchase a plot of land worth $54,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.22% APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $54,000. Round each answer to the nearest dollar.) (a) Assuming that you put some money down, what was your original loan amount (in dollars)? X $ (b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments? $ 170255.84 (c) How much equity (in dollars) do you have in the garden after 4 years? $ Xarrow_forwardSusan would like to buy a car. She went to the bank and got a loan for $40,000 at the annual interest rate of 4%, for 4 years. Calculate the monthly payment. Calculate the interest on the payment. Calculate the total payment. Make complete amortization schedule on excelarrow_forwardCalculate how much money a prospective homeowner would need for closing costs on a house that costs $190,000. Calculate based on a 15 percent down payment, 1.3 discount points on the loan, a 1.2 point origination fee, and $820 in other fees. The closing costs would be $. (Round to the nearest dollar.)arrow_forward

- what would the formula be to solve for the table value? the table value is what i need to solve the problemarrow_forwardA computer chip designer purchased a car for $59,476.47, which includes sales tax and registration. The designer obtains a 5-year loan for the total amount at an annual interest rate of 6.3% compounded monthly. The designer will make monthly payments. The payments calculation for this type of loan uses the formula for the present value of which type of annuity? Given the formula for the payment amount of annuity where PMT is the payment amount in dollars, PV is the present value in dollars, n is the number of payments, and i is the interest rate per period. PMT= ? Determin the following values. PV= $ n= i= What is the designer’s monthly payment? (Round your answer to the nearest cent.)arrow_forwardA new homeowner is purchasing a living room set for $2,590 and must decide between two monthly installment financing offers.Offer 1: $200 down payment, remaining balanced financed at a 24.90% interest rate for 3 years.Offer 2: $425 down payment, remaining balanced financed at a 22.90% interest rate for 4 years.Part A: What is the total cost of offer 1? Explain which technology you used to solve and each step of your process. Part B: What is the total cost of offer 2? Explain which technology you used to solve and each step of your process.Part C: Which financing offer should the new homeowner choose?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education