FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

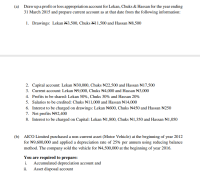

Transcribed Image Text:(a) Draw up a profit or loss appropriation account for Lekan, Chuks & Hassan for the year ending

31 March 2015 and prepare current account as at that date from the following information:

1. Drawings: Lekan N3,500, Chuks N11,500 and Hassan N8,500

2. Capital account: Lekan N30,000, Chuks N22,500 and Hassan N17,500

3. Current account: Lekan N9,000, Chuks N4,000 and Hassan N3,000

4. Profits to be shared: Lekan 50%, Chuks 30% and Hassan 20%

5. Salaries to be credited: Chuks N11,000 and Hassan N14,000

6. Interest to be charged on drawings: Lekan N600, Chuks N450 and Hassan N250

7. Net profits N92,400

8. Interest to be charged on Capital: Lekan N1,800, Chuks N1,350 and Hassan N1,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joseph Bright lists the following transactions for the period ended 30 September 2017. Classify EACH item as follows: i. Write either capital or revenue in the expenditure type column to indicate the type of expenditure involved or EACH item. ii. Insert a-check mark (√) in the appropriate column to indicate whether the item is reported-in the Statement of profit or loss or in the Statement of financial position. The first one is done as an example. Description CLASSIFICATION OF EXPENDITURE Expenditure Type Statement where item should be reported Statement of Profit Statement of Example Wages of the computer operators 1 Cost of customizing software for use in business 2 Installing thief detection equipment 3 Cost of paper used for printing receipts during the year 4 Cost of toner used by the computer printer 5 Cost of adding extra memory to the compute or loss Revenue financial positionarrow_forwardThe owner's Capital account has a pre-closing balance of $36,000, on the 31st December 2020. The owner's Drawings account has a pre-closing balance of $13,600, on the 31st December 2020. The Income Summary account contains a Debit entry of $31,600 and a Credit entry of $66,000. Question: Considering the information above, the post-closing balance of Capital on the 31 December 2020 would therefore be: Select one: O a. $34,400 O b. $ 70,400 c. $22,400 O d. $56,800arrow_forwardWhite Ltd commenced business on 1 July 2017. An extract of the statement of financial position of White Ltd for the year ending 30 June 2019 and 2020 are shown below: Assets Cash Accounts receivable Allowance for doubtful debt 2019 $ 3,800 15,000 (600) 2020 $ 5,000 18,000 (880) Dividend receivable 800 380 Inventory Prepaid insurance Interest receivable Machinery Accumulated depreciation-machinery 13,000 3,800 700 14,000 2,000 500 40,000 (12,000) 35,000 500,000 (150,000) 40,000 (4,000) 25,000 500,000 (125,000) Land Building Accumulated depreciation- building Deferred tax asset 600 Liabilities Accounts payable Current tax liability Provision for Warranty Interest payable Debentures Dividend payable Deferred tax liability 2,000 350 600 3,000 400 700 900 1,200 15,000 5,000 200 17,000 5,000 Additional information: 1. Depreciation for accounting and tax purposes are 20% and 25% straight-line method, respectively. 2. Depreciation for building is non-deductible for tax purpose. 3. Bad debt…arrow_forward

- a. Identify the following transactions as either Capital Expenditure or RevenueExpenditure.i). Pay salary and wages for November 2020 amounting to RM6,200.ii). Purchase vehicle for business use amounting to RM145,000.iii). Depreciation expense for financial year ended 2020 amounting to RM21,000.iv). Purchase stationery for office use amounting to RM450.v). Acquire a building amounting to RM520,000.vi). Repair office door amounting to RM800.arrow_forward2. The following is extracted from the books of White Co as at 31 December 2019: $ nta sets Net current assets 6 010 Current assets 12 585 Non-current liabilities 2 500 Non-current assets 6 475 For the year ended 31 December 2019, 2$ Net profit Drawings 4 500 3 000 REQUIRED: Calculate the amount of capital at 1 January 2019. END OF PAPERarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education