FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

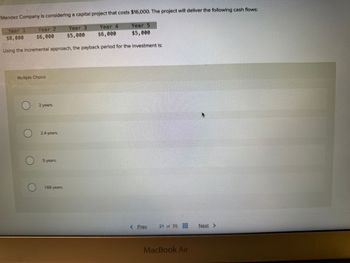

Transcribed Image Text:Mendez Company is considering a capital project that costs $16,000. The project will deliver the following cash flows:

Year 5

Year 4

$6,000

$5,000

$5,000

Using the incremental approach, the payback period for the investment is:

Year 1

$8,000

Year 2

$6,000

Multiple Choice

2 years.

2.4 years.

5 years.

1.66 years.

Year 3

< Prev

21 of 35

MacBook Air

Next >

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Vishuarrow_forwardA small company wants to invest in Project A or B. The cash flows for both are shown below. Determine the payback period for each project assuming a MARR of 5% and suggest which project should be selected based on discounted payback period analysis.arrow_forwardBig Steve's, a maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $130,000 and will generate cash inflows of $37,000 per year for 7 years. If the discount rate is 17%, what is the project's IRR? (Round to two decimal places.) O A.17.00% OB. 20.94% O C. 32.52% OD. 37.33% MacBook Airarrow_forward

- please solve this practice problemarrow_forwardTarget Corporation (TGT) is considering a new delivery system that costs $194,875. Assume a required rate of return of 4.26% and the following cash flow schedule: Year 1: $46,608 .Year 2: $70,559 Year 3: $95,705 Year 4: $11,450 The project's discounted payback period (DPP) is closest to O A. 2.08 years. OB. 2.19 years. OC. 2.31 years. COD. 2.44 years.arrow_forwardGive me step by step full answerarrow_forward

- I need this question completed in 10 minutesarrow_forwardOfice eBook Project L costs $55,000, its expected cash inflows are $13,000 per year for 12 years, and its WACC is 11%. What is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardeBook A project has annual cash flows of $4,000 for the next 10 years and then $8,500 each year for the following 10 years. The IRR of this 20-year project is 10.99%. If the firm's WACC is 10%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Snowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year. Snowflake Resorts requires a 12% return on all of its investments. The payback period of this investment is ________ years 5 3 4 2 The net present value of this project is $65,355 $48,384 $85,652 $57,635 The profitability index of this project is 2016 5924 7350 3852 When projects have scale differences, only the Net Present Value method will rank the projects correctly True False Fees paid to investment bankers and lawyers for issuing securities are called Component costs Issuance costs Security costs Licensing costs Purposes for considering a capital project may include which of the following Cost reductions Growth projects Government required projects All of the above When the weighted average cost of capital for a project is considered on an after tax…arrow_forward(Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year 0 1 2 60 3 100 4 105 (Click on the icon in order to copy its contents into a spreadsheet.) Project Cash Flow (millions) $(180) 100 If the project's appropriate discount rate is 8 percent, what is the project's discounted Davback period? The project's discounted payback period is years. (Round to two decimal places.)arrow_forwardRoss enterprises is considering a 3 year project with the following cash flows: Time 0: spend $4800 Time 1: collect $2200Time 2: collect $3600 Time 3: collect $1400 Ross's discount rate is 7.0%. What is the NPV of the project? (Do not roundintermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education