FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

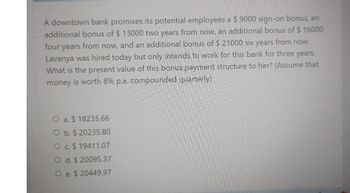

Transcribed Image Text:A downtown bank promises its potential employees a $9000 sign-on bonus, an

additional bonus of $ 13000 two years from now, an additional bonus of $ 16000

four years from now, and an additional bonus of $ 21000 six years from now.

Lavanya was hired today but only intends to work for this bank for three years.

What is the present value of this bonus payment structure to her? (Assume that

money is worth 8% p.a. compounded quarterly)

O a. $18235.66

O b. $ 20235.80

O c. $19411.07

O d. $ 20095.37

O e. $ 20449.97

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An accounting firm agrees to purchase a computer for $180,000 (cash on delivery) and the delivery date is in 270 days. How much do the owners need to deposit in an account paying 0.85% compounded quarterly so that they will have $180,000 in 270 days? (a) State the type. sinking fund amortization present value future value ordinary annuity (b) Answer the question. (Round your answer to the nearest cent.) $arrow_forwardMorgan has $500,000 accumulated in her RRSP and intends to use the amount to purchase a 20-year annuity. She is investigating the size of annuity payment she can expect to receive, depending on the rate of return earned by the undistributed funds. What nominal rate of return must the funds earn for the monthly payment to be: a. $3000? b. $3500? c. $4000arrow_forwardAssume that you will have a 10-year, $20,000 loan to repay when you graduate from college next month. The loan, plus 10 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $3,255 each, beginning one year after you graduate. You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years (immediately after making the third annual payment of $3,255). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation. (Round your answers to the nearest dollar amount. Enter all amounts as positive numbers.) Interest Period Date of Graduation Year 1 Year 2 Year 3 Annual Payment Annual Interest Expense @10% a. Actual net-of-tax interest cost b. Effective interest rate Reduction in Unpaid Balance Unpaid Balance One of the advantages of borrowing is that interest is deductible for income tax purposes. a.…arrow_forward

- Assume that you will have a 10-year, $10,000 loan to repay when you graduate from college next month. The loan, plus 8 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $1,490 each, beginning one year after you graduate. You have accepted a wellpaying job and are considering an early settlement of the entire unpaid balance in just three years (immediately after making the third annual payment of $1,490). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation. (Round amounts to the nearest dollar.)arrow_forwardSuppose a recent college graduate's first job allows her to deposit $250 at the end of each month in a savings plan that earns 9%, compounded monthly. This savings plan continues for 14 years before new obligations make it impossible to continue. How much money has accrued in the account at the end of the 14 years? (Round your answer to the nearest cent.) $ If the accrued amount remains in the plan for the next 15 years without deposits or withdrawals, how much money will be in the account 29 years after the plan began? (Round your answer to the nearest cent.) $arrow_forwardPlease step by step solutionsarrow_forward

- To start a new business, Alysha intends to borrow $25.000 from a local bank. If the bank asks her to repay the loan in 5 equal annual instalments of $6,935.24, determine the bank's effective annual interest rate on the ipan transaction. With annual compounding, what nominal rate would the bank quote for this loan?arrow_forwardWhen you begin your new job, your employer says they will match any 401k deposits you make by 50% up to 5% of your overall salary annually. When you start your new job as a college grad, you will make $50400 per year and you decide to take full advantage of the matching by depositing 5% of your monthly salary every month. a) How much will YOU be depositing in the 401k each month from your salary? $ b) How much will YOUR EMPLOYER be depositingin the 401k each month? c) How much TOTAL will be deposited into your 401k each month? $ d) How much will you have in the account in 35 years if it pays 7.5% APR? $ e) How much total money will you put into the account after 35 years? $ f) How much total will the employer have put into the account after 35 years? $ g) How much total interest will you earn? $ h) If you choose NOT to take advantage of depositing money into the 401k because you feel you need that money to pay bills now, how much money will you be losing from your employer and interest…arrow_forwardSuppose a recent college graduate's first job allows her to deposit $250 at the end of each month in a savings plan that earns 9%, compounded monthly. This savings plan continues for 13 years before new obligations make it impossible to continue. If the accrued amount remains in the plan for the next 15 years without deposits or withdrawals, how much money will be in the account 28 years after the plan began? (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education