Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

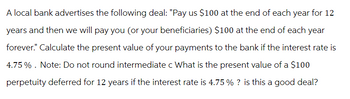

Transcribed Image Text:A local bank advertises the following deal: "Pay us $100 at the end of each year for 12

years and then we will pay you (or your beneficiaries) $100 at the end of each year

forever." Calculate the present value of your payments to the bank if the interest rate is

4.75%. Note: Do not round intermediate c What is the present value of a $100

perpetuity deferred for 12 years if the interest rate is 4.75% ? is this a good deal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- A $6,000,000 apartment complex loan is to be paid off in 10 years by making 10 equal annual payments. How much is each payment if the interest rate is 7.5% compounded annually? (a) State the type. ordinary annuity sinking fund amortization present value of an annuity present value (b) Answer the question. (Round your answer to the nearest cent.)arrow_forwardAn accounting firm agrees to purchase a computer for $180,000 (cash on delivery) and the delivery date is in 270 days. How much do the owners need to deposit in an account paying 0.85% compounded quarterly so that they will have $180,000 in 270 days? (a) State the type. sinking fund amortization present value future value ordinary annuity (b) Answer the question. (Round your answer to the nearest cent.) $arrow_forwardThe problem describes a debt to be amortized. (Round your answers to the nearest cent.)A man buys a house for $330,000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 9 years. The interest rate on the debt is 10%, compounded semiannually. (a) Find the size of each payment.$ (b) Find the total amount paid for the purchase.$ (c) Find the total interest paid over the life of the loan.$arrow_forward

- An investor wants to save money to purchase real estate. He deposits $550 at the end of each year in an ordinary annuity that pays 4% interest, compounded annually. Answer each part. Do not round any intermediate computations nor answers. If necessary, refer to the list of financial formulas. (a) Find the total value of the annuity at the end of the 1 year. st 24 (b) Find the total value of the annuity at the end of the 2 nd year. (c) Find the total value of the annuity at the end of the 3 rd year.arrow_forwardProvide manual solutions to below mentioned problems. An engineer is entitled to receive P25,000 at the beginning of each year for 18 years. If the rate of interest is 4% compounded annually. 1. What is the present value of this annuity at the time he is supposed to receive the first payment?2. What is the sum of this annuity at the end of the 18th year?3. Find the difference between the sum of this annuity which is paid at the beginning of each year and an annuity paid at the end of each year. Answer. 1. P329,141.72 2. P666,780.73 3. P25,645.41arrow_forwardSebastopol Movie Theater will need $170,000 in 4 years to replace the seats. What deposit should be made today in an account that pays 0.6% compounded semiannually? (a) State the type. sinking fundordinary annuity present valueamortizationpresent value of an annuity (b) Answer the question. (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education