Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

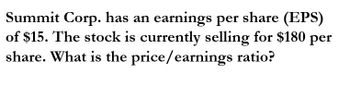

Transcribed Image Text:Summit Corp. has an earnings per share (EPS)

of $15. The stock is currently selling for $180 per

share. What is the price/earnings ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ABD common stock is selling for $36.08 a share. The company has earnings per share of S.34 and a book value per share of S12.19. What is the market-to-bok ratio?arrow_forwardPfizer, Inc. (PFE) has earnings per share of $2.09 and a P/E ratio of 11.02. What is the stock price?arrow_forwardPQR Co. has earnings of $2.65 per share. The benchmark PE for company is 22. What stock price (to two decimals) would you consider appropriate?arrow_forward

- Ultra Petroleum (UPL) has earnings per share of $1.57 and a P/E ratio of 32.96. What's the stock price? Note: Round your answer to 2 decimal places. Stock pricearrow_forwardAmes, Inc., has a current stock price of $58. For the past year, the company had a net income of $8,400,000, total equity of $25,300,000, sales of $52,800,000, and 4.6 million shares of stock outstanding. a. What are earnings per share (EPS)? b. What is the Price-earnings ratio? c. What is the Price sales ratio? d. What is Book value per share?arrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forward

- Ultra Petroleum (UPL) has earnings per share of $1.65 and a P/E ratio of 33.12.What’s the stock price? (Round your answer to 2 decimal places.)arrow_forwardWhat is the book value per share and earning per share accountingarrow_forwardWhat is the book value per share and earning per share on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub