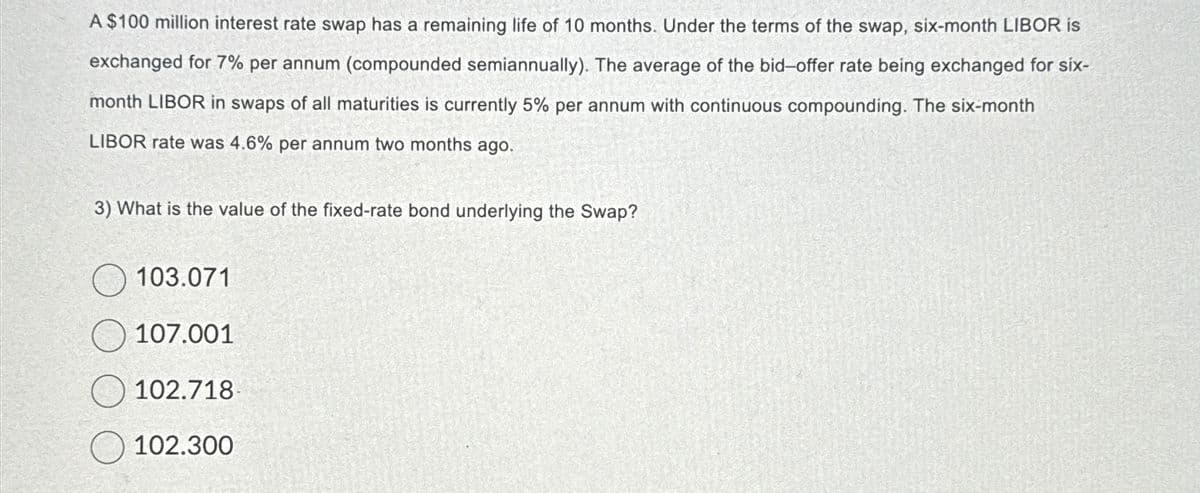

A $100 million interest rate swap has a remaining life of 10 months. Under the terms of the swap, six-month LIBOR is exchanged for 7% per annum (compounded semiannually). The average of the bid-offer rate being exchanged for six- month LIBOR in swaps of all maturities is currently 5% per annum with continuous compounding. The six-month LIBOR rate was 4.6% per annum two months ago. 3) What is the value of the fixed-rate bond underlying the Swap? 103.071 107.001 102.718 102.300

Q: Procter and Gamble (PG) paid an annual dividend of $2.79 in 2021. You expect PG to increase its…

A: The DDM refers to the method of finding the stock value based on the future dividends paid by the…

Q: S07-18 Bond Price Movements [LO2] Bond X is a premium bond making semiannual payments. The bond pays…

A: The bond price or the bond value refers to the present value of the future cash inflows of the bond…

Q: Answer the below questions. (a) For a single-name credit default swap, what is the difference…

A: A Credit Default Swap (CDS) is a financial contract between two parties where one party (the buyer…

Q: Fun With Finance is considering a new 3-year expansion project that requires an initial fixed asset…

A: The objective of the question is to calculate the net cash flow for each year of the project and the…

Q: Reasons detailing how a max $20,000 scholarship would improve someone's situation.

A: Reasons detailing how a max $20,000 scholarship would improve someone's situation:Financial Relief:…

Q: Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not.…

A: For increase in sales there is need of external finance required to meet the increase in assets and…

Q: Aria Acoustics, Incorporated (AAI), projects unit sales for a new 7-octave voice emulation implant…

A: Net present value is the difference between the present value of cash inflows and present value of…

Q: i need the answer quickly

A: Standard deviation is a measure of risk in stocks. When it's high, it indicates that the stock price…

Q: 12 years ago, I purchased 130 shares of Klein Incorporated stock at $14.50 per share. The stock had…

A: Original number of shares purchased = 130 sharesFirst stock split was 4:1It means you will get 4…

Q: Required: Zeda Incorporated, a U.S. MNC, is considering making a fixed direct Investment In Denmark.…

A: Direct investment refers to a ownership which is helped by the investors, government, etc such as…

Q: The following are the cash flows of two projects: Year Project A 0 $ (340) Project B $ (340) 1 170…

A: Payback period is the duration of time in which the initial investment is recovered by the cash…

Q: The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place…

A: Variables in the question:Rate of return=12%Cash inflow per year=$12500n=3 yearsSalvage value=nil

Q: Mercado Ltd started its business with £21,000 in cash on 1 Jan 20X1, and immediately purchased 400…

A: Comparative purchasing power accounting is a technique utilized to assess metrics, between nations…

Q: (a) Calculate the net present value of the planned purchase of the machine using a nominal (money…

A: Net Present Value is the difference between the present value of cash inflows and present value of…

Q: Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation…

A: The Sample std Deviation of the firm's returns is equal to 20.59% Please see the detailed…

Q: Williams Software has 9.3 percent coupon bonds on the market with 24 years to maturity. The bonds…

A: Bonds are issued by governments and corporations when they want to raise money from market.

Q: Two depository institutions have composite CAMELS ratings of 1 or 2 and are "well capitalized."…

A: Financial risk assessment is the process of evaluating potential financial losses and uncertainties…

Q: te.7

A: Arithmetic mean return = 11.98%Geometric mean return = 9.92% Geometric mean return is more…

Q: we believe we can sell 90, security devices per year at $150 per piece. They (variable cost). Fixed…

A: The term "net present value" describes the capital budgeting methods used to assess the project's or…

Q: You have looked at the cu has an EBIT of $5,150,000 this year. Depreciation, the increase in net…

A: A share price, also known as a stock price, is the current market value of a single share of a…

Q: Williams Software has 9.3 percent coupon bonds on the market with 24 years to maturity. The bonds…

A: Coupon rate = 9.3%Maturity = 24 yearsPrice of bond = 112.5% of parTo find: Current yield, YTM, and…

Q: of the swap as a percentage of the principal when OIS and LIBOR rates are the same?

A: The worldwide banks that lend to one another in an international interbank market for short-term…

Q: Kiser Mfg. is considering a rights offer. The company has determined that the ex-rights price will…

A: The subscription price is the cost at which existing shareholders have the option to purchase…

Q: Neil recently obtained his Florida sales associates license. He then decides to open his own office…

A: The question is asking whether Neil, who recently obtained his Florida sales associates license and…

Q: Halloween Costumes Unlimited is considering a new 3-year store expansion project that requires an…

A: Net Present value refers to the Capital budgeting technique helps in evaluating the profitability…

Q: Although appealing to more refined tastes, art as a collectible has not always performed so…

A: Number of years (n) = 2003 - 1998 = 5Future Value (FV) in 2003 = $10,351,500Present Value (PV) in…

Q: redo to give me the accurate answer for b please in the first picture in addition redo thois…

A: A stock is a capital market security that allows the investor to take part in the equity interest of…

Q: The federal government is considering an investment that would cost $25 billion in construction…

A: Initial Investment = $25 billion or $25,000,000,000Annual Saving (P) = $2 billion or…

Q: You have looked at the current financial statements for Reigle Homes, Co. The company has an EBIT of…

A: Share price refers to the price at which the stock is being traded in the market among investors for…

Q: What secondary source of data can I use for the following research topic: COVID-19 : A Threat to the…

A: The objective of the question is to identify secondary sources of data that can be used for research…

Q: Stated Rate (APR) Number of Times Compounded 9.7 % Quarterly 18.7 Monthly 14.7 Daily 11.7 Infinite…

A: Effective Annual Rate is the actual rate earned on any investment when the interest is earned more…

Q: You need to prepare for three large, upcoming project expenditures which will begin 3 years from…

A: The time value of money is a fundamental financial concept that states that a dollar today is worth…

Q: Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence,…

A: The stock value today (current stock value) can be calculated by adding the present value of future…

Q: Hello, for corporate finanace, can you please show me each step to solving this problem without…

A: The price of one share of Coffee Roasters stock, with dividends starting in three months, is…

Q: Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon…

A: Investment interest rates reflect the return earned on invested capital. This return can be a fixed…

Q: Bobbi Hilton, 62, is considering the purchase of a 77-year long-term care policy. If nursing home…

A: The objective of the question is to calculate the total out-of-pocket cost for Bobbi Hilton if she…

Q: Linda is taking out an amortized loan for $91,000 to open a small business and is deciding between…

A: Loan amount = $91,000Maturity of credit union loan = 8 yearsAnnual interest rate = 13.30%Maturity of…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: The answer is in the explanation.Explanation:Part 1: Computing the Appropriate Discount RateThe…

Q: Exercise 5-16 (Static) Deferred annuities [LO5 - 8] President Company purchased merchandise from…

A: The current value of a series of future cash flows is an annuity's present value. These cash flows…

Q: You own an oil pipeline that will generate a $2.8 million cash return over the coming year. The…

A: Expected Cash Flow = cf = $2.8 millionGrowth Rate = g = -5.5%Discount Rate = r = 12%

Q: Problem 10-14 Spreadsheet Problem: Portfolio Beta and Return (LG10-3) You own the portfolio of five…

A: Portfolio beta means the weighted average beta of the assets in the portfolio.

Q: A company is going to set up a oerpetuity to withdraw $ 150 for miscellaneous expenses each quarter.…

A: To have enough in the account in one year to fund a perpetuity of $150 withdrawals each quarter with…

Q: Consider the following spot interest rates for maturities of one, two, three, and four years. r₁ =…

A: Sure, I'll avoid using special symbols and commands. Let's solve the problem using plain text:To…

Q: The finance balance sheet is is the same as the accounting balance sheet which is used to determine…

A: The objective of the question is to identify the correct description of a finance balance sheet…

Q: Alphabet Soup Inc jointly produces A, B, and C at a joint cost of $100,000. The company uses the…

A: As per Net Realizable Method (NRV), the net realizable value of by-product is reduced from the joint…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: capital budgeting refers to the concept which is used for evaluating the viability of the project…

Q: A homeowner took out a 25-year fixed-rate mortgage of $85,000. The mortgage was taken out 10 years…

A: Mortgages are a type of loan that can be used to purchase or maintain a home, a plot of land, or any…

Q: 3. Lohn Corporation is expected to pay the following dividends over the next four years: $9, $7,…

A: calculating Lohn Corporation's current share price using the Dividend Discount Model (DDM), a key…

Q: Consider two mutually exclusive new product launch projects that Nagano Golf' is considering. Assume…

A: NPV, or Net Present Value, determines an investment's profitability by assessing the present value…

Q: 12. Suppose Hunter Valley is deciding whether to purchase new accounting software. The payback for…

A: The payback period denotes the duration it takes for an investment to recover its initial…

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

- Suppose that a bank has agreed to the following terms of an interest rate swap:- The notional principal is CAD 300 million and the remaining life of the swap is 11 months.- The bank pays 8% per annum, and receives three-month LIBOR.- Payments are exchanged every three months.- The swap (fixed) rate is 11% per annum for all maturities.- The three-month LIBOR rate a month ago was 12.5% per annum. All rates are compounded quarterly. Estimate the value of the swap using a) a bond-price valuation method, and b) a FRAs-based method?A $100,000 interest rate swap has a remaining life of 10 months. Under the terms of the swap, six-month LIBOR is exchanged for 4% per annum (compounded semi-annually). Six-month LIBOR forward rates for all maturities are 3.3% (compounded semi-annually). The six-month LIBOR rate was 2.6% two months ago. The risk free rate is 2.7% (cont. comp) for all maturities. What is the value of the swap to the party paying floating? (Required precision: 0.01 +/- 1)Consider a $15 million interest-rate swap in which cash flows based on a fixed rate of 5% (with semi-annual compounding) are exchanged for 6-month LIBOR. The swap has a remaining life of 9 months. The 6-month LIBOR that was observed three months ago was 4.85% (with semi-annual compounding). The forward LIBOR for the period between 3 months and 9 months (from today) is 6.14% (with semi-annual compounding). The risk-free rates for 3 months and 9 months are 5.3% and 5.8%, respectively, with continuous compounding. Calculate the value of the swap to the party receiving the fixed rate.

- Consider a $10,000,000 1-year quarterly-pay swap with a fixed rate of 4.5% and a floating rate of 90-day LondonInterbank Offered Rate (LIBOR) plus 150 basis points. 90-day LIBOR is currently 3% and the current forward ratesfor the next four quarters are 3.2%, 3.6%, 3.8%, and 4%. If these rates are actually realized, at the second quarterlysettlement date, the fixed-rate payer in the swap will:a. receive a payment of $5,000b. receive a payment of $5,000c. receive a payment of $7,500d. neither make nor receive a paymentA firm enters into a five-year fixed for float agreement one year ago. Because one year has passed the swap has exactly four more years remaining. Since the reset date for the next floating payment is today, the next applicable floating rate can be identified in the table below. Payments from each firm occur at the end of each year. Assume that the firm agreed to pay a fixed rate of 6.45% (based on annual compounding) and to receive the floating rate. The notional amount of the swap is $12 million. Use the following current spot term structure for annual interest rates (all based on continuous compounding) to determine the value of the plain vanilla, fixed for float interest rate swap. Term (years) Spot Zero Annual Interest Rates (based on continuous compounding) 0.5 5% 1 5.5% 1.5 6% 2 6.5% 2.5 7% 3 8% 3.5 8.5% 4 9% 4.5 9.5% 5 10%The 9-month LIBOR rate is 5%, and the 6-month LIBOR rate is 4%, on the basis of continuous compounding and 365 days a year. The 3-month Eurodollar futures price quote for a contract with a delivery date in 6 months should be: a. 93.0000 b. 92.9384 c. 93.0351

- Suppose you have a 2.5-year remaining on an interest rate swap with a notionalprincipal of $10, 000, 000 between Company A and Company B. Company A pays fixed rateand Company B pays the float rate. Fixed and float payments are exchanged every year andthe last payment was exchanged 6 months ago. The fixed rate is 3.5% per annum, and thefloating rate is tied to the annual LIBOR. The previous 1-year LIBOR rate, set 6 months ago,is 2.75%, 6 month LIBOR is 3.25%. the 1.5-year LIBOR is 3.25%, and the 2.5-year LIBOR is3.50%.Calculate the present value of the fixed and floating legs of the swap, and determine the swap’snet present value from Company A’s perspective. Assume annual compounding for discounting.A semi-annual pay interest rate swap where the fixed rate is 5.00% (with semi-annual compounding) has a remaining life of nine months. The six-month LIBOR rate observed three months ago was 4.85% with semi-annual compounding. Today’s three and nine month LIBOR rates are 5.3% and 5.8% (continuously compounded) respectively. From this it can be calculated that the forward LIBOR rate for the period between three- and nine-months is 6.14% with semi-annual compounding. If the swap has a principal value of $15,000,000, what is the value of the swap to the party receiving a fixed rate of interest? Assume OIS rates are the same as LIBOR rates.A semi-annual pay interest rate swap where the fixed rate is 5.00% (with semi-annual compounding) has a remaining life of nine months. The six-month LIBOR rate observed three months ago was 4.85% with semi-annual compounding. Today’s three and nine month LIBOR rates are 5.3% and 5.8% (continuously compounded) respectively. From this it can be calculated that the forward LIBOR rate for the period between three- and nine-months is 6.14% with semi-annual compounding. If the swap has a principal value of $15,000,000, what is the value of the swap to the party receiving a fixed rate of interest? Assume OIS rates are the same as LIBOR rates. Please show how you get the floating payments

- Current USD Interest rates are 7% per annum and AUD rates are 9% per annum, flat for all terms. Current value of AUD is 0.62 USD. Under a FX swap agreement, a financial institution pays 8% per annum in AUD and receives 4% per annum in USD. Notional principals are 12 Million USD and 20 Million AUD. Payments are exchanged every year, with one exchange having just taken place. The swap will last 5 more years. What is the value of the swap to the financial institution?On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $5,000,000. The contract calls for cash settlement of the net interest amount at December 31 of each year. The yield curve is flat, and the agreement is to last until December 31, 20X9. Both the fixed annual rate and the variable annual rate at January 1, 20X1, are 7.00%. The variable interest rate is reset at the end of each year and becomes effective for the next year. On December 31, 20X1, the variable rate is reset to 8.00% per year, and on December 31, 20X2, the variable rate is reset to 5.00%. 1. Compute the fair value of the swap agreement at December 31, 20X1. Asset or a liability?2. Compute the fair value of the swap agreement at December 31, 20X2. Asset or a liability?On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $5,000,000. The contract calls for cash settlement of the net interest amount at December 31 of each year. The yield curve is flat, and the agreement is to last until December 31, 20X9. Both the fixed annual rate and the variable annual rate at January 1, 20X1, are 7.00%. The variable interest rate is reset at the end of each year and becomes effective for the next year. On December 31, 20X1, the variable rate is reset to 8.00% per year, and on December 31, 20X2, the variable rate is reset to 5.00%. Required: Compute the fair value of the swap agreement at December 31, 20X1. Be sure to indicate whether it is an asset or a liability. Compute the fair value of the swap agreement at December 31, 20X2. Be sure to indicate whether it is an asset or a liability.