FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

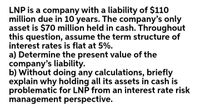

Transcribed Image Text:LNP is a company with a liability of $110

million due in 10 years. The company's only

asset is $70 million held in cash. Throughout

this question, assume the term structure of

interest rates is flat at 5%.

a) Determine the present value of the

company's liability.

b) Without doing any calculations, briefly

explain why holding all its assets in cash is

problematic for LNP from an interest rate risk

management perspective.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Minimizing liquidity is an excellent way to meet a company's short-term financial obligations. 1) False 2) Truearrow_forwardWhich of the following statements is correct? A. Investors appreciate illiquid assets in their portfolios as they can easily sell them off to cover margin calls. B. Liquid assets can quickly be converted into cash without changing prices too much. O C. Corporate bonds are among the most liquid financial assets as they trade at a very high frequency. D. Liquid assets tend to be cheaper as investors are not willing to pay for their liquidity benefits.arrow_forwardReinvestment risk occurs when a financial institution holds longer-term assets relative to liabilities and faces uncertainty about the interest rate at which it can reinvest funds borrowed over a longer period. Select one: True Falsearrow_forward

- Which of the following statements is/are true? Multiple statements may be true A bank borrowing from the central bank signals confidence to other market participants The risk of fire sale is decreasing in the underlying item's illiquidity Liquidity risk can be addressed using off-balance sheet items Liquidity risk can originate from off-balance sheet itemsarrow_forwardTrue (t) or False (f) ______ Short-term, highly liquid investments may be included with cash on the balance sheet.arrow_forwardWhich of the following circumstances would result in an increase in cash from operations but not an increase in net income? Select one: a. None of the other choices is correct b. The failure to take advantage of a purchase discount offered by the supplier c. The sale of equipment for an amount greater than its book value d. The reissuance of treasury stock for an amount greater than its cost e. The issuance of bonds at a premiumarrow_forward

- What are some advantages of matching the maturities of claims against assets with the lives of theassets financed by those claims? Is it feasible for afirm to match perfectly the maturities of all assetsand claims against assets? Why might a firm deliberately mismatch some asset and claim maturities?arrow_forwardQuestion1. Arbitrage is limited because the wealth of arbitrageurs is limited. Discuss this statement in the context of those who are managing their own money and those who are managing other people’s money. Question 2. Differentiate the following terms and concepts: a,Primacy and recency effects b. Salience and availability c. Fast-and-frugal heuristics and bias-generating heuristics d. Autonomic and cognitive heuristics Please include refernces and in text citations.arrow_forwardSubstantial doubt exists regarding a client's ability to continue. The client must present its plans to mitigate the effects of the events and conditions. Which item is NOT an acceptable plan? a. Restructure debt to delay due date of Bonds Payable. b. Sell assets used in product production for cash. c. Issue Common Stock at market value. d. Decrease dividend requirements. e. Obtain cash by issuing notes.arrow_forward

- Consider the following statement: "The estimation of the Free Cash Flow to the Firm (FCF) considers investment decisions but ignores financing decisions." Is this statement true or false? Explain your answer.arrow_forward1.What are the benefits and costs to an FI of holding large amounts of liquid assets? Why are Treasury securities considered good examples of liquid assets? 2. What are the primary methods that insurance companies can use to reduce their exposure to liquidity risk?arrow_forwarddescribe and compare alternative ways to estimate the probability of company defaulting on its debt obligations. Explain the difference between real-world and risk-neutral estimatesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education