Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

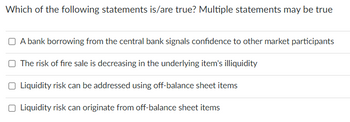

Transcribed Image Text:Which of the following statements is/are true? Multiple statements may be true

A bank borrowing from the central bank signals confidence to other market participants

The risk of fire sale is decreasing in the underlying item's illiquidity

Liquidity risk can be addressed using off-balance sheet items

Liquidity risk can originate from off-balance sheet items

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financial intermedires play a crucial role in an economic crisis they are responbile for both causing The market to crash and then helping it recover from the crisis is this statement true?Discuss with an examplearrow_forwardHow Liquidity coverage ratio (LCR) & Net stable funding ratio (NSFR) can ensure the liquidity of bank , explain with some example.arrow_forward1.What are the benefits and costs to an FI of holding large amounts of liquid assets? Why are Treasury securities considered good examples of liquid assets? 2. What are the primary methods that insurance companies can use to reduce their exposure to liquidity risk?arrow_forward

- F3arrow_forwardIt is said that open market transactions involve the sale or purchase of securities by the BSP to withdraw or inject liquidity into the system. What is Securities?arrow_forwardWhich of the following statements is false? A. Internal controls are the processes by which the firm ensures that it presents accurate financial statements. B. Greenfield investments provide uncertain cash flows with high yields and high growth potential. C. Footnotes allow investors or any users to improve their assessments of the amount, timing, and uncertainty of the estimates reported in financial statements. D. Secondary markets are the markets in which existing, already outstanding securities are traded among investors.arrow_forward

- and allow a financial intermediary to offer safe liquid liabilities such as deposits while investing the depositors money in riskier illiquid assets. Multiple Choice O Diversification; high equity returns Price risk; collateral Free riders; regulationsarrow_forwardWhich of the following is not likely cause of Default? Select one: O aLack of compliance with loan policies O b.Inadequate controls over loan officers c.Over concentration of bank lending in certain sectors or areas Od.Lending in familiar markets Oe.All of the abovearrow_forwardOne of the following statement is true about strategies of liquidity management Select one: O a. Asset Liquidity Management or Asset Conversion Strategy. This strategy calls for storing liquidity in the form of illiquid assets (T-bills, fed funds loans, CDs, etc.) and selling them when liquidity is needed b. Borrowed Liquidity or Liability Management Strategy. This strategy calls for the bank to purchase or borrow from the money market to cover all of its liquidity needs Balanced Liquidity Strategy. The C. use of liquid asset holdings (Asset Management) O d. No need to follow any strategy for liquidity managementarrow_forward

- The risks below faced the financial institutions: Credit Risk Liquidity Risk Interest Rate Risk Off-Balance-Sheet Risk Market Risk Foreign Exchange Risk Sovereign Risk Technology Risk Operational Risk FinTech Risk Insolvency Risk What causes these risks, and How to mitigate them? I understand these risks are interdependent to each others.arrow_forwardQuestion about Securitization in Accounts Receivables How does a large company convert it's accounts receivables into securities? How does that process exactly work? And how does this benefit both parties? (when selling the security). Please explain this case and give an e.g for better understanding.arrow_forwardInterbank borrowings are borrowings among banks are non-collateralized loans among banks are subject to asymmetric information problems. O all of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education