College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

I don't need ai answer general accounting question

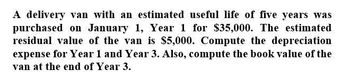

Transcribed Image Text:A delivery van with an estimated useful life of five years was

purchased on January 1, Year 1 for $35,000. The estimated

residual value of the van is $5,000. Compute the depreciation

expense for Year 1 and Year 3. Also, compute the book value of the

van at the end of Year 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardMontello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardA delivery van costing $35,000 is expected to have a $2,000 salvage value at the end of its useful life of five years. Assume that the truck was purchased on January 1. Compute the annual depreciation expense under the straight‑line depreciation method. (Round your answer to the nearest whole number.)arrow_forward

- What is the amount of straight line depreciation for each year of this financial accounting question?arrow_forwardPlease show all your workarrow_forwardA piece of equipment is purchased for $40,000 and has an estimated salvage value of $1,000 at the end of the recovery period. Prepare a depreciation schedule for the piece of equipment using the straight-line method, the sum-of-the-years method, and the 200% declining-balance method with a recovery period of five years. Compare these depreciation methods in a graph.arrow_forward

- An asset is purchased for $90,000. It is expected to have a useful life of six years and a salvage value of $18,000 at the end of its useful life. Find the BV at the end of the second year using the SL method.arrow_forward1. The cost of a certain machinery is $30,000. Its useful life is 6 years, and its resale value is $5,000. Estimate the book value of the machine after 2 years, using constant percentage depreciation method. Tabulate the annual depreciation amounts and the book value of the equipment at the end of each year.arrow_forwardCalculate the annual depreciationarrow_forward

- A machine can be purchased for $80,000 and used for five years, yielding the following Income. This income computation Includes annual depreciation expense of $16,000. Income Year 1 $5,300 Year 2 $13,300 Year 3 Year 4 Year 5 $35,000 $19,900 $53,200 Compute the machine's payback period. Note: Round payback period answer to 2 decimal places. Year Net Income Depreciation Net Cash Flow Cumulative Net Cash Flow Initial invest $ (80,000) $ (80,000) Year 1 $ 5,300 Year 2 13,300 Year 3 35,000 Year 4 19,900 Year 5 53,200 Payback period=arrow_forwardAn asset is purchased for $500,000. Salvage in 25 years is $100,000. What are the depreciation in the first three years using single line, double declining balance, and sum-of-the-years digits depreciation methods?arrow_forwardA tool is purchased for $500,000. The expected life is 25 years. The salvage value is $100,000. what is the second year’s depreciation using the double declining balance method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College