FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

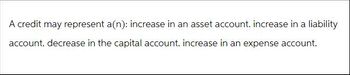

Transcribed Image Text:A credit may represent a(n): increase in an asset account. increase in a liability

account. decrease in the capital account. increase in an expense account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- T accounts are used to reflect increases and decreases in individual assets, liabilities, and equity accounts. Which of the following statements is true? For liability accounts: Increases are recorded on the left side (debit side) of liability T accounts. For Revenue accounts: Increases are recorded on the left side (debit side) of revenue T accounts For Asset accounts: Increases are recorded on the left side (debit side) of asset T accounts. For Asset accounts: Increases are recorded on the right side (credit side) of asset T accounts.arrow_forwardIn the case of a bank's accrued interest ?revenues, which occurs first Earning The Interest Revenues Nothing Receiving The Interest From The Borrowerarrow_forwardWhat is incorrect here? Available options are: Accounts Payable, Accounts Receivable, Accumulated Depreciation, Bond Premium, Bonds Payable, Building, Cash, Common Stock, Cost of Goods Sold, Delivery Expense, Depreciation Expense, Discount on Bonds Payable, Dividends Declared, Finance Costs, Goodwill, Intrest Expense, Intrest Income, Intrest Payable, Intrest Receivable, Land, Merchandise Inventory, Micellanious Expense, Other Expenses, Sales, Sales Discounts, Sales Returns and Allowances, Finance Costs, Goodwillarrow_forward

- Which of the following groups of accounts increase with credits? O a. Accounts Receivable, Prepaid Insurance, Unearned Rent O b. Accounts Payable, Accounts Receivable, Fees Earned O c. Accounts Payable, Unearned Rent, Fees Earned O d. Prepaid Insurance, Unearned Rent, Fees Earnedarrow_forwardWhich one of the following will decrease net working capital? Select one: a. A decrease in accounts payable. b. A sale of inventory at a profit. c. A sale of a fixed asset for cash. d. An increase in accounts receivable. e. An increase in accounts payable.arrow_forwardCredits increase assets and decrease liabilities. decrease assets and increase liabilities. increase both assets and liabilities. decrease both assets and liabilities.arrow_forward

- Net working capital increases when: A. a credit customer pays for his or her purchase B. inventory is sold at cost. C. fixed assets are purchased for cash D. inventory is purchased on creditarrow_forwardSimple interest refers to interest on a loan computed as a percentage of the loan amount. Compound interest refers to the process of, investing your money. saving your money. C a loan amortization. a loan computed at a nominal interest rate. E earning interest on interest.arrow_forwardIf current assets exceed current liabilities, payments of accounts payable willa. decrease the current ratio.b. increase the current ratio.c. decrease working capital.d. increase working capital.arrow_forward

- Increases in asset accounts are recorded on the debit side the right side the dark side the credit sidearrow_forward1. True or false. Rate of return is the interest earned on the unpaid balance of an amportized loanarrow_forward69. Claim against assets are represented by A. saved earning B. retained earnings C. maintained earning D. saving account earningarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education