Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

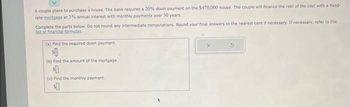

Transcribed Image Text:A couple plans to purchase a house. The bank requires a 20% down payment on the $470,000 house. The couple will finance the rest of the cost with a fixed-

rate mortgage at 3% annual interest with monthly payments over 30 years.

Complete the parts below. Do not round any intermediate computations. Round your final answers to the nearest cent if necessary. If necessary, refer to the

list of financial formulas

(a) Find the required down payment.

$

(b) Find the amount of the mortgage.

$0

(c) Find the monthly payment.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your brother is considering the purchase of a home rather than renewing the lease on his two-bedroom apartment. He is currently paying $800 per month for rent. He has asked you to help decide what sort of home he might be able to afford with his current monthly rent payment. His bank offers first-time home buyers (with good credit) a 25-year mortgage at a fixed rate of 8.95%. Use this information to answer the questions below. Express your answers rounded correctly to the nearest cent! () If the cost of insurance and property taxes is about $290 per month in the neighborhood where he'd like to live, what monthly mortgage payment can he afford? (Refer to your class notes for the formula.) Payment = $ 650 (i) Use Excel's P function to determine how much your sister could afford to borrow for a home. Amount to Borrow $ 629.9arrow_forwardA young newly married couple wish to purchase a unit house in a remote area priced at $190,000. They want to borrow the entire amount and repay this amount in full plus interest over the next 20 years. You can offer them a mortgage for the full amount at an interest rate of 17% (sounds like extortion to me) and calls for equal annual instalment payments at the end of each of the 20 years. Required: (a) Calculate the amount of the annual payment? (b) Create and complete the amortizationarrow_forwardBhaarrow_forward

- 不 Claire needs to borrow $5000 to pay for NHL season tickets for her family. She can borrow from a finance company (at 2.78% add on interest for 5 years) or she can borrow from credit union (60 monthly payments of $03 78 each). Find the APR for each loan using a TVM solver, and decide which one is Claire's better choice The APR for the finance company loan is (Type an integer or decimal rounded to the nearest hundredth as needed)arrow_forward9. Jason bought a home in Arlington, Texas, for $127,000. He put down 25% and obtained a mortgage for 30 years at 6%. a. What is Jason’s monthly payment? (Do not round intermediate calculations. Round your answer to the nearest cent.) Monthly payment $ b. What is the total interest cost of the loan? (Use the amortization worksheet on the financial calculator.) Total interest cost $arrow_forwardHarriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $74,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? (Use the Table 15.1) Note: Do not round intermediate calculations. Round your answers to the nearest cent. Monthly payment Total cost of interest a. 25 Years, 4.75% $337.51 $42,053.00 b.25 Years, 5.25% c. 25 Years, 5.50% $363.54 $49,862.00 d. 25 Years, 5.75% e. What is the savings in interest cost between 4.75% and 5.75%? Note: Round your answer to the nearest dollar amount. Interest cost: f. If Harriet uses 30 years instead of 25 for both 4.75% and 5.75%, what is the difference in interest? Note: Use 360 days a year. Round your answer to the nearest dollar amount. Interest difference: TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year…arrow_forward

- Please see attachedarrow_forwardYou decide to do some remodeling in the kitchen. Your parents agree to lend you the money, but you insist on paying them interest. The agreement is that they will lend you $8000.00 at a simple interest rate of 2% per year. Once the interest amounts to $480, you agree to pay them back the $8000 plus the $480 interest. After how many months will you have to pay them back? Please answer step by steparrow_forwardPlease show how to solve this using excel and please show all formulas in the spreadsheet please!! Steven decides to buy a house with price of $500,000, Steven puts 20% down payment and considers a 15-year fixed rate mortgage to pay the remaining balance. The lender offers him three choices of the mortgage with monthly payments shown in the table as a., b., and c. Assume that the origination cost is $8,000. A. If the loan will be outstanding for 15 years, what is the effective cost for each choice? Which choice is most ideal? explain? B. Which mortgage choices are not properly priced? explain?arrow_forward

- O CONSUMER MATHEMATICS Finding the monthly payment, total payment, and interest for a... When Laura bought her house, she got her mortgage through a bank. The mortgage was a personal, amortized loan for $99,500, at an interest rate of 3.75%, with monthly payments for a term of 40 years. For each part, do not round any intermediate computations and round your final answers to the nearest cent. If necessary, refer to the list of financial formulas. (a) Find Laura's monthly payment. (b) If Laura pays the monthly payment each month for the full term, find her total amount to repay the loan. $0 (c) If Laura pays the monthly payment each month for the full term, find the total amount of interest she will pay. $0 X Monthly Payment Formula M= P r 12 r 1- ( 1 + 12 ) - 12tarrow_forwardA man borrows $60,000 to help pay for his college expenses. He intends to pay off the loan with regular monthly payments over the next 20 years. Find the monthly payment if he is being charged 4.7% interest per year, compounded monthly. Give the answer to 2 decimal places, and do not use the $ sign in the answer box. The monthly payment is Blank 1. Calculate the answer by read surrounding text. dollars.arrow_forwardA small business owner visits her bank to ask for a loan. The owner states that she can repay a loan at $1, 100 per month for the next three years and then $2, 200 per month for two years after that. If the bank is charging customers 7.75 percent APR, how much would it be willing to lend the business owner? (Do not round intermediate calculations and round your final answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education