Exploring Economics

8th Edition

ISBN: 9781544336329

Author: Robert L. Sexton

Publisher: SAGE Publications, Inc

expand_more

expand_more

format_list_bulleted

Question

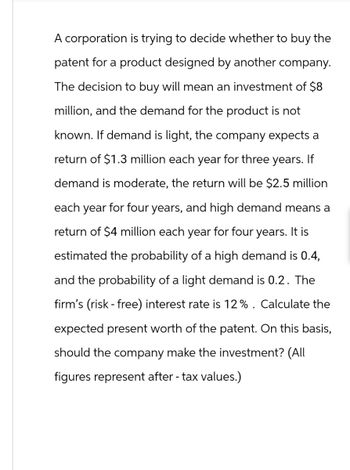

Transcribed Image Text:A corporation is trying to decide whether to buy the

patent for a product designed by another company.

The decision to buy will mean an investment of $8

million, and the demand for the product is not

known. If demand is light, the company expects a

return of $1.3 million each year for three years. If

demand is moderate, the return will be $2.5 million

each year for four years, and high demand means a

return of $4 million each year for four years. It is

estimated the probability of a high demand is 0.4,

and the probability of a light demand is 0.2. The

firm's (risk-free) interest rate is 12%. Calculate the

expected present worth of the patent. On this basis,

should the company make the investment? (All

figures represent after - tax values.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Investors sometimes fear that a high-risk investment is especially likely to have low returns. Is this fear true? Does a high risk mean the return must be low?arrow_forwardWhat are some ways that someone looking for a loan might reassure a bank that is faced with imperfect information about whether the borrower will repay the loan?arrow_forwardWhat is the total amount of interest from a 5,000 loan after three years with a simple interest rate of 6?arrow_forward

- A mortgage 105m is a loan that a person makes to purchase a house. Table 19.11 provides a list of the mortgage interest rate for several different years and the rate of inflation for each of those years. In which years would it have been better to be a person borrowing money from a bank to buy a home? In which years would it have been better to be a bank lending money?arrow_forwardWhat is a capital gain?arrow_forwardWhen do firms receive money from a stock sale in their firm and when do they not receive money?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co