FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:2

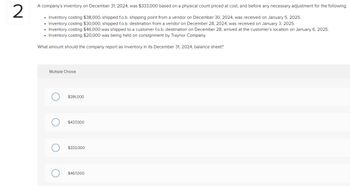

A company's inventory on December 31, 2024, was $333,000 based on a physical count priced at cost, and before any necessary adjustment for the following:

• Inventory costing $38,000, shipped f.o.b. shipping point from a vendor on December 30, 2024, was received on January 5, 2025.

• Inventory costing $30,000, shipped f.o.b. destination from a vendor on December 28, 2024, was received on January 3, 2025.

• Inventory costing $46,000 was shipped to a customer f.o.b. destination on December 28, arrived at the customer's location on January 6, 2025.

• Inventory costing $20,000 was being held on consignment by Traynor Company.

What amount should the company report as inventory in its December 31, 2024, balance sheet?

Multiple Choice

$391,000

$437,000

$333,000

$467,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2024, with an inventory of $165,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows: Year Ended December 31 Ending Inventory at Year-End Costs Cost Index (Relative to Base Year) 2024 $ 243,800 1.06 2025 324,500 1.18 2026 304,750 1.15 2027 299,700 1.11 Required: Calculate inventory amounts at the end of each year. (nearest whole dollars)arrow_forwardGarrow_forwardA physical inventory count showed ABC Company had inventorycosting $428,000 on hand at December 31, 2025. This amountdid not include the following:1. Inventory costing $39,000 that was shipped to acustomer FOB shipping point on December 30, 2025.The inventory was expected to be received by thecustomer on January 3, 2026.2. Inventory costing $17,000 that was shipped to acustomer FOB destination point on December 29, 2025.The inventory was expected to be received by thecustomer on January 6, 2026.3. Inventory costing $26,000 that ABC Company hadpurchased from one of its suppliers. The goodswere shipped to ABC Company on December 31, 2025.ABC Company expects to receive the inventory onJanuary 4, 2026. The shipping terms were FOBshipping point.Calculate the correct dollar amount of ending inventoryto be reported on ABC Company’s December 31, 2025 balancesheet.arrow_forward

- You have the following information for Ivanhoe Inc. for the month ended October 31, 2025. Ivanhoe uses a periodic system for inventory. Date Oct. 1 Oct. 9 Oct. 11 Oct. 17 Oct. 22 Oct. 25 Oct. 29 (a1) (a2) Description Beginning inventory 55 Purchase Sale Purchase Sale Purchase Sale Ending inventory Cost of goods sold Gross profit Units Unit Cost or Selling Price $26 $ tA 140 tA 100 1.LIFO. 2. FIFO. 3. Average-cost. (Round answers to O decimal places, e.g. 125.) 100 55 65 110 Calculate ending inventory, cost of goods sold, and gross profit under each of the following methods. LIFO tA $ 28 LA 45 29 50 31 50 FIFO tA tA tA AVERAGE-COSTarrow_forwardBrandeis Company's accounting records show the following for the year ending on December 31, 2022. Beginning Inventory Net Purchases Ending Inventory Using the periodic system, the cost of goods sold is $252,500 $235,000 $270,900 $208,500 $17,500 213,000 22,000 ? I hope you needed this image.arrow_forwardThe records for the Flagstaff Company showed the following for the one item they sell during the year ended December 31, 2022: Date of Transactions Units Unit Costs Inventory 1/1 40 $20 Purchase 3/5 120 $24 Sale 5/15 80 Purchase 7/11 40 $22 Sale 9/24 30 Purchase 10/23 50 $26 Sale 11/5 40 Required: Assuming a periodic inventory system compute the cost of goods sold during the year and the ending inventory in dollars under each of the following inventory costing methods (show computations and round to the nearest cents): 1) Weighted-average cost (Average cost method the book calls it) 2) First-in, First-out (FIFO) 3) Last-in, First-out (LIFO)arrow_forward

- Rapid Resources, which uses the FIFO inventory costing method, has the following account balances at July 31, 2025, prior to releasing the financial statements for the year: Merchandise Inventory, ending $ Cost of Goods Sold Net Sales Revenue Date 16,500 71,000 122,000 Jul. 31 Requirement 1. Prepare any adjusting journal entry required from the given information. (Record debits first, then credits. Select the explanation on the last line of the journal entry. For situations that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Accounts and Explanation Credit Rapid has determined that the current replacement cost (current market value) of the July 31, 2025, ending merchandise inventory is $13,500. Read the requirements. Debit 4arrow_forwardDuring January 2019, Marta Company, which maintains a perpetual inventory system, recorded the following information pertaining to its inventory: Units Unit Cost Bal. 1/1/19 Purchased on 1/4/19 Sold on 1/20/18 Purchased on 1/25/18 Under the moving average method, what amount should Metro report as Cost of Sales on January 1,000 40 600 @ 120 900 400 @ 200 31,arrow_forward1. At the beginning of September 2020, Bonita company reported inventory of 8200. During the month, the company purchases of 35900. At September 30 2020, a physical count of inventory reported 8600 on hand. Cost of goods solids for the month is ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education