Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

If image is not clear then comment.

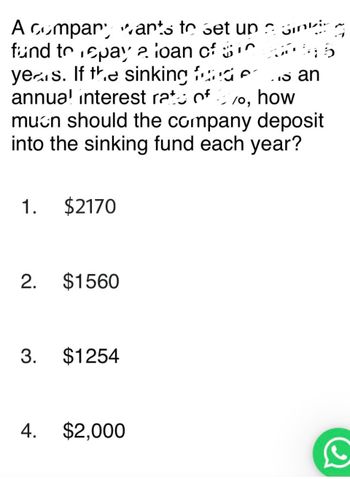

Transcribed Image Text:A company wants to set up in

fund to spay a loan of

15

years. If the sinking

as an

annual interest rate of

10, how

muon should the company deposit

into the sinking fund each year?

1. $2170

2. $1560

3. $1254

4. $2,000

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company decides to borrow $100 000 at j1 = 12% in order to finance a new equipment purchase. One of the conditions of the loan is that the company must make annual payments into a sinking fund (the sinking fund will be used to pay off the loan at the end of 20 years). The sinking-fund investment will earn j1 = 6%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) a) What is the amount of each sinking-fund payment if they are all to be equal? Amount of each sinking-fund 2$ b) What is the total annual cost of the loan? Total annual cost c) What overall annual effective compound interest rate is the company paying to borrow the $100 000 when account is taken of the sinking-fund requirement? Compound interest rate %arrow_forwarda. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time $? at the end of each year 5% compounded annually 14 years Financial Goal $130,000 Click the icon to view some finance formulas. a. The periodic deposit is $ ☐. (Do not round until the final answer. Then round up to the nearest dollar as needed.) b. S of the $130,000 comes from deposits and $ comes from interest. (Use the answer from part (a) to find these answers. Round to the nearest dollar as needed.)arrow_forward1. Let's assume that a loan of $100,000 with an annual interest rate of 6% over 30 years pays monthly payments of $500. a. Calculate the accumulation rate b. Calculate the payment rate . c. Answer : How will the balance of the principal be at the end of the loan in relation to the original amount of the loan? Less, equal or greater? Provide calculations.arrow_forward

- If Your bank _offers to lend y~u $100,000 at_ an 8.5% annual interest rate to start your new business. The terms reqwre you to amortize the loan with 10 equal end-of-year payments. How much interest would you be paying in Year 2?arrow_forwardWhat is the internal rate of return on a $3,000 loan to be repaid as $3,500 twoyears from now?arrow_forwardUse the following amortization chart: Selling price of home $77,000, Down payment $5,000, Principal $72,000, Rate of interest 5.0%, 30 years, Payment per $1,000 $5.37, Monthly mortgage payment $386.64. What is the total cost of interest?arrow_forward

- Use the following amortization chart: Selling priceof home Downpayment Principal(loan) Rate of interest Years Payment per$1,000 Monthly mortgage payment $ 95,000 $ 6,000 $ 89,000 6% 30 $ 6.00 $ 534.00 Assume the interest rate rises to 7.5%. What is the total cost of interest with the new interest rate? (Use Table 15.1.) (Do not round intermediate calculations. Round your final answer to the nearest cent.) Total Cost of Interestarrow_forwardCan someone help me find the right answer?arrow_forwardA property has NOI of $4,000,000. One hope to borrow $50,000,000 at 4.25% payable monthly in arrears fully amortizing over 30-years. The bank requires a minimum DSC of 1.40 times. What is the maximum amount can borrow assuming the same interest rate and payment terms?arrow_forward

- please helparrow_forwardA company wants to make a single deposit now so it will have enough money to purchase a beckhoe costing $60000 seven years from now A) if the account will earn interest of 12% per year, the amount that must be deposit can be calculated as? B)if the account will earn interest of 12% per year, the amount that must be deposited now is nearest to Option a)60,000 (F/P.12%7b.$27,138c 60,00 (P/F, 12%7d.$29,256e60,000 (F/A, 12%,7)f $28,326arrow_forwardWhat are the actual total savings for a borrower if the note rate is 6.625%, 30 year, 2/1 buy-down, sales price of a $140,000 with $20,000 down payment? (use P&l only for calculations)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT