EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Finance question..

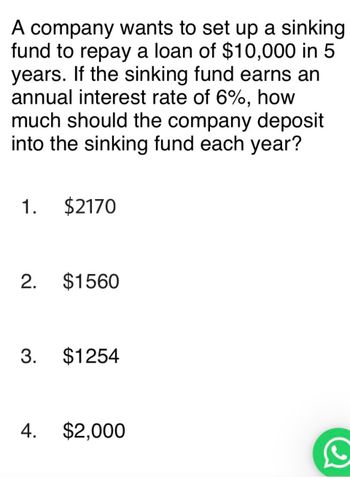

Transcribed Image Text:A company wants to set up a sinking

fund to repay a loan of $10,000 in 5

years. If the sinking fund earns an

annual interest rate of 6%, how

much should the company deposit

into the sinking fund each year?

1. $2170

2. $1560

3. $1254

4. $2,000

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company would like to have $400,000 in 6 years. How much should be invested semiannually into an account paying 3.6% compounded semiannually? 7. Identify the type of problem. a. Present Value with compound interest b. Future Value of an Annuity c. Present Value of an Annuity d. Amortization e. Sinking Fund 8. Answer the question in the problem. a. $30,681.38 b. $29,754.02. c. $34,245.54 d. $30,160.79 c. $28,541.46arrow_forwardA company decides to borrow $100 000 at j1 = 12% in order to finance a new equipment purchase. One of the conditions of the loan is that the company must make annual payments into a sinking fund (the sinking fund will be used to pay off the loan at the end of 20 years). The sinking-fund investment will earn j1 = 6%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) a) What is the amount of each sinking-fund payment if they are all to be equal? Amount of each sinking-fund 2$ b) What is the total annual cost of the loan? Total annual cost c) What overall annual effective compound interest rate is the company paying to borrow the $100 000 when account is taken of the sinking-fund requirement? Compound interest rate %arrow_forwardA company estimates that it will have to replace a piece of equipment at a cost of $800,000 in 5 years. The company has an account that pays 5.6% interest compounded monthly. The company has two options: a lump sum deposit or a sinking fund c) Instead, if a sinking fund is established, how much should each payment be? d) How much will be earned in interest?arrow_forward

- If you borrow $5,400 at a simple interest of 5% per year, how much will be repayed after 6 years? a. $7,020 b. $5,670 c. $7,237 d. $1,620 e. $1,837 Clear my choicearrow_forwardYou deposit $2500 each year into an investment account that earns 8.5% interest for 20 years.Find the value of sn\i. Group of answer choices 11.76470588 16.87675201 51.10869654 48.37701323arrow_forwardA company wants to make a single deposit now so it will have enough money to purchase a beckhoe costing $60000 seven years from now A) if the account will earn interest of 12% per year, the amount that must be deposit can be calculated as? B)if the account will earn interest of 12% per year, the amount that must be deposited now is nearest to Option a)60,000 (F/P.12%7b.$27,138c 60,00 (P/F, 12%7d.$29,256e60,000 (F/A, 12%,7)f $28,326arrow_forward

- Provide manula solution. Attached herewith the copy of the problemarrow_forwardWhat amount must you invest today at 6% compounded annually so that you can withdraw $5,000 at the end of each year for the next 5 years? O a. $12,300.0 O b. $20,540.8 O c. $21,061.8 O d. $22,548.8arrow_forwardSuppose that $10,000 is borrowed now at 15% interest per year.arrow_forward

- Prblmarrow_forwardQ2: Find out the capitalized cost of a certain investment based on the following: 1. An initial deposit of $100,000 2. Recurring payments of $10,000 each 6 years starting by the end of the first year for infinity. 3. Annual uniform payments of $2,000 starting by the end of year 10 for infinity. Interest rate is 6%arrow_forwardNeed answer pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning