ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

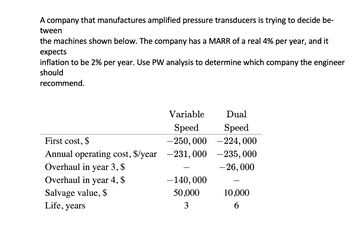

Transcribed Image Text:A company that manufactures amplified pressure transducers is trying to decide be-

tween

the machines shown below. The company has a MARR of a real 4% per year, and it

expects

inflation to be 2% per year. Use PW analysis to determine which company the engineer

should

recommend.

Variable

Speed

-250, 000

First cost, $

Annual operating cost, $/year -231,000

Overhaul in year 3, $

Overhaul in year 4, $

Salvage value, $

Life, years

-140, 000

50,000

3

Dual

Speed

-224, 000

-235, 000

-26, 000

10,000

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The cost of constructing a roundabout (R/A) in a low-traffic residential neighborhood 5 years ago was $625,000. A civil engineer designing another R/A that is almost the same design estimates the cost today will be $740,000. If the cost had increased only by the inflation rate over the 5 years, determine the inflation rate per year.arrow_forwardUsing 1913 as the base year with a value of 100,the ENR construction cost index (CCI) for October2005 was 7562.50. For October 2006, the CCIvalue was 7882.53. (a) What was the inflation ratefor construction for that one-year period? (b) Theindex value for January 2007 was 7879.58. Whatwas the inflation rate over the period October2006 and January 2007?arrow_forwardA machine currently under consideration by Marcus Industries has a cost of $31, 000. When the purchasing manager complained that a similar machine the company purchased 5 years ago was much cheaper, the salesman responded that the cost of the machine has increased solely in accordance with the inflation rate, which has averaged 5% per year. When the purchasing manager checked the invoice for the machine he purchased 5 years ago, he saw that the price was $25,000. Was the salesman telling the truth about the increase in the cost of the machine? What should the machine cost now, provided the price increased by only the inflation rate? Use the formulaarrow_forward

- An offshore services company is considering the purchase of equipment that has a cost today of $96,000. Inflation is a concern. The manufacturer plans to raise the price exactly in accordance with the inflation rate that may be somewhere between 1% and 8% per year. Develop a graph of how much the equipment will cost 3 years from now in terms of both (a) CV, and (b) future dollars.arrow_forwardFind the present worth of earthmoving equipment that has a first cost today of $145,000, an annual operating cost of $60,000, and a salvage value of 20% of the first cost after 5 years, these estimates being in future dollars. Assume that the real interest rate is 12% per year and that inflation has averaged 7% per year. Solve with inflation (a) not accounted for and (b) accounted for. a) The present worth with inflation not accounted for is $ b) The present worth with inflation accounted for is $arrow_forwardFind the present worth of earthmoving equipment that has a first cost today of $139,000, an annual operating cost of $54,000, and a salvage value of 20% of the first cost after 5 years, these estimates being in future dollars. Assume that the real interest rate is 10% per year and that inflation has averaged 5% per year. Solve with inflation (a) not accounted for and (b) accounted for. a) The present worth with inflation not accounted for is $ b) The present worth with inflation accounted for is $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education