FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Could you please help me find the correct balance in the cash and cash equivalents account on December 31, 2020?

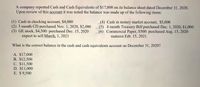

Transcribed Image Text:A company reported Cash and Cash Equivalents of $17,000 on its balance sheet dated December 31, 2020.

Upon review of this account it was noted the balance was made up of the following items:

A

(1) Cash in checking account, $4,000

(2) 3 month CD purchased Nov. 1, 2020, $2,000

(3) GE stock, $4,500: purchased Dec. 15, 2020

expect to sell March, 1, 2021

(4) Cash in money market account, $5,000

(5) 4 month Treasury Bill purchased Dec. 1, 2020, $1,000

(6) Commercial Paper, $500: purchased Aug. 15, 2020

matures Feb. 15, 2021.

What is the correct balance in the cash and cash equivalents account on December 31, 2020?

A. $17,000

B. $12,500

C. $11,500

D. $11,000

E. $9,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- vable Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Do not round intermediate calculations. Round your answers to nearest whole dollar value. Use 360 days a year.) View transaction list Journal entry worksheet 1 Record cash received on note plus interest.arrow_forwardHi, How do I organize these transactions ? Thanksarrow_forwardBramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Made Bramble credit card sales totaling $25,800. (There were no balances prior to January 15.) Made Visa credit card sales (service charge fee 2%) totaling $5,800. Collected $12,000 on Bramble credit card sales. Added finance charges of 1.5% to Bramble credit card account balances. Jan. 15 20 Feb. 10 15 Journalize the transactions for Bramble Stores. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date Jan 15 Jan. 20 Cash Debit Credit M Ç T 9 M Q Me Mu VI 65 Ac Q 59 Acearrow_forward

- The bank statement for Unique Fashion had an ending cash balance of $2,200 on April 30, 2022. On this date the cash balance in their general ledger was $3,678. After comparing the bank statement with the company records, the following information was determined. The bank returned an NSF cheque in the amount of $350 that Unique Fashion deposited on April 20. The NSF service fee was $9. A direct deposit received from a customer on April 29 in payment of their accounts totaling $3,780. This has not yet been recorded by the company. On April 29, the bank deposited $16 for interest earned. The bank withdrew $35 for bank service charges. Deposits in transit on April 30 totalled $4,880. Required Reconcile the ledger and bank statement and create the required journal entries. Do not enter dollar signs or commas in the input boxes. Do not use negative signs. Select the proper order for the headings of the Bank Reconciliation. Cash balance per bank statement Add Outstanding deposit Adjusted bank…arrow_forwardFill out the check register that follows with this information for August 2022: Note: Enter your answer in the order of given data. Round your answers to 2 decimal places. Negative amounts should be indicated by a minus sign in the Balance column only. August 7 August 15 August 19 August 20 August 24 August 29 NUMBER Check Number 959 Check Number 960 Deposit Check Number 961 Check Number 962 Deposit AT&T Staples Balance West Electric Bank of Americal RECORD ALL CHARGES OR CREDITS THAT AFFECT YOUR ACCOUNT DESCRIPTION DATE 2022 PAYMENT/ DEBIT (-) FEE (IF ANY) (-) OF TRANSACTION DEPOSIT/ CREDIT (+) BALANCE $ 4,500.75arrow_forwardUse the following bank statement and T-account to prepare any journal entries needed as a result of the May 31 bank recor no entry Is requlred for a transactlon/event, select "No Journal Entry Requlred" In the first account fleld.) BANK STATEMENTarrow_forward

- Current Attempt in Progress What is the ending balance for the following check register? Check Register Check# 1230 1231 O $1938.25. O $2736.25. O $1124.25. O $2858.25. Date 9/2 9/5 Payee/Description Payment Deposit 9/4 Target 9/7 Utilities Paycheck Cash(ATM) $232.00 $144.00 $23.00 $407.00 Balance $1930.25 $ $arrow_forwardWhat amount should be reported as cash on december 31, 2022 Huston’s company had a checkbook balance on December 31, 2022, of P820,000 and held back the following terms: I. Check payable to Huston dated January 4, 2023, included in the December 31 checkbook balance, P90,000.II. Check payable to Huston dated December 28, 2022, and included in the December 31 balance, it was returned by the bank on December on December 30 marked NSF. The check was redeposited on January 3, 2023 and is cleared January 5, 2023, P80,000. III. Check payable to Regina Mills, a supplier, dated January 3, 2023, was delivered on December 29, 2022, P65,000. This was excluded in the December 31 balance.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education