Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please give me answer general accounting

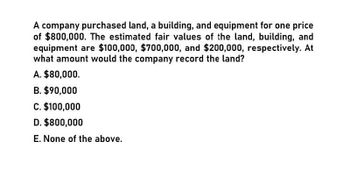

Transcribed Image Text:A company purchased land, a building, and equipment for one price

of $800,000. The estimated fair values of the land, building, and

equipment are $100,000, $700,000, and $200,000, respectively. At

what amount would the company record the land?

A. $80,000.

B. $90,000

C. $100,000

D. $800,000

E. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Anderson Corporation has purchased a group of assets for $23,200. The assets and their relative fair value are listed below Land Equipment Building $7,300 2,300 3,100 Which of the following amounts would be debited to the Land account? Round any intermediate calculations to two (2) decimal places, and the final answer to the nearest dollar OA $4.233 OB. $4,176 OC. $5.568 OD. $13,224arrow_forwardLand, a building and equipment are acquired for a lump sum of $900,000. The market values of the land, building an equipment are $500,000, $600,000 and $200,000, respectively. What is the cost assigneed to the equipment? (Do not round to any intermediary calculations and round your final answer to the nearest dollar). A. $0 B. $900,000 C. $200,000 D. $138,462 thnaka sfor help appareicatedarrow_forwardplease need help about this questionarrow_forward

- A company purchased land, a building, and equipment for one price of $1,800,000. The estimated fair values of the land, building, and equipment are $225,000, $1,575,000, and $450,000, respectively. At what amount would the company record the land?arrow_forwardSEASH, Inc. acquired an office building, land, and equipment in a single basket purchase. The fair values were $2,400,000, $1,200,000, and $400,000 for the building, land, and equipment, respectively. The company recorded the building for $2,160,000. What was the total purchase cost for all three assets? Select one: a. $3,400,000 b. $3,600,000 c. $3,200,000 d. $3,800,000 e. $4,000,000arrow_forwardCarlos Company purchased a building and land for $400,000 in total. Individually, the landappraised for $84,000 and the building appraised for $336,000. How much of the purchaseprice should be allocated to the cost of the land?a. $75,000b. $80,000c. $84,000d. $400,000arrow_forward

- Kingbird Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $447,300. The estimated fair values of the assets are land $85,200, building $312,400, and equipment $113,600. At what amounts should each of the three assets be recorded? (Do not round intermediate calculations and round final answers to O decimal places e.g. 58,971.) Land Building LA LA Equipment $ Save for Later Recorded Amount eTextbook and Media DAE O Search LDLC 8 F8 DOLL Attempts: 0 of 3 used prt sc home Submit Answer end insertarrow_forwardA SE company has on its books for its proved property: P/P- tangible assets $50,000 Well and E&F $220,000 Accumulated DD&A $32,000 If the entire proved property is sold for $220,000, what will be any gain or loss? Accouintingarrow_forwardWhta value should be allocated to the building?arrow_forward

- 2 d ut of Salmyia bought land, buildings and equipment for a combined cash payment of $800,000. The estimated fair value of the assets are: land: $200,000; buildings, $500,000 and equipment $300,000. The amount capitalized for Equipment is: Select one: O a. $300,000 O b. None of the these answers O c. $200,000 O d. $160,000 O e. $240,000arrow_forwardPlease help me with this questionarrow_forwardExcellent Company purchased a plant, including land, building and machinery, for P 110,000. These items were carried on the bools of the seller as follows: land, P 30,000; building, P 60,000; and machinery, P 30,000. Immediately after the purchase, the assets were appraised at the following values: land, P 30,000; building, P 45,000; and machinery, P 75,000. QUESTION: What cost should Excellent record for the land, building and machinery, respectively? O P 36,666; P 36,667; P 36,667 O P 22,000; P 33,000; P 55,000 O P 27,500; P 55,000; P 27,500 O P 24,000; P 30,000; P 66,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning