FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Certainly! Here's a transcription of the text from the image:

---

**ACCT 2000 Study Guide - Chapter 5**

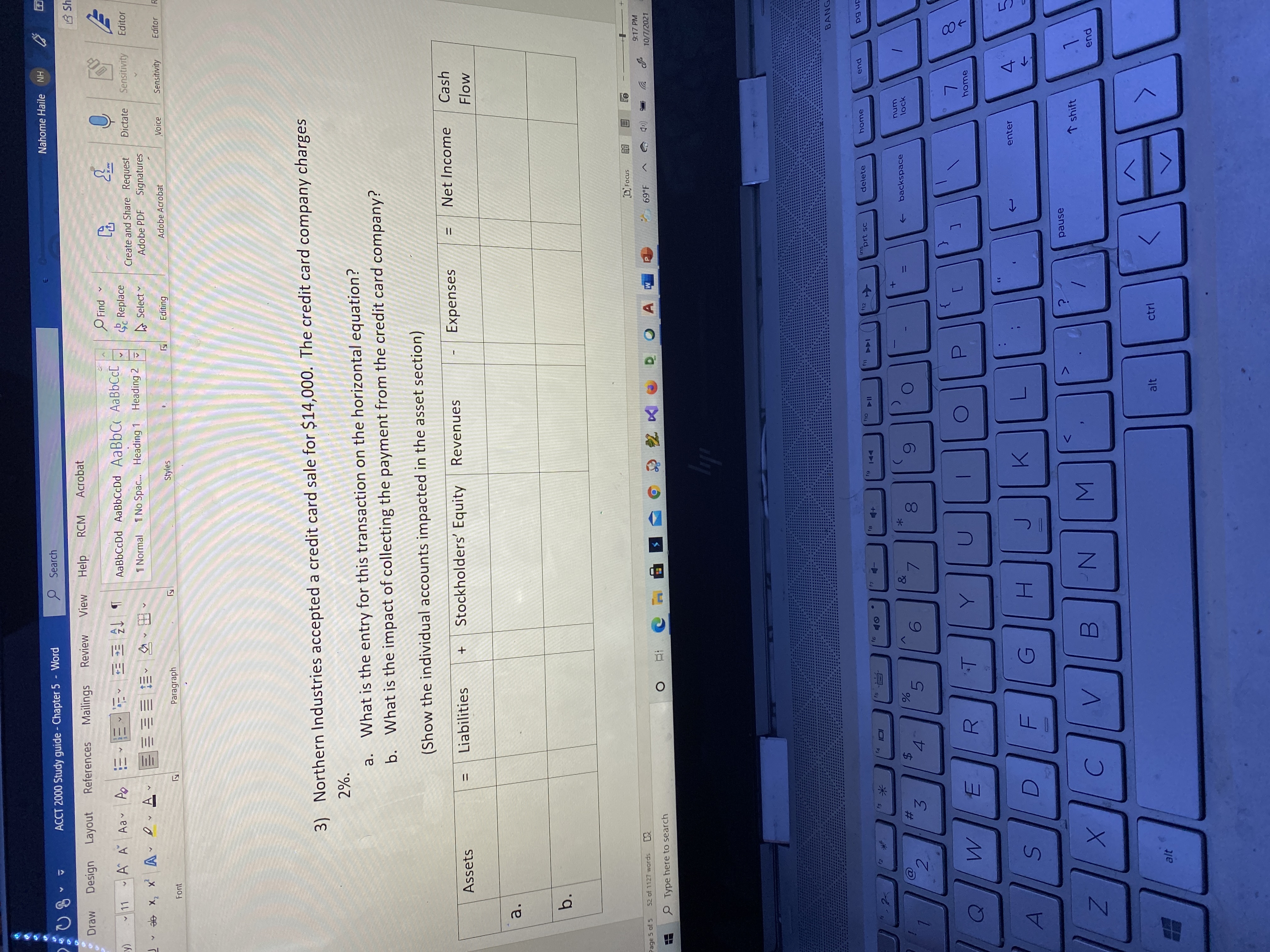

3) Northern Industries accepted a credit card sale for $14,000. The credit card company charges 2%.

a. What is the entry for this transaction on the horizontal equation?

b. What is the impact of collecting the payment from the credit card company?

(Show the individual accounts impacted in the asset section)

| Assets | = | Liabilities | + | Stockholders’ Equity | Revenues | Expenses | = | Net Income | Cash Flow |

|--------|---|-------------|---|----------------------|----------|----------|---|------------|-----------|

| a. | | | | | | | | | |

| b. | | | | | | | | | |

---

**Explanation:**

This section of the study guide discusses financial transactions related to credit card sales. The company, Northern Industries, makes a credit card sale of $14,000 and needs to account for the 2% fee charged by the credit card company. The questions focus on creating appropriate accounting entries and analyzing the impact on financial statements using the horizontal equation format.

The table provided serves as a framework for students to fill in, showing how this transaction affects different accounts in the balance sheet and income statement.

Expert Solution

arrow_forward

Golden Rules of Accounting

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses and losses and credit all incomes and gains.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Your answer is partially correct. Try again. Presented below is information related to Buffalo Corp., which sells merchandise with terms 2/10, net/60. Buffalo Corp. records its sales and receivables net. July 1 Buffalo Corp. sold to Warren Harding Co. merchandise having a sales price of $16,000. 5 Accounts receivable of $12,600 (gross) are factored with Andrew Jackson Credit Corp. without recourse at a financing charge of 8%. Cash is received for the proceeds; collections are handled by the finance company. (These accounts were all past the discount period.) 9 Specific accounts receivable of $12,600 (gross) are pledged to Alf Landon Credit Corp. as security for a loan of $6,900 at a finance charge of 7% of the amount of the loan. The finance company will make the collections. (All the accounts receivable are past the discount period.) Dec. 29 Warren Harding Co. notifies Buffalo that it is bankrupt and will pay only 10% of its account. Give the entry to write…arrow_forward3 Broadmor Industries collected $7,500 from a customer on account. What journal entry will be prepared by Broadmor to record this transaction? Multiple Choice Debit Cash and credit Accounts Receivable. Debit Cash and credit Service Revenue. Debit Accounts Receivable and credit Service Revenue. Debit Accounts Receivable and credit Cash.arrow_forward42.The following data were available for ABC Company, which uses perpetual system, at Dec 31, 20X2:Accounts Payable, beg P15,000Accounts Payable, end P10,000Inventory, beg P17,000Inventory, end P9,000Cash payment to creditors(net of 2% discount) 294,000Purchase returns, P5,000How much were the credit purchases during the period? 285,000 294,000 300,000 315,000arrow_forward

- Subject - account Please help me. Thankyou.arrow_forward(Bonus Question 02) Record the sale by Verity Springs, Inc. of $136,000 in accounts receivable on May 1. Verity Springs is charged a 3.00% factoring fee. View transaction list Journal entry worksheet < 1 Record the sale of receivable. Note: Enter debits before credits. Date May 01 General Journal Debit Creditarrow_forwardUse the following information for the Problems below. (Algo) Skip to question [The following information applies to the questions displayed below.] Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 617,500 Cost of goods sold 292,000 Gross profit 325,500 Operating expenses (excluding depreciation) $ 139,400 Depreciation expense 27,750 167,150 Other gains (losses) Loss on sale of equipment (12,125) Income before taxes 146,225 Income taxes expense 34,050 Net income $ 112,175 FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year…arrow_forward

- What should i do? Accounts payable were paid in the amount of $1,077,500. Note: Enter debits before credits. Transaction General Journal Debit Credit 08arrow_forward(a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forwardJasper makes a $79,000, 90-day, 7% cash loan to Clayborn Co. Jasper's entry to record the transaction should be Debit Notes Receivable for $79,000, credit Cash S79,000. Debit Accounts Receivatble $79,000, credit Notes Receivable $79,000 Debit Cash $79,000, credit Notes Recevable for $79,000. Debit Notes Payable $79,000: credit Accounts Payable $79,000 Debit Notes Receivable $79.000, credit Sales $79.000arrow_forward

- 3. On March 3, Greentree Appliances sells $480,000 of its receivables to Naomi Factors, Inc. Naomi Factors assesses a finance charge of 6% of the amount of receivables sold. Prepare the entry on Greentree Appliance's books to record the sale of the receivables. List two advantages to Greentree to using a factor. Date Account Titles and Explanation Ref Debit Credit EXTRA CREDIT: List two advantages to Greentree due to using a factor.arrow_forwardDescribe 2 accrual transactions and 2 deferral transactions. For the accrual transactions, please use credit or debit sales and credit purchase. For the deferral transactions, please use prepaid insurance and prepaid telephone charges. Note: This can be made up amounts, just as long as they make sense. This is for an Electrotechnology Sales and Repairs business. Please include the dates that the transactions occurred. Please see below, as I have included an example of what the end product should look like. Please include an explanation as to what was done. Accruals: 1. On March 30, 2021 Ortiz LLC provided accounting reservices for Beker Law firm and sent them a bill for $5,000. Payment has not been received to this day. 2. Store supplies of $200 are on hand. The supplies account shows a $1,900 balance. Deferrals: 1. On April 1, 2021. ORTIZ LLC paid $12,000 for a one-year insurance Policy. 2. On February 1, 2021 . ORTIZ LLC received $20,000 for accounting services for 1 year.arrow_forwardSales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education