FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

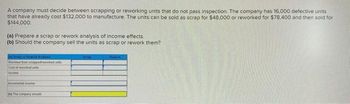

Transcribed Image Text:A company must decide between scrapping or reworking units that do not pass inspection. The company has 16,000 defective units

that have already cost $132,000 to manufacture. The units can be sold as scrap for $48,000 or reworked for $78,400 and then sold for

$144,000.

(a) Prepare a scrap or rework analysis of income effects.

(b) Should the company sell the units as scrap or rework them?

4) Sempor Red Analysis

Revenue from sorappedworked un

Cast of reworked units

Income

incrementalne

by The company should

Rework

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cari Heat (CH) Ltd. is currently faced with a critical decision regarding its productionequipment. Cari Heat (CH) is evaluating two options for its production equipment:upgrading or replacing. The company manufactures and sells 7,500 heaters every year, eachpriced at $920. The current production equipment, which was acquired at a cost of$2,150,000, has been in use for just two years and is subject to straight-line depreciation overa five-year useful life. Furthermore, it possesses no terminal disposal value, but it can becurrently sold for $650,000.The following table presents data for the two alternatives:A B C1 Choice Upgrade Replace2 One-time equipment costs $3,500,000 $5,200,0003 Variable manufacturing cost per Heater $180 $904 Remaining useful life of equipment (years) 3 35 Terminal disposal value of equipmentRequired0 01. Prepare a schedule, for the remaining 3 years, reflecting whether CH should upgrade itsproduction line or replace it? 2. Assuming that all other data are as…arrow_forwardA4arrow_forwardAarrow_forward

- Please do not give solution in image format thankuarrow_forwardBramble Corp. spent $11600 to produce Product 89, which can be sold as is for $15000, or processed further incurring additional costs of $4200 and then be sold for $20000. Which amounts are relevant to the decision about Product 89? $11600, $15000, and $20000 $15000, $4200, and $20000 $11600, $15000, $4200 and $20000 $11600, $4200, and $20000arrow_forwardLegendary Motors has 7,000 defective autos on hand, which cost $12, 880,000 to manufacture. Legendary can either sell these defective autos as scrap for $8,000 per auto, or spend an additional $18, 320, 000 on repairs and then sell them for $12,000 per unit. What is the net advantage to repair the autos compared to selling them for scrap? Group of answer choices $84,000,000 $18, 320, 000 $9, 680,000 $56,000,000arrow_forward

- Answer the following questions. 1. 2. A company has an inventory of 1,050 assorted parts for a line of missiles that has been discontinued. The inventory cost is $73,000. The parts can be either (a) remachined at total additional costs of $25,500 and then sold for $32,500 or (b) sold as scrap for $2,500. Which action is more profitable? Show your calculations. A truck, costing $104,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $16,000 cash and replaced with a similar truck costing $106,000 or (b) rebuilt for $82,000, and thus be brand-new as far as operating characteristics and looks are concemed. Which action is less costly? Show your calculations 1. A company has an inventory of 1,050 assorted parts for a line of missiles that has been discontinued. The inventory cost is $73,000. The parts can be either (a) remachined at total additional costs of $25,500 and then sold for $32,500 or (b) sold as scrap for $2,500. Which action is more…arrow_forwardgo.0arrow_forwardNeed help with this practice problemarrow_forward

- -S Garcia Company has 10,500 units of its product that were produced at a cost of $157,500. The units were damaged in a rainstorm. Garcia can sell the units as scrap for $21,000, or it can rework the units at a cost of $39,500 and then sell them for $52,000. (a) Prepare a scrap or rework analysis of income effects. (b) Should Garcia sell the units as scrap or rework them and then sell them? (a) Scrap or Rework Analysis Revenue from scrapped/reworked units Cost of reworked units Income Incremental income (b) The company should: Scrap Reworkarrow_forwardHelp Save & Che Required information [The following information applies to the questions displayed below.] Armstrong Corporation manufactures bicycle parts. The company currently has a $19,700 inventory of parts that have become obsolete due to changes in design specifications. The parts could be sold for $7,200, or modified for $10,200 and sold for $20,700. 2-a. Calculate the benefit under each alternative for disposing of the obsolete parts. 2-b. How should the obsolete parts be disposed? Complete this question by entering your answers in the tabs below. Req 2A Req 2B Calculate the benefit under each alternative for disposing of the obsolete parts. Benefit if parts are sold without modification Net benefit if parts are sold after being modified Req 2B >arrow_forwardA company must decide between scrapping or reworking units that do not pass Inspection. The company has 10,000 defective units that have already cost $132,000 to manufacture. The units can be sold as scrap for $31,000 or reworked for $45,000 and then sold for $85,000. (a) Prepare a scrap or rework analysis of Income effects. (b) Should the company sell the units as scrap or rework them? (a) Scrap or Rework Analysis Revenue from scrapped/reworked units Cost of reworked units Income Incremental income (b) The company should: Scrap Reworkarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education