FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

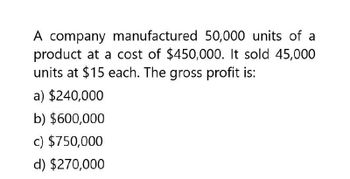

Gross profit? General accounting question

Transcribed Image Text:A company manufactured 50,000 units of a

product at a cost of $450,000. It sold 45,000

units at $15 each. The gross profit is:

a) $240,000

b) $600,000

c) $750,000

d) $270,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Help me with thisarrow_forwardWu Company incurred $40,000 of fixed cost and $50,000 of the variable cost when 4,000 units of products were made and sold. If the company's volume increases to 5,000 units, the total cost per unit will be: a. $18.00. b. $20.00. c. $20.50. d. $22 50.arrow_forwardFidalgo Company makes stereo systems. During the year, Fidalgo manufactured and sold 75,700 stereo systems at a sales price of $570 per unit. Fidalgo's per-unit product cost was $505, and selling and administrative expenses totaled $2,270,000. Compute the total sales revenuearrow_forward

- Tyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using?arrow_forwardFor the following annual data of the electrical company producing 25,000 electrical bulbs, calculate the selling price of each electrical bulb. No. of workers= 10 Working wage= $10,000 Material cost = $200,000 Water, generator and electricity invoices = 17% of the prime cost. Distribution cost = 15% of the direct cost. Administration cost= 10% of the direct cost. Advertising cost= 20% of the administration cost. Profit = 8% of the total cost.arrow_forwardGeneral Accountingarrow_forward

- Farrow Co. expects to sell 300,000 units of its product in the next period with the following results. Sales (300,000 units) $ 4,500,000 Costs and expenses Direct materials 600,000 Direct labor 1,200,000 Overhead 300,000 Selling expenses 450,000 Administrative expenses 771,000 Total costs and expenses 3,321,000 Net income $ 1,179,000 The company has an opportunity to sell 30,000 additional units at $13 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 16% and (2) administrative expenses would increase by $129,000. Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $13 per unit. Should the…arrow_forwardChelsea Company has sales of $400,000, variable costs of $10 per unit, fixed costs of $100,000, and a profit of $60,000. How many units were sold?arrow_forwardA company purchases 250 units at $12 each and 310 units at $19 each. What is the weighted average cost per unit? A) $12.25 B) $ 15.88 C) $14.78 D) $15.61arrow_forward

- Bluegill Company sells 45,000 units at $18 per unit. Fixed costs are $62,000, and income from operations is $298,000. Determine the following: Round the contribution margin ratio to two decimal places. a. Variable cost per unit b. Unit contribution margin per unit c. Contribution margin ratioarrow_forwardMahogany Company manufactures computer keyboards. The total cost of producing 17,000 keyboards is $534,000. The total fixed cost amounts to $160,000. Determine the total cost of manufacturing 27,000 keyboards. a. $814,000 O b. $594,000 O c. $908,000 O d. $754,000arrow_forwardWu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold. If the company's volume doubles, what happens to the total cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education