Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please give me answer general accounting question

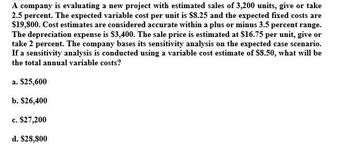

Transcribed Image Text:A company is evaluating a new project with estimated sales of 3,200 units, give or take

2.5 percent. The expected variable cost per unit is $8.25 and the expected fixed costs are

$19,800. Cost estimates are considered accurate within a plus or minus 3.5 percent range.

The depreciation expense is $3,400. The sale price is estimated at $16.75 per unit, give or

take 2 percent. The company bases its sensitivity analysis on the expected case scenario.

If a sensitivity analysis is conducted using a variable cost estimate of $8.50, what will be

the total annual variable costs?

a. $25,600

b. $26,400

c. $27,200

d. $28,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A proposed project has estimated sale units of 2,500, give or take 2 percent. The expected variable cost per unit is $12.79 and the expected fixed costs are $17,500. Cost estimates are considered accurate within a plus or minus 3 percent range. The depreciation expense is $2,850. The sale price is estimated at $15.40 a unit, give or take 3 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $13, what will be the total annual variable costs?arrow_forwardA proposed project has estimated sale units of 2,500, give or take 2 percent. The expected variable cost per unit is $12.79 and the expected fixed costs are $17,500. Cost estimates are considered accurate within a plus or minus 3 percent range. The depreciation expense is $2,850. The sale price is estimated at $15.40 a unit, give or take 3 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $13, what will be the total annual variable costs? Show me answerarrow_forwardSouthern Goods is analyzing a proposed project using standard sensitivity analysis. The company expects to sell 4,500 units, ±11 percent. The expected variable cost per unit is $13 and the expected fixed costs are $12,000. Cost estimates are considered accurate within a ± 5 percent range. The depreciation expense is $5,000. The sale price is estimated at $22 a unit, ±2 percent. If the company conducts a sensitivity analysis using a variable cost of $12, what will the total variable cost estimate be? $53,625 $53,500 $54,000 $48,060 $59,940arrow_forward

- Jeweled Outlook is analyzing a proposed project with expected sales of 9,200 units, ±4 percent. The expected variable cost per unit is $26 and the expected fixed costs are $49,000. Cost estimates are considered accurate within a range of ±5 percent. The depreciation expense is $18,300. The sale price is estimated at $52 a unit, ±3 percent. If the company conducts a sensitivity analysis using a variable cost of $27, what will be the total variable cost estimate?arrow_forwardAppalachian Crafts is analyzing a project with expected sales of 18,900 units, ±2 percent. The expected variable cost per unit is $23 and the expected fixed costs are $52,000. Cost estimates are considered accurate within a range of ±1 percent. The depreciation expense is $18,400. The sale price is estimated at $54 a unit, ±2 percent. What is the total dollar difference between the revenue using the optimistic sale price versus the expected sale price?arrow_forwardWhat will be the total annual variable costs ?arrow_forward

- A company is analyzing a proposed 3-year project using standard sensitivity analysis. The company expects to sell 15,000 units, \pm 5 percent. The expected variable cost per unit is $8 and the expected fixed costs are $ 40,000. The fixed and variable cost estimates are considered accurate within a \pm 7 percent range. The sales price is estimated at $15 a unit, \pm 6 percent. The project requires an initial investment of $120,000 for equipment that will be depreciated using the straight-line method to zero over the project's life. The equipment can be sold for $30,000 at the end of the project. The project requires $12,000 in net working capital for the three years but will be fully recovered when the project closes. The discount rate is 12.8 percent and tax rate is 20 percent. What is the net present value for the optimistic scenario? $92,058.28 $94, 075.71 $ 96,093.14 $98,110.57 $100, 128.00arrow_forwardAnswer this Problemarrow_forwardTotal annual variable costs?arrow_forward

- Automatic Transmissions, Inc., has the following estimates for its new gear assembly project: price = $1,080 per unit; variable cost = $300 per unit; fixed costs = $4.81 million; quantity = 71,000 units. Suppose the company believes all of its estimates are accurate only to within ±16 percent. What values should the company use for the four variables given here when it performs its best-case and worst-case scenario analysis? (Do not round intermediate calculations and enter your answers in dollars, not million, rounded to the nearest whole number, e.g., 1,234,567.)arrow_forwardStinnett Transmissions, Incorporated, has the following estimates for its new gear assembly project: Price = $ 1,250 per unit; variable cost = $470 per unit; fixed costs $4.98 million; quantity = 88,000 units. Suppose the company believes all of its estimates are accurate only to within \pm 21 percent. What values should the company use for the four variables given here when it performs its best-case and worst-case scenario analysis? Note: Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234, 567.arrow_forwardStinnett Transmissions, Incorporated, has the following estimates for its new gear assembly project: Price = $1,130 per unit; variable cost = $350 per unit; fixed costs = $4.86 million; quantity = 76,000 units. Suppose the company believes all of its estimates are accurate only to within 116 percent. What values should the company use for the four variables given here when it performs its best- case and worst-case scenario analysis? Note: Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. Scenario Base case Best case Worst case Unit Sales Unit Price 76,000 $ Unit Variable Cost 350 1,130 S Fixed Costs $4,860,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning