Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

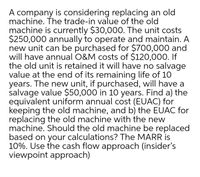

Transcribed Image Text:A company is considering replacing an old

machine. The trade-in value of the old

machine is currently $30,000. The unit costs

$250,000 annually to operate and maintain. A

new unit can be purchased for $700,000 and

will have annual O&M costs of $120,000. If

the old unit is retained it will have no salvage

value at the end of its remaining life of 10

years. The new unit, if purchased, will have a

salvage value $50,000 in 10 years. Find a) the

equivalent uniform annual cost (EUAC) for

keeping the old machine, and b) the EUAC for

replacing the old machine with the new

machine. Should the old machine be replaced

based on your calculations? The MARR is

10%. Use the cash flow approach (insider's

viewpoint approach)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Starling Co. is considering disposing of a machine with a book value of $25,000 and estimated remaining life of five years. The old machine can be sold for $5,400. A new high-speed machine can be purchased at a cost of 65,500. It will have a useful life of five years and no residual value. It is estimated that the annual variable manufacturing costs will be reduced from $22,900 to $20,100 if the new machine is purchased. The five-year differential effect on profit from replacing the machine is a(n) a. increase of $59,930 b. decrease of $59,930 c. decrease of $46,100 d. increase of $46,100arrow_forwardThere is old machinery with a value of $95,565, with an expected life of 20 years. There is a sale of old equipment with a book value of $30,000 and a market value of $66,000.It is intended to replace that machine with a new one worth $145,000 with a useful life of 10 years. It will ultimately be sold at market value for $90,000, to generate salvage value.Old operating costs are $95,565 and new costs are $56,984. There is an initial working capital of $35,000, with movements of 15% of the initial working capital untilyear 6. From year 7 and 8 they are 20% of the initial working capital and in the ninth year 14% of the initial working capital.The WACC required for this project is 17% with a tax rate of 38.5%. The following table shows the depreciation of the new equipment.Depreciation1 20%2 15%3 15%4 10%5 10%6 10%7 7%8 5%9 5%10 3%Calculate your PV, NPV, IRR, TIRM, PAYBACK, IR and ROIPlease if you can send me the excel to: 0229275@up.edu.mxor tell me the steps to follow and if you can…arrow_forwardThe Susan Company is debating if they should purchase a new machine for its factory operations at a cost of $745,200. The investment is expected to generate $150,000 in annual cash flows for a period of eight years. The required rate of return is 10%. The old machine has a remaining life of eight years. The new machine is expected to have zero value at the end of the eightminus-year period. The disposal value of the old machine at the time of replacement is zero. (Click the icon to view the Future Value of $1 factors.) (Click the icon to view the Future Value of Annuity of $1 factors.) (Click the icon to view the Present Value of $1 factors.) (Click the icon to view the Present Value of Annuity of $1 factors.) Requirement 1: What is the Internal Rate of Return of this investment that Susan Company is making? O A. 14% В. 8% С. 10% D. 12% Requirement 2: Should Susan Company purchase the new machine? Why? O A. Yes, as the internal rate of return is more than their required rate return B.…arrow_forward

- A division of Virginia City Highlands Manufacturing is considering purchasing for $1,500,000 a machine that automates the process of inserting electronic components onto computer motherboards. The annual cost of operating the machine will be $50,000, but it will save the company $370,000 in labor costs each year. The machine will have a useful life of 10 years, and its salvage value in 10 years is estimated to be $300,000. Straight-line depreciation will be used in calculating taxes for this project, and the marginal corporate tax rate is 32 percent. If the appropriate discount rate is 12 percent, what is the NPV of this project?arrow_forwardThe management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $66,000. The machine would replace an old piece of equipment that costs $17,000 per year to operate. The new machine would cost $8,000 per year to operate. The old machine currently in use is fully depreciated and could be sold now for a salvage value of $29,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)arrow_forwardInternational Soup Company is considering replacing a canning machine. The old machine is being depreciated by the straight-line method over a 10-year recovery period from a depreciable cost basis of $120,000. The old machine has 5 years of remaining usable life, at which time its salvage value is expected to be zero, and it can be sold now for $40,000. This machine has a current book value of $60,000. The purchase price of the new machine is $250,000. Employees were sent to a training course last year on how to use the new machine; this training cost $5,000. The new machine has a 5-year life and an expected salvage value of $25,000. Annual savings of electricity, labor, and materials from use of the new machine are estimated at $40,000. The company is in a 40 percent tax bracket and its cost of capital is 16 percent. The MACRS depreciation method will be used and the recovery percentages for assets with a 5-year class life are given below: What is the initial cash outlay for the…arrow_forward

- Ballard MicroBrew is considering the purchase of an automated bottling machine for $120,000. The machine would replace an old piece of equipment that costs $30,000 per year to operate. The new machine would cost $12,000 per year to operate. The old machine currently in use is fully depreciated and could be sold now for a salvage value of $40,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the initial investment used for calculating the machine's simple rate of return? 4. What is the simple rate of return on the new bottling machine? Note: Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3% 1. Depreciation expense 2. Incremental net operating income 3. Initial investment 4. Simple rate of return $ $ 12,000 80,000arrow_forwardBlossom Company has a factory machine with a book value of $85,000 and a remaining useful life of 5 years. It can be sold for $25,000. A new machine is available at a cost of $345,000. This machine will have a 5-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $550,000 to $450,000. Prepare an analysis showing whether the old machine should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Retain Equipment Variable manufacturing costs $ Replace Equipment $ Net Income Increase (Decrease) New machine cost Sell old machine Total $ The old factory machine should be tA $ $arrow_forwardVastine Medical, Inc., is considering replacing its existing computer system, which was purchased 2 years ago at a cost of $318,000. The system can be sold today for $203,000. It is being depreciated using MACRS and a 5-year recovery period (see the table). A new computer system will cost $506,000 to purchase and install. Replacement of the computer system would not involve any change in net working capital. Assume a 21% tax rate on ordinary income and capital gains. a. Calculate the book value of the existing computer system. b. Calculate the after-tax proceeds of its sale for $203,000. c. Calculate the initial cash flow associated with the replacement project. Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9%…arrow_forward

- Henrie’s Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $137,320, including freight and installation. Henrie’s estimated the new machine would increase the company’s cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine’s internal rate of return? (Round your answer to whole decimal place i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 14%, what is the machine’s net present value? Interpret your results. 3. Suppose the new machine would increase the company’s annual cash inflows, net of expenses, by only $31,720 per year. Under these conditions, what is the internal rate of return? (Round your answer to whole decimal place i.e. 0.123 should be considered as 12%.)arrow_forwardRockyford Company must replace some machinery that has zero book value and a current market value of $1,800. One possibility is to invest in new machinery costing $40,000. This new machinery would produce estimated annual pretax cash operating savings of $12,500. Assume the new machine will have a useful life of 4 years and depreciation of $10,000 each year for book and tax purposes. It will have no salvage value at the end of 4 years. The investment in this new machinery would require an additional $3,000 investment of net working capital. (Assume that when the old machine was purchased, the incremental net working capital required at the time was $0.) If Rockyford accepts this investment proposal, the disposal of the old machinery and the investment in the new one will occur on December 31 of this year. The cash flows from the investment are expected to occur over a four-year period. Rockyford is subject to a 40% income tax rate for all ordinary income and capital gains and has a 10%…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education