FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

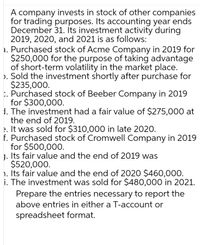

Transcribed Image Text:A company invests in stock of other companies

for trading purposes. Its accounting year ends

December 31. Its investment activity during

2019, 2020, and 2021 is as follows:

a. Purchased stock of Acme Company in 2019 for

$250,000 for the purpose of taking advantage

of short-term volatility in the market place.

). Sold the investment shortly after purchase for

$235,000.

:. Purchased stock of Beeber Company in 2019

for $300,000.

1. The investment had a fair value of $275,000 at

the end of 2019.

e. It was sold for $310,000 in late 2020.

f. Purchased stock of Cromwell Company in 2019

for $500,000.

J. Its fair value and the end of 2019 was

$520,000.

1. Its fair value and the end of 2020 $460,000.

i. The investment was sold for $480,000 in 2021.

Prepare the entries necessary to report the

above entries in either a T-account or

spreadsheet format.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is information related to the purchases of common stock by Cheyenne Company during 2020. Cost(at purchase date) Fair Value(at December 31) Investment in Arroyo Company stock $97,000 $76,000 Investment in Lee Corporation stock 266,000 311,000 Investment in Woods Inc. stock 176,000 185,000 Total $539,000 $572,000 (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Cheyenne make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? (b) What entry would Cheyenne make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Cheyenne did not select the fair value option for these investments? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0…arrow_forwardMidwest Bank invests in equity securities. At the beginning of December 2019, the bank held no equity securities. During December of 2019, it entered into the following transactions: Dec. 10 Purchased 500 shares of Carroll Company common stock for $76 per share. Dec. 21 Purchased 800 shares of Dynamo Company common stock for $34 per share. At the end of December, the Carroll Company common stock had a quoted market price of $79 per share, and the Dynamo Company common stock had a quoted market price of $33 per share. a. Prepare journal entries to record the December 2019 transactions. b. Show how the bank reports the equity securities on its December 31, 2019, balance sheet.arrow_forwardThe following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2021. The company buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to maturity, but to have them available for sale in years when circumstances warrant. Ornamental’s fiscal year ends on December 31. No investments were held by Ornamental on December 31, 2020. Mar. 31 Acquired 5% Distribution Transformers Corporation bonds costing $410,000 at face value. Sep. 1 Acquired $915,000 of American Instruments’ 8% bonds at face value. Sep. 30 Received semiannual interest payment on the Distribution Transformers bonds. Oct. 2 Sold the Distribution Transformers bonds for $436,000. Nov. 1 Purchased $1,410,000 of M&D Corporation 3% bonds at face value. Dec. 31 Recorded any necessary adjusting entry(s) relating to the investments. The market prices of the investments are:…arrow_forward

- On December 31, 2019, Novak Corp. provided you with the following pre-adjustment information regarding its portfolio of investments held for short-term profit-taking: Investments Moonstar Corp. shares Bilby Corp. shares. Radius Ltd. shares Total portfolio December 31, 2019 Carrying Amount $20,000 10,000 19,800 $49,800 Fair Value $18,800 8,900 20,400 $48,100 During 2020, the Bilby Corp. shares were sold for $9,500. The fair values of the securities on December 31, 2020, were as follows: Moonstar Corp. shares $19,900 and Radius Ltd. shares $20,300. The company does not recognize and report dividends and other components of investment gains and losses separately. Prepare the adjusting journal entry needed on December 31, 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forward3arrow_forwardMarigold’s Vegetable Market had the following transactions during 2019:1. Issued $51000 of par value common stock for cash.2. Repaid a 6 year note payable in the amount of $21200.3. Acquired land by issuing common stock of par value $98000.4. Declared and paid a cash dividend of $2100.5. Sold a long-term investment (cost $2500) for cash of $8200.6. Acquired an investment in IBM stock for cash of $15300.What is the net cash provided used by investing activities? A. 15300 B. 34400 C. (7100) D. 8200arrow_forward

- Help Save & Exit Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated's investment activities during the last quarter of 2021 and the first month of 2022. The only securities held by Amalgamated at October 1, 2021 were $35 million of 10% bonds of Kansas Abstractors, Inc., purchased on May 1, 2021 at face value and held in Amalgamated's trading securities portfolio. The company's fiscal year ends on December 31. 2021 Oct. 18 Purchased 2 million shares of Millwork Ventures Company common stock for $55 million. Millwork has a total of 32 million shares issued. 31 Received semiannual interest of $2.1 million from the Kansas Abstractors bonds. 1 Purchased 10% bonds of Holistic Entertainment Enterprises at their $18 million face value, to be held until they mature in 2031. Semiannual interest is payable April 30…arrow_forwardABAKA Co. reported the following differences in the statement of financial position accounts on December 31, 2023 and 2022. Additional information: - Net income for the current year was P1,900,000 - During 2023, ABAKA Co. purchased trading securities for P900,000 cash and sold trading securities costing P500,000 for P800,000. On December 31, 2023, the market value of the remaining trading securities increased to P500,000. - Cash dividend of P500,000 was declared. - Equipment costing P800,000 and having a carrying amount of P550,000 was sold for P650,000. - Equipment costing P3,000,000 was acquired through issuance of long-term debt. - The long-term investment pertains to 20% common stock investment in SANDALS Corp. which was purchased on December 31, 2022. SANDALS Corp. reported 2023 net income at P5,000,000 and declared and paid dividends of P500,000. - 100,000 ordinary shares were issued for P20. Requirements: Determine the net cash provided by: a) Operating activities b)…arrow_forwardMidwest Bank invests in equity securities. At the beginning of December 2019, the bank held no equity securities. During December of 2019, it entered into the following transactions: Dec. 10 Purchased 600 shares of Carroll Company common stock for $75 per share. Dec. 21 Purchased 700 shares of Dynamo Company common stock for $34 per share. At the end of December, the Carroll Company common stock had a quoted market price of $78 per share, and the Dynamo Company common stock had a quoted market price of $33 per share. Required: 1. Prepare journal entries to record the preceding information. 2. What is the unrealized holding gain or loss, and where is it reported in the 2019 financial statements? 3. Show how the bank reports the equity securities on its December 31, 2019, balance sheet. 4. Next Level If Midwest uses IFRS, how would the accounting be different from U.S. GAAP?arrow_forward

- Dineshbhaiarrow_forwardHello, Can you help with the questions attached, thanks much.arrow_forwardConcord Co. purchased 1,150 shares of Sugarland Company for $18 each this year and classified the investment as a trading security. Concord sold 270 shares of the stock for $21 each. At year end the price per share of the Sugarland Company had increased to $22.Prepare the journal entries for these transactions and any year-end adjustments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record the purchase enter a debit amount enter a credit amount enter an account title to record the purchase enter a debit amount enter a credit amount (To record the purchase.) enter an account title to record the sale enter a debit amount enter a credit amount enter an account title to record the sale enter a debit amount enter a credit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education