FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

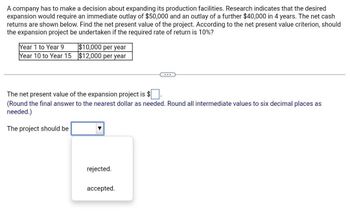

Transcribed Image Text:A company has to make a decision about expanding its production facilities. Research indicates that the desired

expansion would require an immediate outlay of $50,000 and an outlay of a further $40,000 in 4 years. The net cash

returns are shown below. Find the net present value of the project. According to the net present value criterion, should

the expansion project be undertaken if the required rate of return is 10%?

Year 1 to Year 9

Year 10 to Year 15

$10,000 per year

$12,000 per year

The net present value of the expansion project is $

(Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as

needed.)

The project should be

rejected.

accepted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You are evaluating an investment project, which has a cost of $161,000 today and is expected to provide after-tax annual cash flows of $20,000 for seven years. In order to compute the MIRR, you are modifying the cash flows. Assuming the cost of capital is 9.1 percent, what is the terminal cash flow of the modified cash flows? Question 12 options: $173,074 $176,474 $178,474 $180,974 $182,874 $184,574arrow_forwardMolin Inc. is considering to a project that will have the following series of cash flow from assets (in $ million): Year Cash flow 0 -1,580.92 1 453 2 749 3 935 The required return for the project is 6%. Year Cash flow 0 -1,580.92 1 453 2 749 3 935 1. The required return for the project is 6%. 2. What is the project's profitability index? 3. What is the internal rate of return (IRR) for this project?arrow_forwardBhaarrow_forward

- NPV and maximum return A firm can purchase new equipment for $25,000 that generates an annual cash inflow of $8,000 for 5 years. a. Determine the net present value (NPV) of the asset, assuming that the firm has a cost of capital of 15%. Is the project acceptable? b. Determine the maximum required rate of return that the firm can have and still accept the asset. a. The net present value (NPV) of the new equipment is (Round to the nearest cent.)arrow_forwardReplacing old equipment at an immediate cost of $50,000 and an additional outlay of $15,000 six years from now will result in savings of $11,000 per year for 7 years. The required rate of return is 5% compounded annually. Compute the net present value and determine if the investment should be accepted or rejected according to the net present value criterion. The net present value of the project is S (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The proposal should be аcсepted. rejected.arrow_forwardA project that costs $2,300 to install will provide annual cash flows of $730 for each of the next 5 years. a. Calculate the NPV if the opportunity cost of capital is 12%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? Yes O No c. What is the project's internal rate of return IRR? (Do not round intermediate calculations. Round your answer to 2 decimal places.) %24arrow_forward

- 1. A project requires an initial capital cost of (40 million ID). The investor expects the project will generate annual returns of (12 million ID), with expenditures about (4 million ID) annually. If you know that the economic life is (12) years, and the salvage value after the end of the economic life is (4 million ID). Considering that the less acceptable interest rate for the investor is (10%): A. Determining the economic feasibility for investing using the present worth method? B. What is the equivalent annual worth of this investment? C. Find the internal rate of return?arrow_forwardc. A company is planning to invest in a project over a 5-year period, but wants to know its financial implications. It expects the cash in-flow return on the investment to steadily increase over the 5 years. Using the information below, help determine the Total Net Cash Flows, the Net Present Value and the estimated Payback Period. Note: Estimate the payback period to the nearest year. Discount Rate 12% Investment Project Initial Investment Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow $ $ $ $ $ $ Total Net Cash Flow (5,000) 800 ? 900 ? 1,500 ? 1,800 ? 3,200 NPV of investment Estimated Payback Periodarrow_forwardThe IBC Company is considering undertaking an investment that promises the following cash flows: Period 0 is = -$100 Period 1 is =$80 Period 2 is = $80 If the company waits a year, it can make the following investment: Period 1 is = -2 $220 Period = $280 Assume a time value of 0.10. Which investment should the firm undertake? Use both the net present value and IRR approaches. With the IRR method, use incremental cash flows.arrow_forward

- ← (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine This investment requires an initial outlay of $105,000 and will generate net cash inflows of $17,000 per year for 9 years a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not?arrow_forwardA company has to make a decision about expanding its production facilities. Research indicates that the desired expansion would require an immediate outlay of $130,000 and an outlay of a further $20,000 in 3 years. The net cash returns are shown below. Find the net present value of the project. According to the net present value criterion, should the expansion project be undertaken if the required rate of return is 10%? Year 1 to Year 8 Year 9 to Year 12 $22,000 per year $18,000 per year The net present value of the expansion project is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardMoates Corporation has provided the following data concerning an investment project that it is considering: Initial investment $ 200,000 Annual cash flow $ 123,000 per year Expected life of the project 4 years Discount rate 10% Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to: (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education