FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

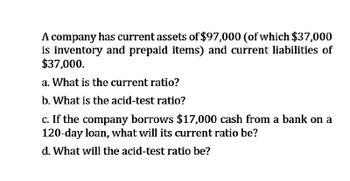

Transcribed Image Text:A company has current assets of $97,000 (of which $37,000

is inventory and prepaid items) and current liabilities of

$37,000.

a. What is the current ratio?

b. What is the acid-test ratio?

c. If the company borrows $17,000 cash from a bank on a

120-day loan, what will its current ratio be?

d. What will the acid-test ratio be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- a company has current assets of $87,000 (of which $43,000 is inventory and prepaid items) and current liabilities of $43,000. What is the current ratio? What is the acid-test ratio? If the company borrows $14,000 cash from a bank on a 120-day loan, what will its current ratio be? What will the acid-test ratio be? Current Ratio enter the ratio rounded to 2 decimal places :1 Acid Test Ratio enter the ratio rounded to 2 decimal places :1 New Current Ratio enter the ratio rounded to 2 decimal places :1 New Acid Test Ratio enter the ratio rounded to 2 decimal places :1arrow_forwardA firm has $ 1.2 million in current assets and $ 1 million in current liabilities. If the company uses $ 0.5 million of cash to pay part of its accounts payable, what will happen to the “current ratio”?arrow_forwardSolve this one for general accountingarrow_forward

- Find the following using the data bellow a. Accounts receivable B. Current assets C. Total assets D. Return on assets E. Common equity F. Quick ratioarrow_forwardProvide answer financial accountingarrow_forwardIdentify the ratio that is relevant to answering each of the following questions.a. How much net income does the company earn from each dollar of sales?b. Is the company financed primarily by debt or equity?c. How many dollars of sales were generated for each dollar invested in fixed assets?d. How many days, on average, does it take the company to collect on credit sales made tocustomers?e. How much net income does the company earn for each dollar owners have invested in it?f. Does the company have sufficient assets to convert into cash for paying liabilities as theycome due in the upcoming year?arrow_forward

- Credit Card of America (CCA) has a current ratio of 3.5 and a quick ratio of 3.0. If its total current assets equal $73,500, what are CCA’s (a)current liabilities and (b)inventory?arrow_forwardThe current ratio: a. Is used to help assess a company's ability to pay its debts in the near future. b. Measures the effect of operating income on profit. c. Is used to measure the relationship between assets and long-term debt. d. Is used to measure a company's collection period.arrow_forward-What is XYZ's current ratio on December 31, 2021? -What is XYZ's Accounts Receivables Turnover for 2021? (assume Accounts Receivable, net was $500,000 on December 31, 2020) -What is XYZ's Asset Turnover for 2021? (assume total assets were $14 million on December 31, 2020) Account Balance Data Debit Credit Cash 217,650 Accounts Receivable 545,000 Interest Receivable 1,200 Allowance for Doubtful Accounts 8,450 Merchandise Inventory 778,000 Prepaid Insurance 30,000 Notes Receivable Land 2,000,000 Office Building 4,000,000 Office Equipment 320,000 Store Building 9,000,000 Store Equipment 3,560,000 Accumulated Depreciation - office building and equipment 1,580,000 Accumulated Depreciation - store building and equipment 4,126,000 Goodwill 700,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education