FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

quick answer of this accounting question

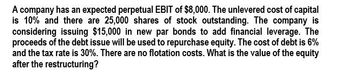

Transcribed Image Text:A company has an expected perpetual EBIT of $8,000. The unlevered cost of capital

is 10% and there are 25,000 shares of stock outstanding. The company is

considering issuing $15,000 in new par bonds to add financial leverage. The

proceeds of the debt issue will be used to repurchase equity. The cost of debt is 6%

and the tax rate is 30%. There are no flotation costs. What is the value of the equity

after the restructuring?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- nonearrow_forwardI want to correct answer accounting questionsarrow_forwardBuggins Inc. is financed equally by debt and equity, each with a market value of $1 million. The cost ofdebt is 5%, and the cost of equity is 10%. The company now makes a further $250,000 issue of debt anduses the proceeds to repurchase equity. This causes the cost of debt to rise to 5.5% and the cost of equityto rise to 10.83%. Assume the firm pays no taxes. 1. What is the overall cost of capital?2. What is the percentage increase in earnings per share after the refinancing? I already asked the question, and there was a mistake: equity and debt are each 1.000.000 in the beginning. I don´t understand the solution for the number 2: There was interested included and I don´t know how to derive interest from the given numbersarrow_forward

- Company Y has a target debt ratio of 55%. Currently its debt ratio is 60% and it expects to revert to the target ratio in the near future. The company has a market cost of equity of 20%. While it has no bonds, it has interest payments of R1 000 000 on liabilities of R10 000 000. Assume the tax rate is 27%. What is the WACC for the company? a. 6.36% b. 14.05% c. 13.02% d. 9.10%arrow_forwardTurtle Co. has a total debt ratio of 0.78. The company is considering building a new plant for $75 million. When the company issues new equity, it incurs a flotation cost of 9%. The flotation cost on new debt is 4%. Calculate the cost of the plant, including flotation costs. (Round to 2 decimals and enter the full value,e.g. 5 million must be entered as 5,000,000)arrow_forwardBruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated?arrow_forward

- Bruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated? Please show the graphs.arrow_forwardThe X corporation has unlivered cost of equity of 10%.the company wants to expands its operations by issuing new debt.if the cost of the debt of the company is 6% and the cororate tax is 30%.what is the debt equity ratio of the company if the target cost of equity is 12%.arrow_forwardICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 9 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.6 percent annually. What is the company's pretax cost of debt? If the tax rate is 24 percent, what is the aftertax cost of debt? Pretax cost of debt: __________% Aftertax cost of debt: __________%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education