Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the company's required return on these financial accounting question?

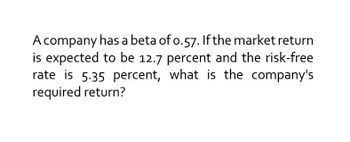

Transcribed Image Text:A company has a beta of 0.57. If the market return

is expected to be 12.7 percent and the risk-free

rate is 5.35 percent, what is the company's

required return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- CAPM Required Return A company has a beta of 1.14. If the market return is expected to be 11.9 percent and the risk-free rate is 3.95 percent, what is the company's required return?arrow_forwardSuppose the beta of this value based company is 0.85, the risk-free rate is 2 percent, and the expected market rate of return is 10 percent. Calculate the expected rate of return. The answer is closest to: Group of answer choices 10.5 percent 13.1 percent 6.5 percent 9.0 percentarrow_forwardAssume that Blast Company has a Beta of 0.85, the Risk Free Rate is 2.0% and the Expected Market Return is 6.75%. i. What is the Required Rate of Return for Blast Company? ii. Now assume that the Risk Free Rate is the same, but the Market Return is 7.5%. What is the Required Rate of Return for Blast Company now?arrow_forward

- The company has a beta of 0.85. If the risk- free rate is 3.4% and the market premium is 8.5%, what is the company's cost of equity?arrow_forwardThe CRT Co. has a beta of 1.6 The expected market return is 9.5 percent and the risk free rate of return is 3.2 percent. What is the required rate of return for the CRT Co.?arrow_forwardSuppose the current risk -free rate of return is 5 percent and the expected market risk premium is 7 percent. Using this information, estimate the cost of retained earnings for a company with a beta coefficient equal to 2.0?arrow_forward

- A company has a beta of 0.25. If the market return is expected to be 8 percent and the risk-free rate is 2 percent, what is the company's required return? Multiple Choice __ 1.50 percent ___ 3.50 percent ___ 4.00 percent ___ 13.50 percentarrow_forwardIf X-Co has a Beta of 1.6, and the risk-free rate is 4.5%, and the average market risk premium is 6%, what is X-Co’s estimated required return per the CAPM? (show calculations)arrow_forwardWhat is the appropriate required return of CSB on this financial accounting question?arrow_forward

- If the expected rate of return on AZNG is 12.72, its beta is 1.09 and the market risk premium is 8%, what is the risk-free rate?arrow_forwardSuppose that Company ABC has a beta of .92. The expected return on the market is 13% and the market risk premium is 10.2%. According to the CAPM, the expected return for ABC is ____________. answer is 12.18%arrow_forwardThe risk free rate currently have a return of 2.5% and the market risk premium is 4.22%. If a firm has a beta of 1.42, what is its cost of equity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning