FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

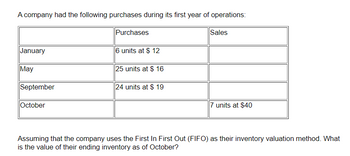

Transcribed Image Text:A company had the following purchases during its first year of operations:

January

May

September

October

Purchases

6 units at $ 12

25 units at $ 16

24 units at $ 19

Sales

7 units at $40

Assuming that the company uses the First In First Out (FIFO) as their inventory valuation method. What

is the value of their ending inventory as of October?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following lots of Commodity Z were available for sale during the year. Beginning inventory 7 units at $48 First purchase 18 units at $52 Second purchase 53 units at $58 Third purchase 18 units at $59 The firm uses the periodic system, and there are 23 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the LIFO method?arrow_forwardBeginning inventory, purchases, and sales for Product XCX are as follows: Sep. 1 Beginning Inventory 25 units @ $14 5 Sale 14 units 17 Purchase 22 units @ $16 30 Sale 14 units Assuming a perpetual inventory system and the last-in, first-out method, determine (a) the cost of the goods sold for the September 30 sale and (b) the inventory on September 30. a) Cost of goods sold $ b) Inventory, September 30 $arrow_forwardA company's inventory records report the following in November of the current year: Date Activities Units Acquired at Cost Units Sold at Retail November 1 Beginning inventory 5 units @ $56 = $280 November 2 Purchase 10 units @ $58 = $580 November 8 Sales 12 units @ $90 November 12 Purchase 6 units @ $61 = $366 Using the LIFO perpetual inventory method, what was the amount recorded in the cost of goods sold account for the 12 units sold? Mutiple Choice. $614 $692 $714 $440 $534arrow_forward

- A company's inventory records indicate the following data for the month of April: Date April 1 April 7 April 11 Beginning inventory Purchase Sale Purchase Sale Purchase Multiple Choice O $33,300. O April 16 April 22 April 29 If the company uses the first-in, first-out (FIFO) method and the periodic inventory system, what would be the cost of the ending inventory? $53,680. O $40,720. Activities $35,922. $38,480. Units Acquired at Cost 700 units @ $36 = $25,200 580 units @ $40 = $23,200 500 units @ $44 = $22,000 Units Sold at Retail 480 units @ $50 = $24,000 1,000 units @ $110 400 units @ $110arrow_forwardSkysong Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 Purchases (gross) Freight-in Sales revenue Sales returns Purchase discounts (a) $145,400 658,600 27,700 990,600 76,300 11,900 Compute the estimated inventory at May 31, assuming that the gross profit is 25% of sales. The estimated inventory at May 31 $arrow_forwardYou have the following information for Bramble Inc. for the month ended October 31, 2022. Bramble uses a periodic method for inventory. Date Description Units Unit Cost or Selling Price Oct. 1 Beginning inventory 54 $23 Oct. 9 Purchase 132 25 Oct. 11 Sale 108 34 Oct. 17 Purchase 103 26 Oct. 22 Sale 55 39 Oct. 25 Purchase 65 28 Oct. 29 Sale 121 39arrow_forward

- company's inventory records report the following in November of the current year: Beginning November 1 5 units @ $20 Purchase November 2 10 units @ $22 Purchase November 12 6 units @ $25 On November 8, it sold 12 units for $54 each. Using the LIFO perpetual inventory method, what amount of gross profit was earned from the 12 units sold?arrow_forwardA company using the periodic inventory system has inventory costing $137 on hand at the beginning of a period. During the period, merchandise costing $473. At year-end, inventory costing $346 is on hand. The cost of good for the year is?arrow_forwardHaynes Company uses the perpetual inventory system. The following information is available for the month the March. March 1 Beginning Inventory 10 units at $2 for $20, March 4 Sold 8 units, March 22 Purchased 50 units at $4 for $200, March 26 Sold 48 units. If Haynes Company uses the LIFO inventory costing method, what is the balance in Ending Inventory at March 31? A. $40 B. $16 C. $12 D. $8arrow_forward

- The following units of a particular item were availlable for sale during the calendar year: Jan. 1 Inventory 4,100 units at $39 Apr. 19 Sale 2,300 units June 30 Purchase 4,500 units at $43 Sept. 2 Sale 5,200 units Nav. 15 Purchase 2,100 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods ssold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the illustrated in Exhibit 4. Under LIFO, if units are in inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Cost of Goods Sold Inventory Purchases Quantity Total Cos Quantity Unit Cost Total Cost Unit Cost Unit Cost Total Cost Quantity Date Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 Dec. 31 Balancesarrow_forwardThe following lots of Commodity Z were available for sale during the year. Beginning inventory 7 units at $47 First purchase 19 units at $55 Second purchase 51 units at $55 Third purchase 18 units at $59 The firm uses the periodic system, and there are 24 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the LIFO method? a.$5,241 b.$1,264 c.$1,392 d.$1,128arrow_forwardDuring the year, TRC Corporation has the following inventory transactions. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 45 $37 $1,665 April 7 Purchase 125 39 4,875 July 16 Purchase 195 42 8,190 October 6 Purchase 105 43 4,515 470 $19,245 For the entire year, the company sells 414 units of inventory for $55 each. Required:1-a & b. Using FIFO, calculate ending inventory and cost of goods sold.1-c & d. Using FIFO, calculate sales revenue and gross profit.2-a & b. Using LIFO, calculate ending inventory and cost of goods sold.2-c & d. Using LIFO, calculate sales revenue and gross profit.3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold.3-c & d. Using weighted-average cost, calculate sales revenue and gross profit.4. Determine which method will result in higher profitability when inventory costs are rising.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education